CS Lalit Rajput | Jul 1, 2020 |

Corporate Compliance Calendar for July 2020

ABOUT ARTICLE :

This article contains various Compliance requirements under Statutory Laws. Compliance means “adhering to rules and regulations.” Compliance is a continuous process of following laws, policies, and regulations, rules to meet all the necessary governance requirements without any failure.

If you think compliance is expensive, try non‐ compliance”

Compliance Requirement Under

1. Income Tax Act, 1961

2. Goods & Services Tax Act, 2017 (GST) and Important Updates / Circulars

3 Foreign Exchange Management Act, 1999 (FEMA) and Important Notifications

4. Other Statutory Laws and Updates

5. SEBI (Listing Obligations & Disclosure Requirements) (LODR) Regulations, 2015

6. SEBI Takeover Regulations 2011

7. SEBI (Prohibition of Insider Trading) Regulations, 2015

8. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

9. SEBI (Buyback of Securities) Regulations, 2018

10. SEBI (Depositories and Participants) Regulations 2018) and Circulars / Notifications

11. Timelines for compliance with the regulatory requirements by DPs / RTAs

12. Companies Act, 2013 (MCA/ROC and LLP Compliance) and Notifications

13. Insolvency and Bankruptcy Board of India (IBBI) Updates

14. Govt Extends Validity of Vehicle Documents till July 31, 2020

IMPORTATNT UPDATES:

1. PAN-Aadhaar linking deadline FURTHER extended to beyond JUNE, 2020

The due date for linking of PAN with Aadhaar as specified under sub-section 2 of Section 139AA of the Income-tax Act,1961 has been extended from 31st December, 2019 to 31st March, 2020 and further extended to 31st March, 2021 due to COVID – 19 outbreak.

| Sl. No. | Particulars of the Notification(s) | File No. / Circular No. | Notification Link(s) |

| 1. | The principal notification was published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (ii), vide number S.O. 1790 | Notification No. 32/2020/ F.No. 370142/17/2020-TPL | LINK |

| 2. | Central Government hereby notifies for the purposes of the said clause, ‘Greater Noida Industrial Development Authority’ (PAN AAALG0129L) – reg. | Notification No. 33/2020 F.No.300196/39/2018-ITA-I | LINK |

| 3. | the Central Government hereby notifies for the purposes of the said clause, ‘Maharashtra Electricity Regulatory Commission’, Mumbai (PAN AAAGM0004R), a commission established by the State Government of Maharashtra | [Notification. No. 34/2020/ F.No.300196/53/2019-ITA-I | LINK |

| 4. | Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 (2 of 2020) | [Notification No.35 /2020/ F. No. 370142/23/2020-TPL | LINK |

| 5. | the Central Government hereby notifies for the purposes of the said clause, ‘Real Estate Regulatory Authority’ as specified in the schedule to this notification | Notification No. 36/2020, F. No. 300196/38/2017-ITA-I | LINK |

R 3B Due Dates for May 2020

A. Taxpayers having aggregate turnover > Rs. 5 Cr. in preceding FY

B. Taxpayers having aggregate turnover upto Rs. 5 crores in preceding FY (Group A)

C. Taxpayers having aggregate turnover upto Rs. 5 crores in preceding FY (Group B)

D. Late Fee Relief to Normal Taxpayers filing Form GSTR-3B

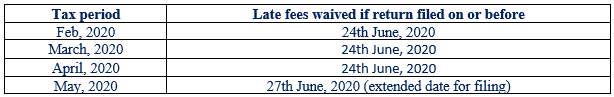

i) Taxpayers having aggregate turnover > Rs. 5 Cr. in preceding FY

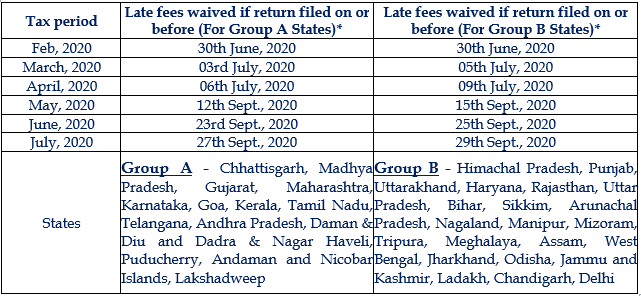

ii) Taxpayers having aggregate turnover upto Rs. 5 crores in preceding FY

Kindly note:

Taxpayers who are yet to file Form GSTR-3B for any month(s) from July, 2017 till Jan., 2020, can now file Form GSTR-3B from 1st July, 2020 till 30th Sept., 2020, without any late fee, for those months in which they did not have any tax liability. However, for the months they had a tax liability, their late fee is capped at Rs 500 per return.

iii) Late Fee Relief to Normal Taxpayers filing Form GSTR-1:

Kindly note:

If the Form GSTR-3B and Form GSTR-1 for the period mentioned in Tables above is not filed by the notified dates, late fee will become payable from the due dates for these returns.

