The term "advance tax" refers to income tax that must be paid in advance throughout the year, in installments, on the scheduled due dates set by the income tax department.

Reetu | Dec 12, 2024 |

Tax Deadline: Advance Tax Payment Deadline extended to 16th December?

Commonly known as the ‘pay as you earn’ tax, the term “advance tax” refers to income tax that must be paid in advance throughout the year, in installments, on the scheduled due dates set by the income tax department. It is expected to be settled in the same year in which the income is earned.

Individuals and businesses with a tax liability of Rs. 10,000 or more in a financial year must pay advance tax to ensure compliance with tax regulation and need to pay advance tax in four installments that are June 15, Sept. 15, Dec. 15, and March 15 as the deadlines.

This time, the deadline for making an advance tax payment is Sunday, December 15, 2024. Taxpayers, including salaried persons, freelancers, and businesses, must submit the payment by the deadline specified in the advance tax laws for the financial year 2024-25.

However, because the deadline falls on a Sunday, taxpayers are concerned about what would happen if they miss it. Here’s all you need to know:

According to the advance tax regulations for the financial year 2024-25, the due dates for advance tax payments are the following:

The next deadline to pay advance tax is December 15, 2024. Because December 15 is a Sunday, taxpayers are recommended to submit their payment on December 16, the next business day. According to the Income Tax Circular, if the due date for advance tax payment falls on a public holiday, the following working day is deemed the payment deadline.

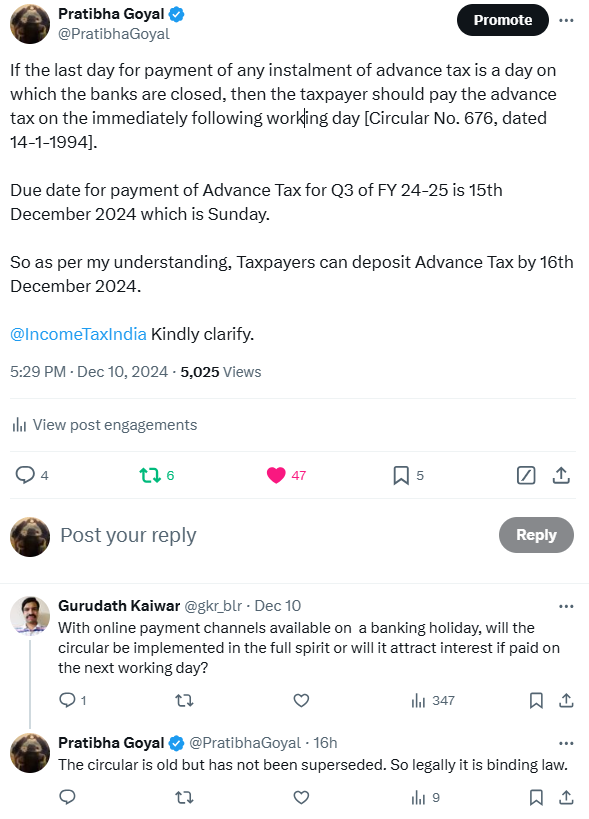

As shared by CA Pratibha Goyal on her Twitter handle “If the last day for payment of any instalment of advance tax is a day on which the banks are closed, then the taxpayer should pay the advance tax on the immediately following working day [Circular No. 676, dated 14-1-1994]. Due date for payment of Advance Tax for Q3 of FY 24-25 is 15th December 2024 which is Sunday. So as per my understanding, Taxpayers can deposit Advance Tax by 16th December 2024.”

Circular No. 676, dated 14-1-1994 reads as follows:

” 1. Representations have been received by the Board seeking waiver of interest chargeable under sections 234B and 234C of the Income-tax Act, 1961 for default in payment of instalments of advance tax by the due dates which are prescribed under section 211 of the Income-tax Act. In cases where the last date for making payment of such instalments (i.e.,15th September, 15th December and 15th March) happens to be a holiday and the assessee pays the due amount of advance tax on the next working day.

2. The matter has been carefully considered by the Board and it is felt that in such cases section 10 of the General Clauses Act, 1897 will be applicable. This section lays down that where any Act or proceeding is directed or allowed to be done or taken in any Court or office on a certain day or within a prescribed period, then, if the Court or office (in the present case the bank which is authorised to receive payment of advance tax from the assessee) is closed on that day or on the last day of the prescribed period, the Act or proceeding shall be considered as done or taken in due time after it is done or taken on the next day, afterwards, on which the Court or office (or the bank) is open. In view of this provision,it is hereby clarified that if the last day for payment of any instalments of advance tax is a day on which the receiving bank is closed, the assessee can make the payment on the next immediately following working day, and in such cases, the mandatory interest leviable under sections 234B and 234C of the Income-tax Act, 1961 would not be charged.”

One of the Query on her post was “With online payment channels available on a banking holiday, will the circular be implemented in the full spirit or will it attract interest if paid on the next working day?” to which she replied “The circular is old but has not been superseded. So legally it is binding law.”

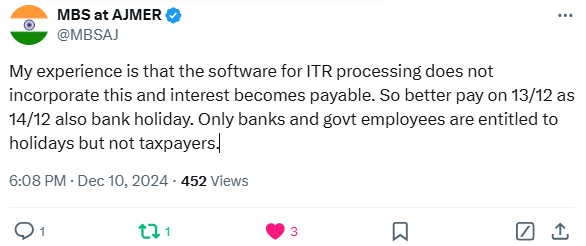

Another Tax Professional wrote “My experience is that the software for ITR processing does not incorporate this and interest becomes payable. So better pay on 13/12 as 14/12 also bank holiday.”

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"