"Extend Due Date Immediately" Trends on Twitter as the ITR Filing Last Date is Near

Sushmita Goswami | Jul 26, 2022 |

“Extend Due Date Immediately” Trends on Twitter as the ITR Filing Last Date is Near

The deadline for filing an Income Tax Return for the Financial Year 2021-22 (Assessment Year 2022–2023) for Non-Audit case is July 31, 2022. The Government Clarified that govt does not intend to extend the deadlines, some Twitter users encouraged the income tax department to do so right away.

Social media users have expressed their dissatisfaction with the e-filing website’s performance.

The hashtag Extend Due Date Immediately is trending on Twitter as the ITR filing deadline for AY 2022-23 is 31st July 2022. There are Around 13.8k Tweets for Extension at the time of publishing of this article.

Users complain that the Income Tax e-filing portal is not functioning properly. All the users are constantly twitting to Extend Due Date Immediately, to persuade the government to extend the deadline for ITR filing by at least one month.

On Wednesday, Union Revenue Secretary Tarun Bajaj stated that the deadline for filing income tax returns for the Financial Year 2022-2023 will not be extended.

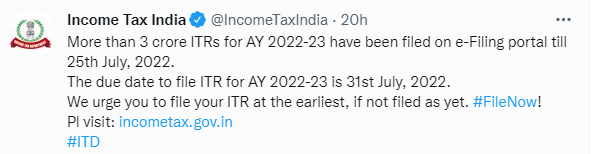

Earlier today, the tax department tweeted, “Dear Taxpayers, If you haven’t yet, don’t forget to file your ITR. ITR submissions for AY 2022–23 must be made by July 31st, 2022.

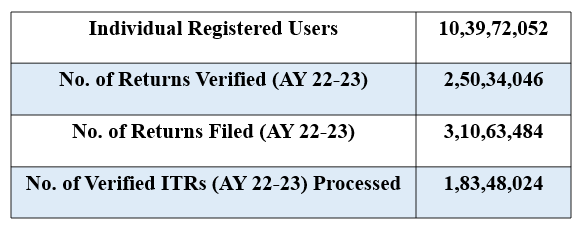

Income Tax Return Filing status as on 25.07.2022 is given below:

As per the Above Stats, there are more than 7 crore ITR pending which need to be filed in 6 days.

By the end of July 2022, salaried Persons and HUFs (Hindu Undivided Families) whose accounts don’t need to be audited must file their income tax returns for the Financial Year 2021–2022 (AY 2022–2023).

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"