Minister of State of Finance replied to a question raised in Lok Sabha that the Government earned a Tax of Rs.98,681.34 from Long Term Capital Gain.

Reetu | Aug 2, 2024 |

Government earned Tax of Rs.98,681.34 crore from Long Term Capital Gain

The Minister of State in the Ministry of Finance Shri. Pankaj Chaudhary has stated in response to a question raised in Lok Sabha that the Government earned a Tax of Rs.98,681.34 crore from Long Term Capital Gain.

The Minister Shri Javed Alikhan and Shri Ramji Lal Suman asked the question in Lok Sabha:

Will the Minister of FINANCE be pleased to state:

(a) whether the Government is contemplating to abolish long term capital gains (LTCG) tax on equities/mutual funds during 2024-25;

(b) if so, the details thereof; and

(c) if not, the reasons therefore along with the details of total tax collection due to the imposition of LTCG tax since 2018 till date, year-wise?

The Minister of State in the Ministry of Finance Shri. Pankaj Chaudhary replied:

(a) & (b) There is no such proposal to abolish long term capital gains (LTCG) tax on equities/mutual funds during 2024-25.

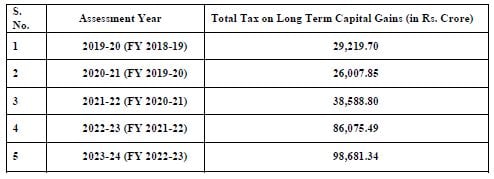

(c) The details with respect to long-term capital gains from e-returns are as under:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"