Course Key Features

- What is ITR? How to File ITR Practically.

- Discussion on Basic Concepts of Income Tax

- Discussion on How many ITR Forms Available

- Changes in ITR Forms as per the Act

- Understanding of ITR 1 & ITR 4 Forms

- Understanding of ITR 2 & ITR 3 Forms

Course Description

By Joining This 3 Days LIVE ITR Filing Workshop

You will Learn ITR Filing Which will Save your Hours Of Time & Effort, and you will be able to File your ITR's and ITR of Others as well.

Who is Eligible to Join Income Tax Return Filing Certification Course:

There is no bound on the eligibility from our side for ITR Filing Certification Course. Any person who wants to learn and master in ITR Filing can join this course. However, it will be more beneficial for the below-mentioned persons:

⭐Corporate Professionals

⭐Marketing Professionals

⭐Human Resource Professionals

⭐Qualified CA/CS/CMA/LLB

⭐Commerce Graduates/CA/CS/CMA/Law Students

⭐Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐Any Other Person not covered above can join course if interested

How I will get the course:

This is an online ITR Filing Certification course so there will not be any physical delivery of the lectures. After the purchase of the ITR Filing Certification course, you can see the ITR Filing Certification course under my account option under purchased courses. All the videos, study materials, PDF files, PPT’s will be uploaded there for quick access of participants. This ITR Filing Certification course is valid for 60 Days.

Course Duration:

The course duration is around 6 hours.

Certificate:

A Certificate of Participation from the Studycafe will be provided on completion of the ITR Filing Certification course.

Views Limitation:

This is a Completely online course, no bar on the number of views. During 60 days you can access this ITR Filing Certification course from anywhere at any time with unlimited views.

Course Content

Day-1: Basic Concepts

2 Hrs✔️ Discussion on Basic Concepts of Income Tax

✔️ Discussion on ITR Forms

✔️ Changes in ITR Form

Day-2: ITR 1 & ITR 4

2 Hrs✔️ Discussion on Basic Concepts of Income Tax

✔️ Discussion on ITR Forms

Day-3: ITR 2 & ITR 3

2 Hrs✔️ Discussion on Basic Concepts of Income Tax

✔️ Discussion on ITR Forms

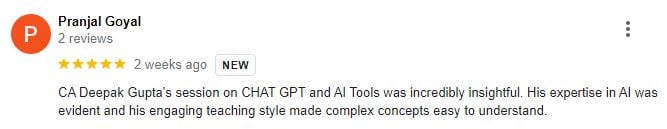

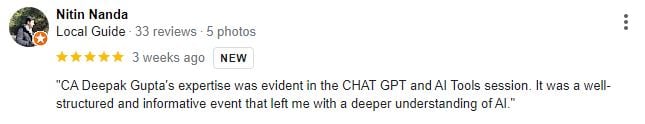

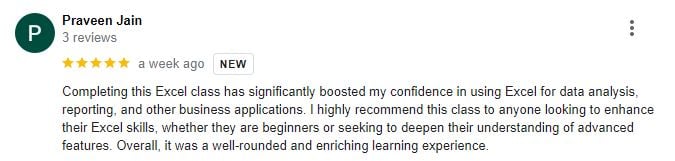

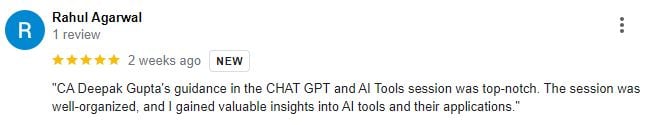

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join ITR Filing Certification Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students ⭐ Tax professionals whether in JOB or Practice ⭐ Qualified CA/CS/CMA/LLB ⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry ⭐ Any other person not covered above can join course if interested.

What will be Language of ITR Filing Certification Course

ITR Filing Course will be in Mix of English and Hindi Language.

What is the Duration of the Course?

Course will be of more than 6 Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 60 Days.

How Can we Join ths Course?

Please register yourself and make the fees. After making fees you will get call fom our side.

Featured In

Terms and Conditions

- Course Recording will be Provided for 60 Days!

- No Limitation on Number of Views you can Watch it Unlimited Times

Requirements

- Required internet connection. Lectures can be viewed on Mobile or Laptop

- No Prior Knowledge or Experience Required to Join 2 Days ITR Filing Workshop!

This course includes:

- Hindi,English

- 6+ Hours of Video Content

- Recording is Available for 60 Days

- Studycafe Certificate of Completion

- Access on mobile or Laptop

Certificate to be provided to all the participants.