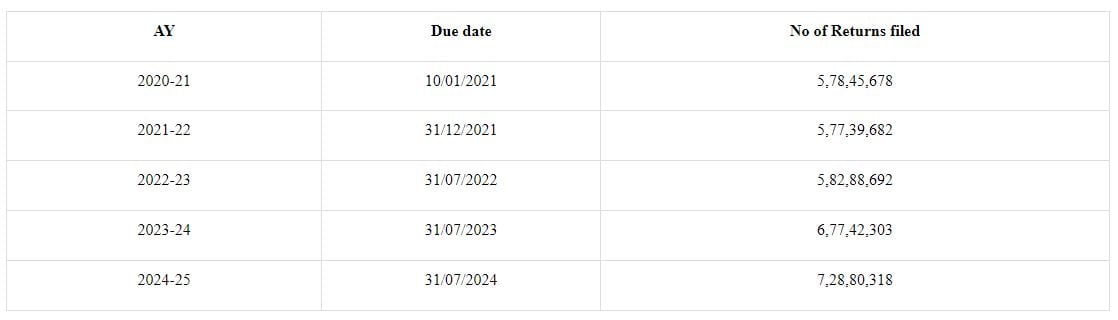

The total number of ITRs for AY 2024-25 filed till 31st July 2024 is more than 7.28 crore, which is 7.5% more than the total ITRs for AY 2023-24 filed till 31st July 2023.

Reetu | Aug 2, 2024 |

72% of taxpayers opted for the New Tax Regime, with 5.27 crore ITRs filed: CBDT

The Income Tax Department praises taxpayers and tax professionals for their timely compliance, which has resulted in a record number of Income Tax Returns (ITRs) filed.

The total number of ITRs for AY 2024-25 filed till 31st July 2024 is more than 7.28 crore, which is 7.5% more than the total ITRs for AY 2023-24 (6.77 crore) filed till 31st July 2023.

This year, a rising number of taxpayers chose the new tax regime. Out of the total 7.28 crore ITRs filed for AY 2024-25, 5.27 crore were filed in the New Tax Regime, whereas 2.01 crore were filed in the Old Tax Regime. Thus, approximately 72% of taxpayers have chosen the New Tax Regime, while 28% remain in the Old Tax Regime.

The filing of ITRs peaked on July 31, 2024 (the due date for salaried taxpayers and other non-tax audit cases), with over 69.92 lakh ITRs filed on a single day. On July 31, 2024, the e-filing system had its highest per-hour rate of 5.07 lakh ITR filings between 07:00 and 08:00 p.m. The highest per-second rate of ITR filing was 917 (17.07.2024, 08:13:54 am), while the highest per-minute rate was 9,367 (31.07.2024, 08:08 pm).

The Department also received 58.57 lakh ITRs from first-time filers until July 31, 2024, indicating an expansion of the tax base.

The following data on ITR filing over the last few years corroborates the same:

Out of the 7.28 crore ITRs filed for the financial year 2024-25, 45.77% are ITR-1 (3.34 crore), 14.93% are ITR-2 (1.09 crore), 12.50% are ITR-3 (91.10 lakh), 25.77% are ITR-4 (1.88 crore), and 1.03% are ITR-5 to ITR-7 (7.48 lakh). Over 43.82% of these ITRs were filed utilizing the online ITR utility provided on the e-filing platform, with the remainder filed using offline ITR utilities.

During the peak filing season, the e-filing platform successfully handled massive traffic, providing taxpayers with a seamless ITR filing process. On July 31, 2024 alone, there were 3.2 crore successful logins.

E-verification is required to begin processing ITRs and give refunds, if applicable. It is gratifying to observe that over 6.21 crore ITRs have been e-verified, with more than 5.81 crore using Aadhaar-based OTP (93.56%).

Over 2.69 crore e-verified ITRs for the financial year 2024-2025 have been processed (43.34%) as of July 31, 2024. Over 91.94 lakh challans were received through the TIN 2.0 payment system in July 2024 (for the financial year 2024-25), with a total of 1.64 crore challans filed through TIN 2.0 from April 1, 2024.

The e-filing Helpdesk team has handled approximately 10.64 lakh queries from taxpayers during the year upto 31.07.2024, supporting the taxpayers proactively during the peak filing period. Support from the helpdesk was provided to taxpayers through inbound and outbound calls, live chats, WebEx and co-browsing sessions.

Helpdesk team also supported resolution of queries received on the Twitter handle of the Department through Online Response Management (ORM), by proactively reaching out to the taxpayers/ stakeholders and assisting them with different issues on a near real-time basis.

The Department also urges taxpayers, who for any reason, missed filing their ITR within the due date, to complete their filing expeditiously.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"