IT Department has achieved a milestone in the Income Tax Return (ITR) Processing with over 1.66 crore ITRs (for A.Y. 2023-24) processed in a single day.

CA Pratibha Goyal | Dec 14, 2023 |

Income Tax Department achieves Milestones by Processing over 1.66 crore ITRs in a single day

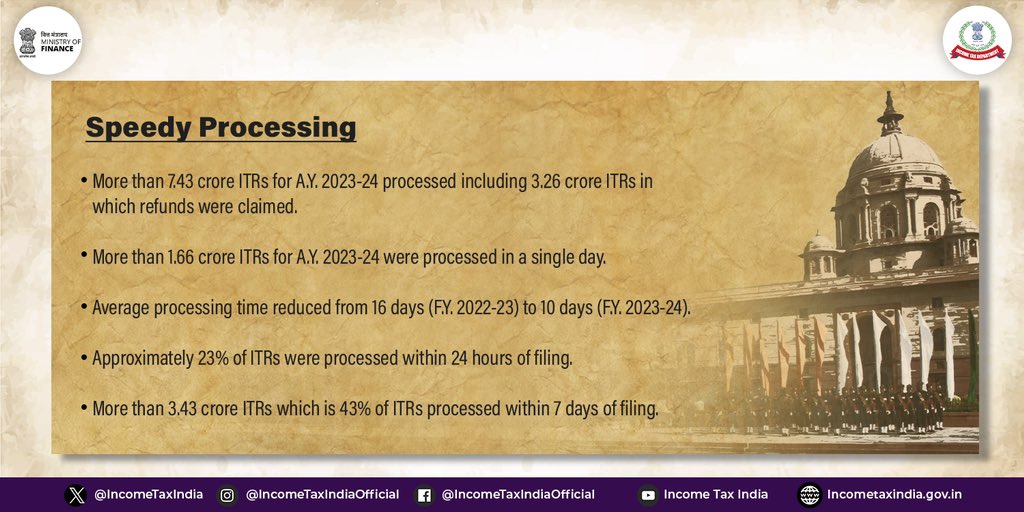

The Income Tax Department has achieved a milestone in the Income Tax Return (ITR) Processing with over 1.66 crore ITRs (for A.Y. 2023-24) processed in a single day.

The average processing time of an ITR has been reduced from 16 days in FY 2022-23 to 10 days in FY 2023-24. This means now 23% of ITRs are processed within 24 hours of filing.

Income Tax Refunds amounting to Rs. 2.03 lakh crores were issued from 01.04.2023 to 30.11.2023.

Many special initiatives were taken for cases where a refund initially failed because the bank was not pre-validated. In those cases, the refund was subsequently issued to the validated bank account after taking appropriate measures.

Over 44.76 lakh Updated Returns filed up to 30th November, 2023

Updated Returns facilitates, the taxpayers to update their returns within two years from the end of the relevant assessment year. As on 30th November, 2023, over 44.76 lakh Updated Returns filed with additional tax of over Rs. 4,000 crore.

Steady growth in Direct Tax collections

The net collection of income tax in FY 2023-24 (upto 30.11.2023) is 23.4% higher year-on-year. It is also good to know that 58.34% of the budget estimates for FY 2023-24 have already been achieved.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"