FCS DEEPAK P. SINGH | Mar 3, 2022 |

Reversal of Input Tax Credit-real Estate Sector

As you are aware that implementation of Goods and Services Ac,2017 (GST) is one of the most important act of this NDA Government. Through implementation of GST the concept “ One Tax one Nation” has been fulfilled and the tax system of India has been totally overhauled. We know that before its implementation there are number of central and state acts which govern business transactions, each state has its own Sales tax, Entertainment tax, Luxury Tax, Cess, VAT, Octroi, etc. The rates , the procedures, the book keeping methods etc. are different in each state. This was very hard to handle for the traders. There are a lot of compliances and submission of returns in various laws and the officers of the department were given more power or collection and Levy of taxes. There was tax on taxes , producing cascading effect , since on manufacture or production of any product , excise duty was first levied and then after ,when product reached in the market, the state governments levied VAT, Sales Tax etc.

The GST has removed above lacunas of previous acts and has brought a seamless process of flow of Input tax credit (ITC) at all stages of manufacturing/production/ sale of goods and provision of services. The ITC concept of GST is the most appreciated and welcome concept ,given much awaited relief to the persons engaged in the business or trading. The GST has brought down the rate of taxes applicable in old regime and help in furtherance of ease of doing business.

The main feature of GST Act,2017 is seamless or continuous flow of Input Tax Credits at each stage of supply of goods and services. Since GST if a consumption based that it means that the supply under GST will be taxable in the state in which goods are consumed or services are utilized. The Government through GST Act,2017 trusted the persons engaged in the business to self -assess and submit GST with the government after utilizing all available Input tax they have paid on input goods and services utilized to produces output goods and services. But there should be some checks ,so that above provisions should not be mis utilized.

LET’S CONSIDER A QUESTION FOR MORE UNDERSTANDING OF REVERSAL OF ITC:

WHAT IS CREDIT REVERSAL

Reversal of ITC means the credit of inputs utilized earlier would now be added to the output tax liability, effectively nullifying the credit claimed earlier. Depending upon when such reversal is done, payment of interest may also be required.

The credit of GST paid on the purchases like raw materials/services used for manufacturing or selling products is known as an Input tax credit (ITC). If the input tax credit is wrongly claimed, then it should be reversed by making payment to that extent of wrongly availed ITC. In certain situations, even if the basic conditions for claiming ITC is satisfied, ITC claimed must be reversed (e.g. Blocked Credits like health insurance, food & beverages expenses, etc.).

Reversal of ITC means the credit of inputs, input service and capital goods utilized earlier would now be added to the output tax liability, effectively nullifying the credit claimed earlier. Depending upon when such reversal is done, payment of interest may also be required.

THE REVERSAL OF ITC IS TO BE DONE IN THE FOLLOWING SCENARIOS:

LET’S DISCUSS SOME CASES AS MENTIONED ABOVE

ITC amount that-cannot be attributable-to a specific supply but is used for partly making both the taxable and non-taxable supplies/supplies used for personal consumption need to be reversed proportionately to the extent of supplies that are non-taxable/used for personal consumption. The remaining ITC left is eligible for claim.

The calculation differs for:

a) Inputs or input services- covered by Rule 42.

b) Capital goods- covered by Rule 43.

Reversal of ITC under Rule 44:

The aim of this rule is to reverse all the ITC that has been availed by a registered person in the event that he chooses to pay tax under the composition scheme or his registration gets cancelled for any reason. For inputs held in stock or contained in

semi-finished goods and finished goods in stock, the ITC which is to be reversed should be calculated proportionate to corresponding invoices on which credit was taken. In case of capital goods, ITC availed will be based on the useful life (in months) and shall be computed on a pro-rata basis.

Reversal of ITC the availment of which is blocked under Section 17(5):

Inputs on goods or services used for personal consumption, inputs on goods which are lost, stolen, destroyed or written off or disposed of by way of gift or free samples, and any ITC availed which is blocked as per Section 17(5) needs to be reversed by the recipient.

