Course Key Features

- Learn all about SAP S/4 HANA

- Attain in-depth knowledge on the fundamentals of SAP S/4HANA Finance

- Gain clear understanding on the scope of SAP

- Understanding of How Cost Centre Works in SAP

- Learn How to execute T Codes in SAP S/4 HANA

- AP, AR, Asset Accounting in SAP S/4 HANA

- How to Extracts B/S, P/L & Monthly Reports from SAP

- Master Tally from Beginner to Advanced

- Learn the most common Tally functions used in the Office

- Learn How to manage Accounting of any Company with GST Independently

- Learn how to compute TDS & extract TDS Reports

- How to create GST Computation & Reports in Tally Prime Erp with GST

- RCM - Reverse Charge Mechanism in Tally Prime Erp with GST Training

- How to avail Input GST Credit

- How to apply GST at Multiple Level

Course Description

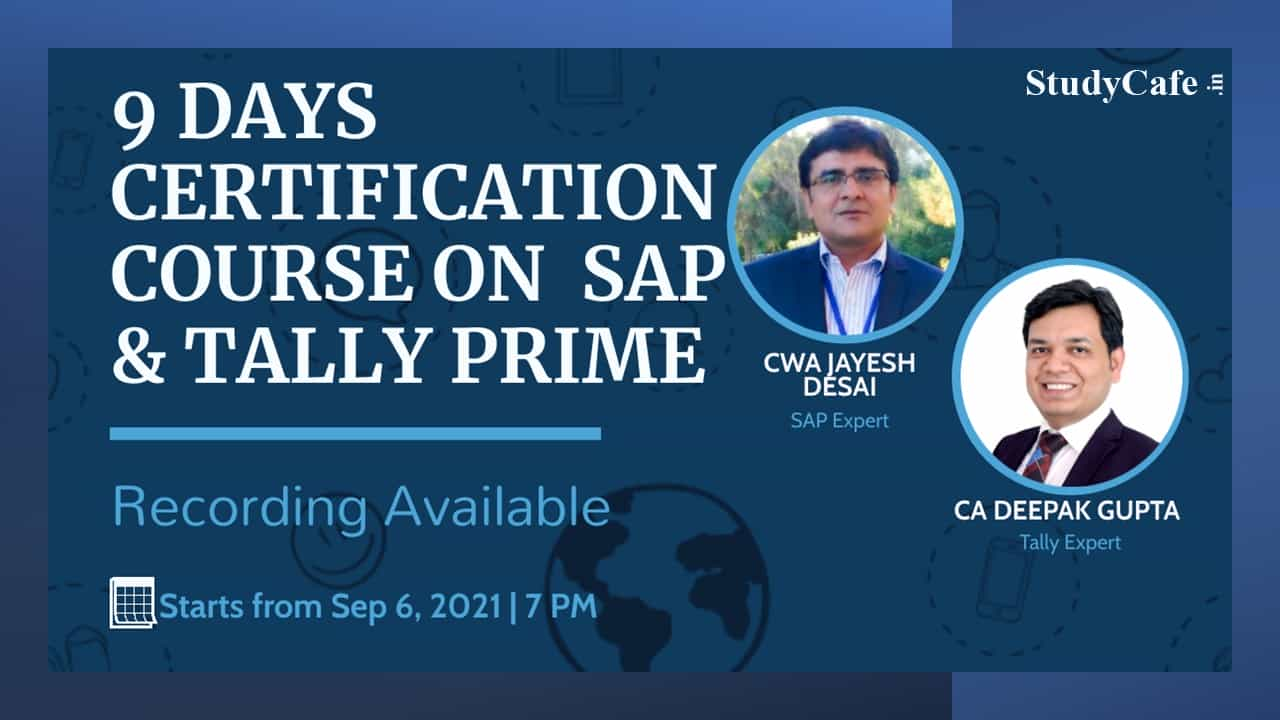

SAP & Tally Prime Certification Course

In our continuous endeavor to empower more and more finance professionals, this SAP & Tally Prime Certification Course has been designed for you. Detailed 3 Days course has been designed where daily more than 2 hrs sessions have been organized. This Course contains Videos along with study material, Files. Live training on SAP & Tally Prime will be given.

