The Income Tax Department has notified that Taxpayer can file ITR-U in case of mismatch between ITR and information shared by reporting entity.

Reetu | Mar 14, 2023 |

Taxpayer can file ITR-U in case of mismatch between ITR and information shared by reporting entity: CBDT

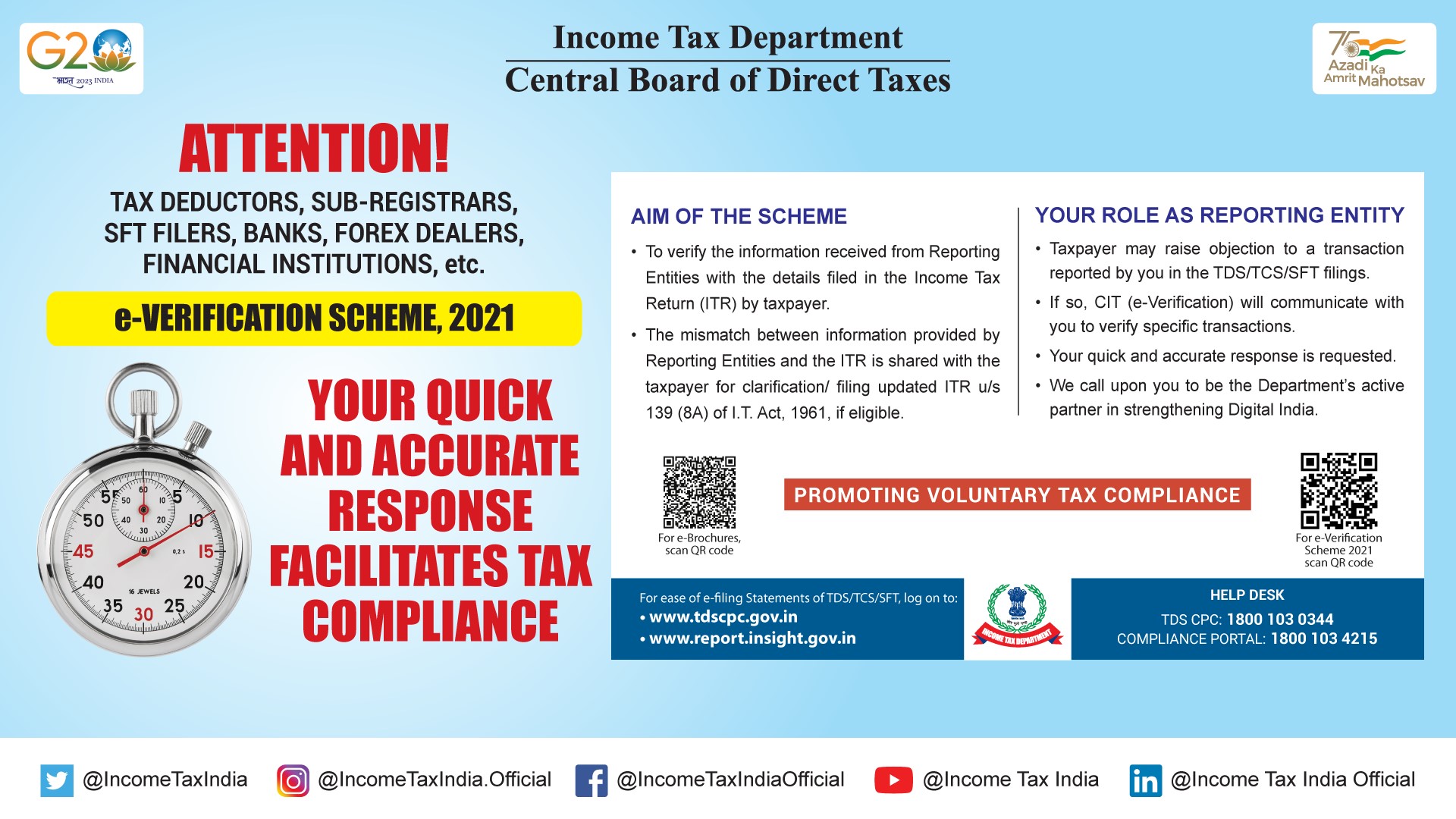

The Income Tax Department has notified that Taxpayer can file ITR-U in case of mismatch between ITR and information shared by reporting entity.

Via tweet on his official twitter handle, the department stated, “Kind Attention Reporting Entities!. Your quick and accurate response to communication on e-Verification, is a step towards facilitating voluntary tax compliance. We call upon you to be Income Tax Department’s active partner in strengthening Digital India.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"