INTEREST ON REVERSAL OF ITC

Chapter X of the CGST Act, 2017 enumerates the provisions relating to ‘payment of tax’. Section 50 in this Chapter lays down the circumstances in which interest would be required to be paid. The Section provides for payment of interest in two circumstances: –

It appears that the first provision (a) would cover all cases where there is a shortfall in payment of tax which inter alia may be on account of payment of tax using irregularly availed credit. In other words, there may be short payment of tax by utilization of ineligible credits.

By plain reading of the section it conveys that mere availment of credit, without utilization, may not fall within the scope of this provision at it would get triggered only due to failure to pay the tax.

The second provision provides for levy of interest where undue or excess claim of input tax credit has been made because of mismatch in the returns. This provision would not cover a scenario wherein an ineligible credit has been availed by an assessee for reasons other than that of excess availment.

Section 50 does not provide for payment of interest for mere wrongful availment of credit, except wherein an ineligible credit has been availed by an assessee. Once there is no interest payable under section 50, an argument can be advanced that the CGST Act does not provide for a provision to demand interest in cases where availment of credit is irregular.

As the provisions relating to recovery of interest under CGST Act does not envisage the scenario of irregular availment of credit, it appears there cannot be any levy of interest on mere wrongful availment of credit for reasons other than those covered under Section 50(3) viz. wrongful availment on account of mismatch [Section 50(3) is explained in the next part].

Also in the judgement by Hon’ble Patna High Court it was held, in the case of M/S Commercial Steel Engineering Corporation Vs State of Bihar, that interest is not leviable on ITC which is availed however not utilized for payment of tax.

RATE OF INTEREST ON REVERSAL OF ITC:

Section 50(3) specifies that interest rate should not exceed 24% p.a. and intends to exclusively cover cases of contravention as per section 42 (10) and section 43 (10). Whereas section 50(1) is a residuary section which covers all cases other than cases falling under section 50(3). Interest rate specified u/s 50(1) is 18% p.a.

Section 42(10) specifies that interest should be charged at 24% p.a. only in those cases where there is reclaiming of ITC as per Section 42(7) which was reversed by the recipient when he has claimed ITC in excess of tax declared by the supplier in his GSTR-1 or supplier has not declared such supplies in his GSTR-1.

Similar provisions are contained in section 43 and are dealing with credit note.

Hence the rate of interest for reversal of ITC is 24% p.a. only in case of reclaim of credit reversed earlier. In other cases interest will be paid @18% p.a. u/s 50 (1).

ANSWER TO THE QUESTION: two schools of through are prevailing on Credit Reversal. One thought is that as the machinery provisions for calculation of reversal of credit are missing , one may avoid any such reversal. The second through is, one can reverse the credit on pure logical assumptions , however the las does not provide the method of reversal which is suitable and applicable to real estate sector. It is a well settled that if a machinery provisions-fails then, the provisions casting liability also fail. Therefore legally one may make this stand. But it is general view that if there is no tax payable on output services, then you cannot tax ITC on inputs used in output services.

LETS’ CONSIDER PROVISIONS OF GST RELATED TO REVERSAL OF ITC;

SECTION 16(1) Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

SECTION 17 (2) Where the goods or services or both are used by the registered person partly for effecting taxable supplies including zero-rated supplies under this Act or under the Integrated Goods and Services Tax Act and partly for effecting exempt supplies under the said Acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies.

SECTION 17(3) The value of exempt supply under sub-section (2) shall be such as may be prescribed, and shall include supplies on which the recipient is liable to pay tax on reverse charge basis, transactions in securities, sale of land and, subject to clause (b) of paragraph 5 of Schedule II, sale of building.

CGST Amendment Act,2018- a new explanation has been added in section17(3) as follows;

Explanation-for the purpose of this sub-section , the expression “ Value of exempt supply” shall not include the value of activities or transactions specified in Schedule III , except those specified in paragraph 5 of the said Schedule.

