The Ministry of Corporate Affairs(MCA) has issued Frequently Asked Questions on 46 Forms migrated to V3 Portal of MCA.

Reetu | May 8, 2023 |

FAQs on 46 Forms migrated to V3 Portal of MCA

The Ministry of Corporate Affairs(MCA) has issued Frequently Asked Questions on 46 Forms migrated to V3 Portal of MCA.

The FAQs are as follows:

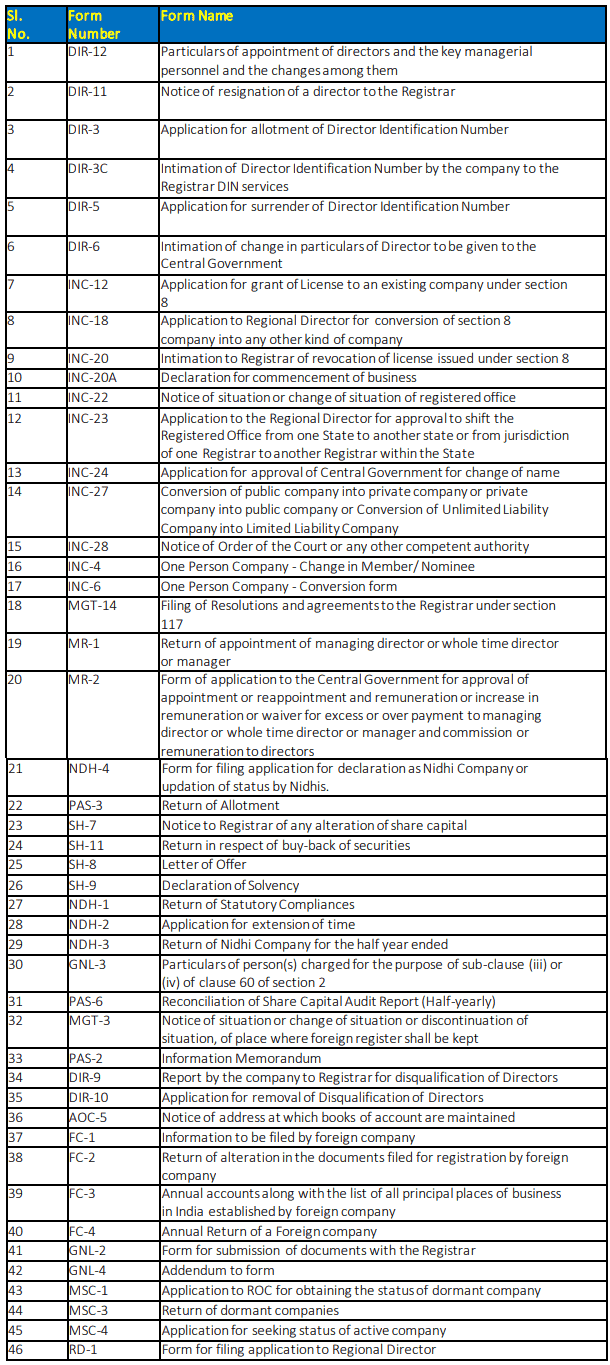

Set 2 forms covering 46 forms have been migrated to V3. Effective from 23rd January 2023, all 46 forms are required to be filed in Version 3.

Forms covered in Set 2 are:

In the version 2, forms are required to be filled and uploaded in the portal while in V3 the forms are to be filled online. This enables user convenience including the ability to save a halffilled form and file it later.

Further in Version 2, there was only a My Workspace which had a list of notices from MCA and circulars issued by them. In Version 3, there is a personalised “My Application” feature which allows one to view all the forms filed by them till date along with the status of the forms such as pending for DSC upload, Under Processing, Pay fees, Resubmission etc.

When a user logs in to V3, the login is through the email id whereas in V2 it was possible with the user id.

When a business user logs in to the MCA system, an OTP will be sent to your mobile and e-mail address to ensure the authenticity of the user.

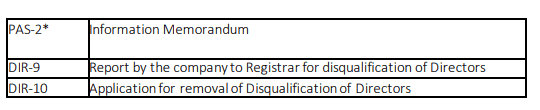

Yes. Below mentioned 3 new forms got rollout in V3 as new web forms which were not available in V3.

Note: PAS-2 in V2 system used to get filed through GNL-2 form. Going forward in V3, this form needs to be filed independently and hence ‘Information Memorandum’ purpose got removed from GNL-2.

DIR-12

1. Form has been made web based.

2. Two new purposes added in case where all the directors of the company become disqualified under the Companies Act, 2013, in the section ‘Purpose of filing the form’ with the nomenclature as ‘Appointment due to disqualifications of all the existing directors’ and in such case Promoter Shareholder shall have the signing rights and ‘Appointment by liquidator/IRP/RP’ in case of liquidation and in such case liquidator shall have the signing rights.

3. Consent to act as a director in form DIR-2 shall be part of form DIR-12 itself. Further, it can be validated with the digital signature of the director appointed.

4. Attachments removed and information captured in machine readable format.

5. Other enhancement (pre-filling of data, repositioning of fields, nomenclature update, additional checks and balances introduced etc.)

DIR-11

1. Form has been made web based.

2. Other enhancement (pre-filling of data, repositioning of fields, nomenclature update, additional checks and balances introduced etc.)

3. When a director files form DIR-11 intimating his resignation and form DIR-12 is not filed by the company, in that case, an email will be sent to the company for filing the form DIR-12.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"