Reetu | Oct 8, 2024 |

Blinkit launches feature of GST invoicing for Businesses; Providing ITC upto 28%

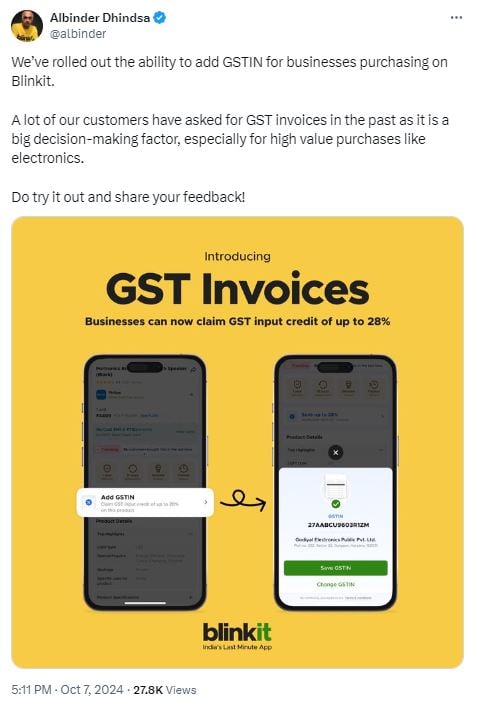

Blinkit has introduced a feature that allows businesses to enter their GSTIN (Goods and Services Tax Identification Number) when purchasing products through the platform. According to CEO Albinder Dhindsa, this change is in response to customer demand, particularly from businesses purchasing high-value items such as electronics.

With the introduction of GST invoices, businesses can now claim up to 28% in GST input credit for their purchases.

The new functionality allows users to enter their GSTIN straight into the Blinkit app, enabling them to get GST-compliant invoices. This is especially important for businesses that want to lower total costs by claiming GST input credits. For example, if a company purchases goods that fall under the 28% GST rate, it can claim that proportion back as input credit.

For numerous businesses, the ability to claim GST input credit is crucial when making large purchases. This upgrade makes Blinkit more appealing to business purchasers, particularly for items with higher GST rates.

CEO Dhindsa invited users to try the feature and share their feedback. He on his Twitter account shared this news.

He wrote, “We’ve rolled out the ability to add GSTIN for businesses purchasing on Blinkit. A lot of our customers have asked for GST invoices in the past as it is a big decision-making factor, especially for high-value purchases like electronics. Do try it out and share your feedback!”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"