RULE 42 OF CGST RULES ,2017 according to the Rule 42 from the total available credits , the following deductions are required to be made;

The net from above transaction will be ITC eligible for credit. The above calculation is seperatly done for CGST, SGST, IGST and UGST.

Please Note That: if inputs are used for both residential units sold after and before receiving of Completion Certificate from competent authority , the credit used proportionately in he unsold portion should be reversed and credits of sold units will be eligible for Input Tax Credit. Further as specified hove, reversal of common credit attributed to land value is also required. Further , inputs procured as consumed after receiving Completion certificate of First Occupancy Certificate ,whichever is earlier will be INELIGIBLE as supply after such event is not taxable. Please note that after receiving of Completion certificate or Occupancy Certificate the sale of residential flats or units is not considered as supply and hence not taxable.

LET’S ANSWER SOME RELEVANT QUESTIONS:

(b) When Reversal is required;

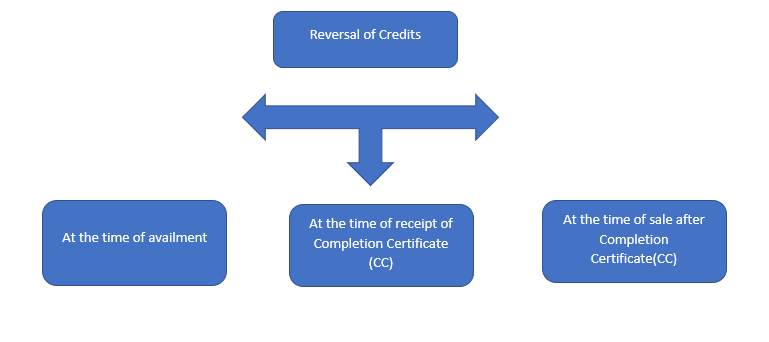

The Above three possible events which May attracts reversal;

Please Note That: From above discussion we conclude that the Input Tax Credits availed will be returned in the same period ,in which we receive Completion certificate from competent authorities.

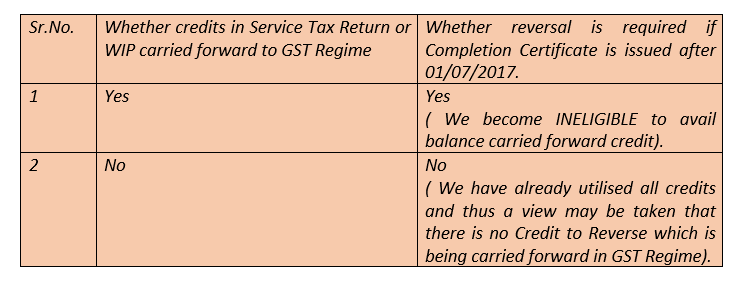

(b) Whether reversal is required when inputs were procured in Service Tax Regime but utilized after Appoinment Date ( i.e. after 01/07/2017).

(c) How does intention to use make a difference?

Section 16(1) allows credit of tax charged on inputs used or intended to be used for making taxable supplies. The word,” used” also covers the intention to use. However the machinery provisions i.e. Rule 42 of CGST Rules, 2017 mentioned that reversal is required only for those inputs which are intended to be used for the purpose other than taxable supplies.

We can interpret above provisions that no reversal of Input Tax Credit is required if same has been used or intended to be used in past for supplies of taxable goods and services. The intention theory is applied only in cases, where input tax credits were used for supplies of taxable as well as exempt goods or services. The reversal should be done on prorate basis.

(d ) How to determine the amount of credit to be reversed in Real Estate Sector?

Rule 42- prescribed the method of reversal of common inputs. However the said method is not workable for Real Estate sector. The reversal of credit may be made based on the Square Feet Area, sold after and before receiving of Completion Certificate (CC).

