Income Tax Dept. released FAQs on Challan Status Inquiry Facility

Reetu | Nov 7, 2022 |

Income Tax Dept. released FAQs on Challan Status Inquiry Facility

The Income Tax E-filing Department has released the frequently asked questions on Challan Status Inquiry(CSI) Facility.

The Income Tax Department facilitates taxpayers to track the status of their challan deposits through an Enquiry of Challan Status on TIN-NSDL website. The ability to check the status of a challan gives taxpayers a way to ensure that their tax payments have been correctly recorded in their names. Both banks and taxpayers are able to use these services.

Taxpayers can track the status of their challan deposits in two ways, namely CIN based view and TAN based view.

Frequently Asked Questions:

Only TAN users can download a CSI file using TAN as user ID.

You can Download the CSI file by following below mentioned steps:

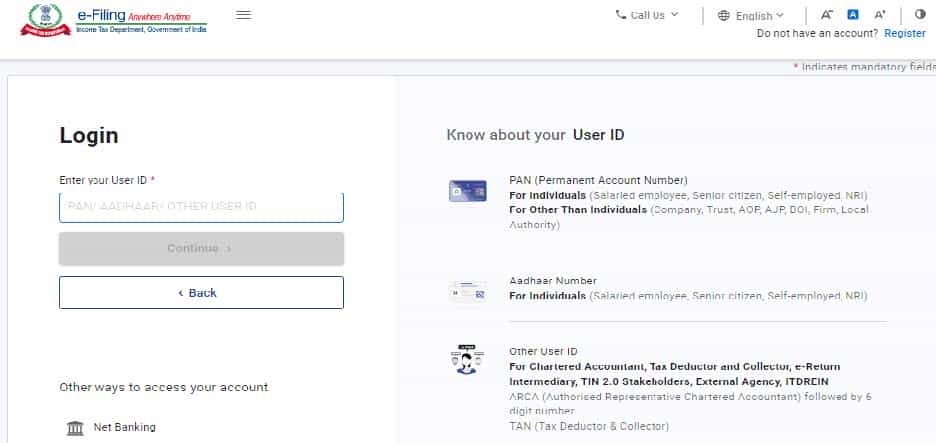

Step 1: Login to e-Filing portal using TAN as User ID.

Step 2: Go to e-File >> e-Pay Tax Service.

Step 3: On e-Pay Tax page click on Payment History tab

Step 4: Click on the Filter options.

Step 5: Select Payment date range (From to To) in Filter options.

Once the download CSI file button gets enabled, you can click on the same to download the file.

Note: You cannot download the CSI (Challan Status Inquiry) file by filtering challans based on the Assessment Year or Type of Payment, You can only download the CSI file by filtering challans paid during a specific period (From – to-To date) not exceeding 24 months.

No, You cannot download the CSI file by filtering challans based on the Assessment Year or Type of Payment you only download the CSI file by filtering challans paid during a specific period ( From -to-To date ) not exceeding 24 months.

No, You can not download the CSI file period prior to 01-July-2022 on e-Filing portal using e-Pay Tax service.

Note: If you want to download the CSI file period prior to 01-July-2022. click on the click here button at the bottom of the e-Pay Tax screen, on click you will be redirected to “Protean portal (NSDL)” where you can download the CSI file period prior to 01-July-2022.

Yes, the challan for payments made through the NSDL portal will also be available in CSI file downloaded using “ePay Tax” service on e-Filing portal. However, the challan receipts for NSDL Payment will not be available for download.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"