Reetu | Aug 5, 2022 |

GSTR-9 & 9C enabled on GST Portal for F.Y. 2021-22

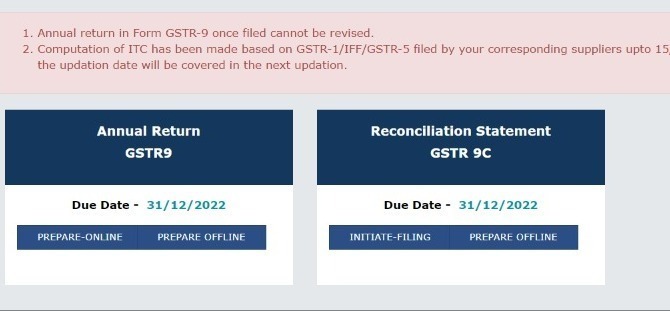

The Goods and Service Tax Network (GSTN) has been enabled GSTR-9 & 9C on GST Portal for F.Y. 2021-22.

The GSTR-9 form is an annual return that has to be filed by all registered taxable persons under GST.

The GSTR-9C is the GST reconciliation Statement for a particular FY on or before 31st December.

Taxpayers with an annual revenue of more than Rs. 2 crore during the FY 2021–22 are exempt from filing GSTR-9 or annual returns, according to the CBIC.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"