Reetu | Sep 13, 2024 |

CBIC suspended Officials for alleged Involvement in Extortion

According to media reports, several CGST officials in Bengaluru have allegedly engaged in extortion in violation of the law.

The officers involved have been suspended immediately. CBIC is in contact with police authorities who have obtained the remand of these personnel who were arrested. Depending on the findings of the investigation, further action will be taken.

In order to maintain a transparent and trade-friendly tax administration, the CBIC has a zero-tolerance policy for official misconduct.

Many people tweeted about their views on this matter on Twitter accounts.

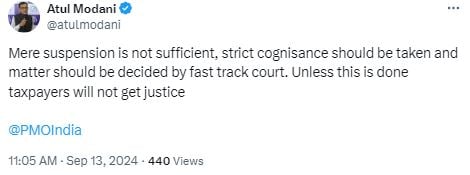

Atul Modani tweeted, “Mere suspension is not sufficient, strict cognisance should be taken and the matter should be decided by fast track court. Unless this is done taxpayers will not get justice @PMOIndia.”

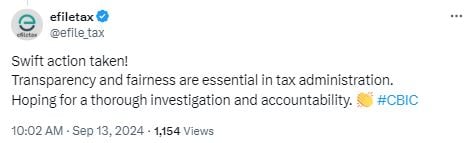

efiletax said in its tweet, “Swift action taken! Transparency and fairness are essential in tax administration. Hoping for a thorough investigation and accountability. 👏 #CBIC”

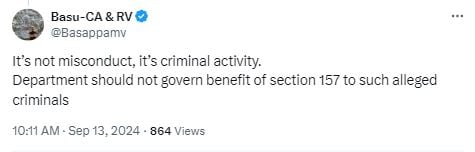

One Person said, “It’s not misconduct, it’s criminal activity. Department should not govern benefit of section 157 to such alleged criminals.”

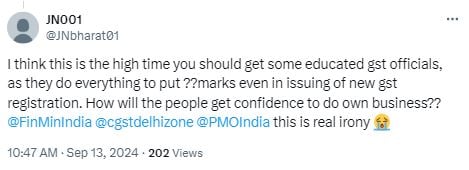

Another person tweeted, “I think this is the high time you should get some educated GST officials, as they do everything to put ?? marks even in issuing of new gst registration. How will the people get confidence to do own business?? @FinMinIndia @cgstdelhizone @PMOIndia this is real irony 😭.”

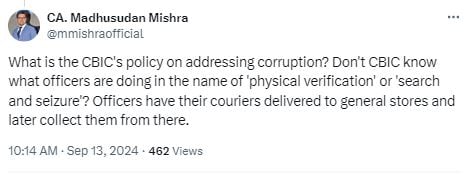

A Chartered Accountant posted, “What is the CBIC’s policy on addressing corruption? Don’t CBIC know what officers are doing in the name of ‘physical verification’ or ‘search and seizure’? Officers have their couriers delivered to general stores and later collect them from there.”

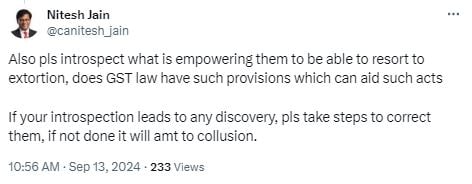

Another Chartered Accountant tweeted, “Also pls introspect what is empowering them to be able to resort to extortion, does GST law have such provisions which can aid such act. If your introspection leads to any discovery, pls take steps to correct them, if not done it will amt to collusion.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"