Priyanka Kumari | Dec 29, 2023 |

File GSTR-9 if not Done: Know Penalty for Late Filing

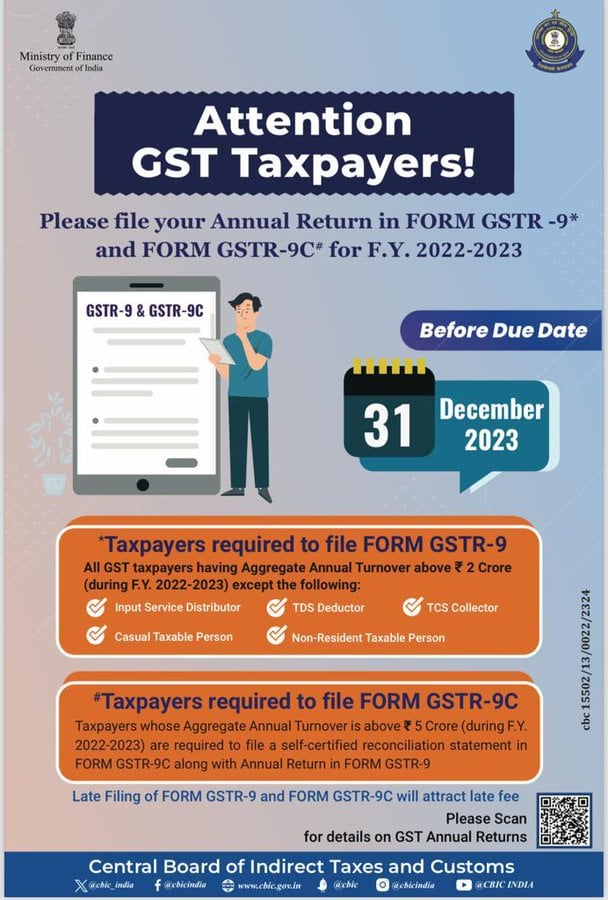

The Central Board of Indirect Taxes and Customs (CBIC) has urged taxpayers to file GST Annual Returns on or before December 31, 2023.

CBIC on the Official Twitter Account wrote, “Attention, GST Taxpayers please file your Annual Return in FORM GSTR-9 and GSTR-9C for F.Y. 2022-2023!”

Who will file FORM GSTR-9?

Taxpayers whose Aggregate Annual Turnover more than Rs. 2 crore (during Financial Year 2022-2023) except the Following:

Who will file FORM GSTR-9C?

All taxpayers having Aggregate Annual Turnover is more than Rs. 5 Crore (during Financial Year 2022-2023) are required to file a self-certified reconciliation statement in FORM GSTR-9C along with Annual Return in FORM GSTR-9.

Late filing of FORM GSTR-9 and GSTR-9C will attract late fee:

For FORM GSTR-9: Late fines of Rs 200 each day of delay (INR 100 each for CGST and SGST) are subject to a maximum cap of 0.25% of total turnover in the particular State / UT.

For FORM GSTR-9C: There is no specific provision; hence, the general penalty under Section 125 is INR 50,000 (25,000 each for CGST and SGST).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"