Course Key Features

- Whether section 44ad is mandatory or optional?

- What is eligible business for section 44ad?

- Who is eligible assessee for the purpose of section 44ad?

- Whether section 43ca override section 44ad?

- Whether section 43b override the provisions of section 44ad ?

- What is the treatment of brought forward losses in case of 44AD Assessee

- Whether TDS provisions are applicable in case of section 44AD Assessee

- Whether 8% deemed profit is minimum or Maximum ?

Course Description

CERTIFICATION COURSE ON PRESUMPTIVE TAXATION - SECTION 44AD, 44ADA, 44AE

In our continuous endeavor to empower more and more finance professionals, this certification course has been designed for you. Detailed 3 Days course has been designed where daily more than 2 hrs sessions have been organized. This Course contains Videos along with study material, International Taxation Files. Live training on International Taxation will be given.

How I will get the course:

This is an online Certification course so there will not be any physical delivery of the lectures. After the purchase of the this Certification course, you can see the this course under my account option under purchased courses. All the videos, study materials, PDF files, PPT’s, will be uploaded there for quick access of participants. This Certification course is valid for 60 Days.

Who is Eligible to Join this Certification Course:

There is no bound on the eligibility from our side for this Certification Course. Any person who wants to learn and master in Taxation can join this course. However, it will be more beneficial for the below-mentioned persons:

⭐Commerce Graduates/CA/CS/CMA/Law students

⭐Tax professionals whether in JOB or Practice

⭐Qualified CA/CS/CMA/LLB

⭐Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐Any other person not covered above can join the course if interested.

Course Duration:

The course duration is 3 Days and around 7 hours.

Certificate:

A Certificate of Participation from the Studycafe will be provided on completion of the Certification course.

Views Limitation:

This is a Completely online course, no bar on the number of views. During 60 days you can access this Certification course from anywhere at any time with unlimited views.

Course Content

Day-1: CERTIFICATION COURSE ON PRESUMPTIVE TAXATION - SECTION 44AD, 44ADA, 44AE

2 HrsWhether section 44ad is mandatory or optional?

Whether turnover or gross receipts is to be taken inclusive of GST the purpose of section 44ad and 44ada?

What is eligible business for section 44ad?

Who is eligible assessee for the purpose of section 44ad?

Whether section 43ca override section 44ad?

Whether section 43b override the provisions of section 44ad ?

How the depreciation and unabsorbed depreciation is to be created in case of 44AD assessee

What is the treatment of brought forward losses in case of 44AD Assessee

Whether the word claimed used in section 44AD is right or obligation?

Whether TDS provisions are applicable in case of section 44AD Assessee

Whether provisions of advance tax applicable in case of section 44AD Assessee

Whether 8% deemed profit is minimum or Maximum

Whether person earning commission or brokerage income can opt section 44AD?

Can a life insurance agent or mutual fund distributor can file his return of income in ITR 4 declaring presumptive income ?

Weather professionals other than professional specified and notified under subsection 1 of section 44AA can declare income under section 44ad

What is the treatment of brought forward losses in the case of 44AD Assessee

Whether TDS provisions are applicable in the case of section 44AD Assessee

Whether provisions of advance tax applicable in case of section 44AD Assessee

Whether 8% deemed profit is minimum or Maximum?

Whether person earning commission or brokerage income can opt for section 44AD?

Can a life insurance agent or mutual fund distributor can file his return of income in ITR 4 declaring presumptive income?

Weather professionals other than professional specified and notified under subsection 1 of section 44AA can declare income under section 44ad

Whether the assessee engages in speculative business can opt for section 44ad?

Whether a person engages in an intraday transaction of securities and share can opt for section 44ad .

Whether a person engages in derivative trading can opt for section 44AD

Day-2: CERTIFICATION COURSE ON PRESUMPTIVE TAXATION - SECTION 44AD, 44ADA, 44AE

2 HrsWhether section 44ad a is mandatory?

whether non specified profession of half covered under section 44ADA?

Whether removal of LLP from section 44ADA is justified?

Whether HUF can do profession?

Whether a chartered accountant providing professional services chartered accountant firm and taking remuneration from firm can go for section 44ADA?

Whether similar provision like 44ad subsection 4 is also provided in section 44ADA?

Day-3: CERTIFICATION COURSE ON PRESUMPTIVE TAXATION - SECTION 44AD, 44ADA, 44AE

2 HrsTo whom section 44ae is applicable?

Difference between gross vehicle weight and unladen weight?

How to decide whether a vehicle is heavy goods vehicle for other than heavy goods vehicle?

Whether private limited company can declared deemed income under section 44ae?

Whether in non resident Assessee can go for section 44ae?

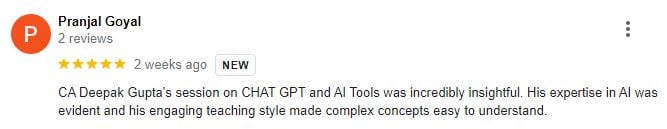

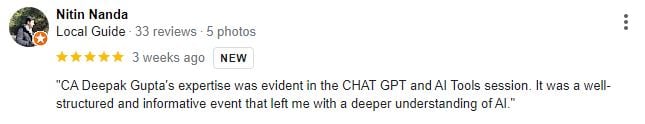

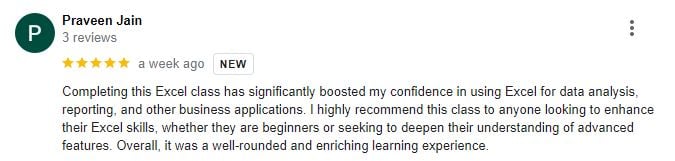

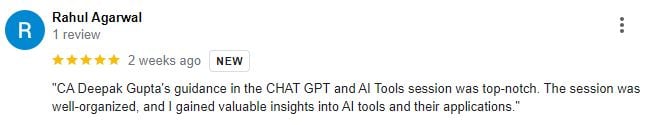

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join this certification Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students ⭐ Tax professionals whether in JOB or Practice ⭐ Qualified CA/CS/CMA/LLB ⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry ⭐ Any other person not covered above can join course if interested.

What will be Language?

It will be in Mix of English and Hindi Language.

What is the Duration of the Course?

3 Session of 2 hrs each

How Can we Join ths Course?

Please register yourself and pay the fees. After paying fees you will get link to join session on your email.

Can we join from Mobile?

yes

Featured In

Terms and Conditions

- Recording will be Valid for 60 Days Only.

Requirements

- Required internet connection. Lectures can be viewed on Mobile or Laptop

This course includes:

- Hindi

- 7+ Hours of Video Content

- Recording is Available for 60 Days

- Studycafe Certificate of Participation

- Access on mobile or Computer/Laptop

- Downloadable Material

Certificate to be provided to all the participants.