CBIC has issued a clarification notification on the applicability of the reverse charge mechanism on the renting of property.

Reetu | Oct 23, 2024 |

![RCM on Renting of Immovable Property; CBIC issued Corrigendum Notification [Read Notification]](/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2024/10/RCM-on-Renting-of-Immovable-Property.jpg)

RCM on Renting of Immovable Property; CBIC issued Corrigendum Notification [Read Notification]

The Central Board of Indirect Taxes and Customs (CBIC) has issued a clarification notification on the applicability of the reverse charge mechanism (RCM) on the renting of property.

CBIC issued a Corrigendum dated 22nd October 2024 to Notification No. 09/2024-Central Tax (Rate) issued on 08th October 2024 to clarify that “any property” should be read as “any immovable property“, for renting of commercial property by an unregistered person to a registered person under RCM to prevent revenue leakage.

The Text of the Corrigendum Notification Read as Follows:

In the notification of the Government of India, in the Ministry of Finance (Department of Revenue), No.09/2024-Central Tax (Rate), dated the 8th October 2024, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i), vide number G.S.R. 623(E), dated the 8th October 2024, at page number 24, against serial number 5AB, in the table, in column (2) in line 12, for “any property” read “any immovable property”.

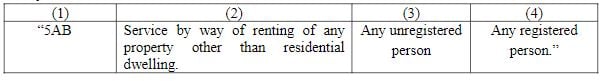

The Notification that issued Earlier Read as Follows:

In exercise of the powers conferred by sub-section (3) of section 9 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the Central Government, on the recommendations of the Council, hereby makes the following further amendments in the notification of the Government of India, in the Ministry of Finance (Department of Revenue), number 13/2017-Central Tax (Rate), dated the 28th June 2017, published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section(i), vide number G.S.R. 692(E), dated the 28th June 2017.

In the said notification, in the Table, after serial number 5AA and the entries relating thereto, the following serial number and entries relating thereto in columns (2), (3) and (4) shall be inserted, namely:

This notification shall come into force with effect from the 10th day of October 2024.

For Official Corrigendum Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"