LET’S CONSIDER AN EXAMPLE: Lets consider total area of a project be 10,000 Sq.Ft. Out of this 5000 Sq.Ft., is sold before receipt of Completion Certificate. In this scenario the available ITC is restricted to 50% whereas remaining 50% shall be subject to reversal.

(e ) When the material is given to a contract laborer for job work, whether credit is to be reversed?

According to the provisions of Section 19(1), the principal is allowed the credit of inputs sent to job work.

Section 19(3) of CGST Act,2017- provides that any supply of goods to a job worker would be treated as supply if it is not received back by the principal within stipulated time of one year.

Section 143 provides that a principal may send any inputs or capital goods without payment of tax , to a job worker under an intimation and conditions as may be prescribed.

Section 2(68) of CGST Act,2017- defines Job Work as “ Job Work” means any treatment or process undertaken by a person on goods belonging to another registered person and the expression “ Job Worker” shall be construed accordingly.

Please Note That:

(f) Whether credit is to be reversed when capital goods are transferred from one project site to another project site when both sites are in different states?

Schedule I specifies activities to be treated as supply even if made without consideration .Entry(1) of the said schedule is given below;

Permanent transfer or disposal of business assets where input tax credit has been divided on such assets.

If company has two sets in different states then as per Section 22 of CGST Act,2017 the contractor has to take registration in all such States where the sites are located. If company has existence in two different states then, as per Section 25 , both such entities are to be treated as deemed distinct persons.

If a company has a Capital Asset and it has taken input tax credit on such asset and post completion of project on one site, it is then transferred the, in such case , the transaction will be treated as supply and taxable under GST.

Let’s consider an example: when a contractor shifts concrete mixer from one project in the State of UP to another State of Maharashtra , he has to raise invoice and charge IGST on appropriate value , which may be deemed rental value.

Please Note That – when the capital goods or any other material is transferred from one state to another state , it would be held as supply and hence IGST will be chargeable. Since in this case tax would be payable and hence no question of reversal of tax credit taken on such materials or capital goods.

(g) Whether Credit vailed on capital goods has to be reversed in case if such goods are disposed off or transferred after some period of use?

According to provisions of section 18(6) of CGST Act,2017- In case of supply of capital goods or plant and machinery, on which input tax credit has been taken, the registered person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery reduced by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery determined under section 15, whichever is higher:

Provided that where refractory bricks, moulds and dies, jigs and fixtures are supplied as scrap, the taxable person may pay tax on the transaction value of such goods determined under section 15.

Please Note that

1) The amount of inputs tax credit relating to inputs held in stock, inputs contained in semi-finished and finished goods held in stock, and capital goods held in stock shall, for the purposes of subsection (4) of section 18 or sub-section (5) of section 29, be determined in the following manner, namely,-

Illustration:

2) The amount of input tax credit for the purposes of sub-section (6) of section 18 relating to capital goods shall be determined in the same manner as specified in clause (b) of sub-rule (1) and the amount shall be determined separately for input tax credit of IGST and CGST.

Provision of Rule 44(6):

CONCLUSION: being a consumption based tax ,GST is a boon for India. In GST Regime it is clear that the taxes are payable to the state in which goods are consumed or services are used or utilized and hence multiple taxation has stopped and of course cascading affect of taxes has been reduced or we can say that eliminated. The GST has provided a seamless or continuous availability of input tax credits at every stage of supply. But in some cases to the government has Blocked Credits u/s. Section 17(5) and imposed some restriction on utilization of ITC. The restriction of ITC in case of Real Estate Projects imposed up to the receive of Completion certificate. The ITC in construction before receive of Completion Certificate is allowed , since sale of flats /units before CC is considered as supply and not after receive pf CC( Completion Certificate). In case a real estate developer has taken any credit ,which he is not eligible to enjoy ,will be reversed in the same period for which CC received.

DISCLAIMER: the above article is only for information and knowledge of readers and same has been prepared on the basis of available information at the time of preparation. The views expressed are the personal views of the author and same should not be considered as professional advice. In case of necessity do consult with tax professional.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"