Know which Due Dates have been extended by CBDT

Deepak Gupta | Jan 12, 2022 |

Know which Due Dates have been extended by CBDT

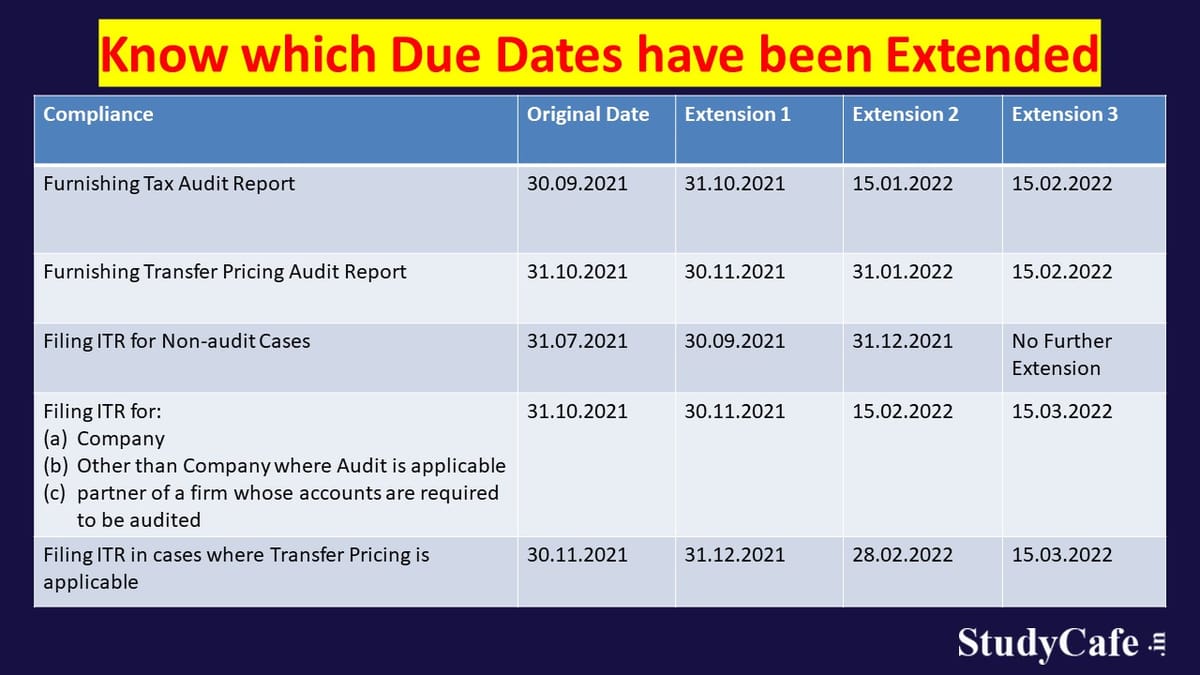

As of now, 3 Extensions have been granted to the Taxpayer by CBDT for filing Income Tax Return [ITR], Tax Audit Report [TAR], and Other reports required to be filed under Income Tax Act. These extensions were given due to Income Tax Portal Glitches and the spread of the Omicron virus. The latest extensions were given on 11th January 2022.

Extension Circular 1 dated 20.05.2021

Extension Circular 2 dated 09.09.2021

Extension Circular 3 dated 11.01.2022

The Extensions were as follows:

Please note that although due dates for filing ITR have been extended, interest u/s 234A is applicable where Tax Payable is more than Rs. 100,000.

Please further note that, in case of a belated return, Late fees is applicable and you are not allowed to carry forward your losses.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"