How I will get the course:

This is an online Certification Course on SAP & Tally Prime so there will not be any physical delivery of the lectures. After the purchase of the Certification Course on SAP & Tally Prime, you can see the Certification Course on SAP & Tally Prime under my account option under Dashboard. All the videos, study materials, PDF files, PPT’s, SAP & Tally Prime files will be uploaded there for quick access of participants. The Recording of Certification Course on SAP & Tally Prime is valid for 60 Days.

Who is Eligible to Join SAP & Tally Prime Certification Course:

There is no bound on the eligibility from our side for the SAP & Tally Prime Certification Course. Any person who wants to learn and master SAP & Tally Prime can join this course. However, it will be more beneficial for the below-mentioned persons:

⭐Commerce Graduates/CA/CS/CMA/Law students

⭐Tax professionals whether in JOB or Practice

⭐Qualified CA/CS/CMA/LLB

⭐Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐Any other person not covered above can join the course if interested.

SAP & Tally Prime Course Duration:

The course duration is 9 Days and around 18+ hours.

Certificate:

A Certificate of Participation from Studycafe will be provided on completion of the Certification Course on SAP & Tally Prime.

Views Limitation:

This is a Completely online course, no bar on the number of views. During 60 days you can access this Certification Course on SAP & Tally Prime from anywhere at any time with unlimited views.

Course Content

Day-1: SAP S/4 HANA – Technology Design & Integration

2 Hrs• How S/4 HANA is transforming Businesses

• SAP Design and Modules

• Integrating Business Processes with FICO, MM, PP and SD

• SAP Live – Navigation and Transactions (T-code)

Day-2: SAP FI - Multiple Accounting Principle & Financial Controls

2 Hrs• New General Ledger – Accounting & Financial Statement

• Accounting for Vendors (AP), Customers (AR) & Asset (AM)

• SAP Live Demonstration

Day-3: SAP CO - Management Decision making

2 Hrs• Why you need Controlling? Controlling Components

• Cost Centre Accounting, Internal Order

• Product Costing (PC), Marginal Costing (COPA), SBU Accounting (PCA)

• Career in SAP FICO

• SAP Live Demonstration

Day-4: Fundamentals of Tally Prime

2 HrsFundamentals of Tally Prime, Accounting Masters in Tally Prime,Tally Prime Shortcuts, Difference Between Tally.ERP9 and TallyPrime,

Day-5: Tally Prime Shortcuts & Entries

2 HrsPurchase and Sales Entries with GST, Advanced Features in Tally Prime which includes Auto Invoice Series,

Day-6: Advanced Features in Tally Prime

2 HrsAdvance Entries in Tally Prime like, RCM, Import, Export, SEZ, Ineligible Goods, How to pass entries for TDS, How to deduct TDS Automatically

Day-7: Difference Between Tally.ERP9 and TallyPrime

2 HrsTally Back up & Restore, Technological Advantages of Tally.ERP 9, Tally.NET and Remote Capabilities, Email Facility in Tally, How to add the logo in invoices, Backup, Restore & Splitting of Company,

Day-8: Application Management and Controls

2 HrsBank Reconciliation, Audit feature of How to Check who has passed the entry, Extract Report from tally in Excel with TALLY ODBC Server, Export and Import GL from XML File.

Day-9: How to File GST Returns from Tally

2 HrsHow to File GST Returns from Tally, Tally.ERP9 Audit Features, How to Generate JSON File of E-way Bill, How to Create Cost Centres, Cost Categories in Tally, How to merge branch and HO in Tally, How to Merge Group Companies in Tally

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join this Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students ⭐ Tax professionals whether in JOB or Practice ⭐ Qualified CA/CS/CMA/LLB ⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry ⭐ Any other person not covered above can join course if interested.

What will be Language?

It will be in Mix of English and Hindi Language.

What is the Duration of the Course?

Course Duration will be of more than 6 Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 60 Days.

How Can we Join ths Course?

Please register yourself and pay the fees. After paying fees you will get link to join session on your email.

Can we join from Mobile?

yes

Featured In

Terms and Conditions

- Recording will be Valid for 60 Days Only.

- Fees will not be Refunded After Enrolling.

Requirements

- Required internet connection. Lectures can be viewed on Mobile or Laptop

This course includes:

- Hindi, English

- 18+ Hours of Video Content

- Recording is Available for 60 Days

- Studycafe Certificate of Participation

- Access on mobile or Computer/Laptop

- Downloadable Material

Certificate to be provided to all the participants.