The Disciplinary Committee of ICAI in the matter of CA. Madhav Balwant Pol has penalised Chartered Accountant for Non-Disclosure of AS-18 and Interest payable to MSME in FS.

Reetu | Aug 8, 2023 |

CA penalised for Non-Disclosure of AS-18 and Interest payable to MSME in FS

The Disciplinary Committee of ICAI in the matter of CA. Madhav Balwant Pol has penalised Chartered Accountant for Non-Disclosure of AS-18 and Interest payable to MSME in FS.

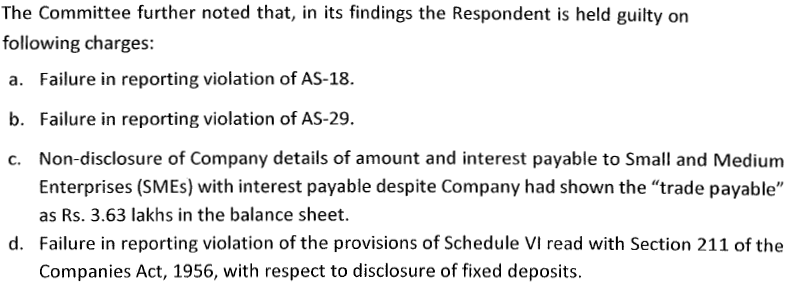

That vide findings under Rule 18 (17) of the Chartered Accountants (Procedure of Investigations of Professional and Other Misconduct and Conduct of Cases) Rules, 2007 dated 11th February, 2023, the Disciplinary Committee was, inter-alia of the opinion that CA. Madhav Balwant Pol (M.No.035069), (hereinafter referred to as the Respondent”) was GUILTY of professional misconduct falling within the meaning of Items (5), (6), (7), and (8) of Part I of the Second Schedule to the Chartered Accountants Act, 1949.

The Committee noted that the Respondent, in his submissions, submitted that the amounts of related party transactions in the current year were properly disclosed and that the failure was in respect of the non-disclosure of figures of the previous year. As regards the charge relating to reporting the violation of AS-29, he submitted that the penalty was not actually levied by the Income Tax Department and there was no quantification of the penalty. He further submitted that a reference to MSME was inadvertently missed. The Respondent regarding the charge relating to the reporting requirement of fixed assets, submitted that the company had been following the same disclosure practice for the last 30-40 years. He further added that he is 66 years old and has 40 years of unblemished professional carrier. He accordingly requested to consider his case sympathetically.

The Committee further noted that the same matter was also heard by Regional Director, Western Region, MCA, Mumbai, wherein Sh. A.K. Chaturvedi, Regional Director, Western Region, Mumbai, ordered the Respondent to pay an amount of Rs. 5,000/- as compounding fees. The Committee noted that this fact was also admitted by the Respondent before it.

The Committee, while considering his oral submissions on record, noted that the lapses were more technical in nature and that no harm was caused to anyone. The Committee further noted that, though the lapses were purely unintentional and without any malafide intentions, the Respondent is still required to be more vigilant while discharging his professional duties. Accordingly, the Committee, looking into the gravity of the charge vis-a-vis submissions of the Respondent, decided to give a minimum punishment to the Respondent that commensurate with his misconduct in the instant matter.

Therefore, keeping in view the facts and circumstances of the case, the material on record, and the submissions of the Respondent before it, the Committee ordered that the Respondent CA. Madhav Balwant Pol (M.No.035069}, be reprimanded along with a fine of Rs.5,000/(Rupees Five Thousand Only).

For Official Order Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"