E. Compliances for Composition taxpayers

F. Non Resident Tax Payers, ISD, TDS & TCS Taxpayers

– (for the month of March, April, May, June & July 2020)

KEY UPDATE(s):

1. Filing NIL Form GSTR-3B through SMS on GST Portal

A taxpayer may now file NIL Form GSTR-3B, through an SMS, apart from filing it through online mode, on GST Portal. Taxpayer can file NIL Form GSTR-3B, through SMS for all GSTINs, for whom they are an Authorized Signatory, using same mobile number.

LINK

2. Relief in opting for Composition by Taxpayers, filing other Returns & EWB.

Due to COVID-19 pandemic and challenges faced by taxpayers, Government has extended dates for GST filings. These are notified in Central Tax Notifications 30, 34 & 35/2020 dated 03.04.2020 & 47/2020 dated 09.06.2020 & 55/2020 dated 27.06.2020.

LINK

GST UPDATES AS ON 30.06.2020:

| Sl. No. | Notification(s) | Notification No. | Link(s) |

| 1 | Seeks to bring into force Sections 118, 125, 129 & 130 of Finance Act, 2020 in order to bring amendment to Sections 2, 109, 168 & 172 of CGST Act w.e.f. 30.06.2020. | 49/2020- Central Tax ,dt. 24-06-2020 | LINK |

| 2 | Seeks to make seventh amendment (2020) to CGST Rules. | 50/2020- Central Tax ,dt. 24-06-2020 | LINK |

| 3 | Seeks to provide relief by lowering of interest rate for a prescribed time for tax periods from February, 2020 to July, 2020. | 51/2020- Central Tax ,dt. 24-06-2020 | LINK |

| 4 | Seeks to provide one time amnesty by lowering/waiving of late fees for non furnishing of FORM GSTR-3B from July, 2017 to January, 2020 and also seeks to provide relief by conditional waiver of late fee for delay in furnishing returns in FORM GSTR-3B for tax periods of February, 2020 to July, 2020. | 52/2020- Central Tax ,dt. 24-06-2020 | LINK |

| 5 | Seeks to provide relief by waiver of late fee for delay in furnishing outward statement in FORM GSTR-1 for tax periods for months from March, 2020 to June, 2020 for monthly filers and for quarters from January, 2020 to June, 2020 for quarterly filers | 53/2020- Central Tax ,dt. 24-06-2020 | LINK |

| 6 | Seeks to extend due date for furnishing FORM GSTR-3B for supply made in the month of August, 2020 for taxpayers with annual turnover up to Rs. 5 crore. | 54/2020- Central Tax ,dt. 24-06-2020 | LINK |

| 7 | Seeks to amend notification no. 35/2020-Central Tax in order to extend due date of compliance which falls during the period from “20.03.2020 to 30.08.2020” till 31.08.2020. | 55/2020-Central Tax dated 27.06.2020 | LINK |

| 8 | Seeks to amend notification no. 46/2020-Central Tax in order to further extend period to pass order under Section 54(7) of CGST Act till 31.08.2020 or in some cases upto fifteen days thereafter. | 56/2020-Central Tax dated 27.06.2020 | LINK |

DUE DATES EXTENED BY RBI – LFAR FOR FY 2019-20:

1. RBI has extended the timeline for submission of Long Form Audit Report (LFAR) by the statutory auditors to the banks by one month and now, it can be submitted by July 31, 2020.

2. with respect to LFAR, all Certificates as per the Certification/Validation requirements for SCAs of scheduled commercial banks for FY 2019-20 can be submitted along with the LFAR by July 31, 2020.

Key Update:

1. Pradhan Mantri Garib Kalyan Yojana: A Scheme to implement the PMGKY package for credit of employee’s & employer’s share of EPF & EPS contributions (24% of wages) for three months (March 2020 to May 2020) by Govt. of India.

2. EPFO operationalizes Pradhan Mantri Garib Kalyan Package for Low Wage Earning EPF Member and EPF covered Establishments with upto 100 Employees:

– Relief available for 6 months from March – August, 2020

– ECR with declaration to be filed to avail benefits of eligible employees and establishments.

– Eligible Establishments remitting for March, 2020 prior to PMGKY ECR Facility have to update Bank details in Form 5A to get re-imbursement.

3. ONLINE EPF TRANSFER PROCESS:

Employees’ Provident Fund Organization (EPFO), India Ministry of Labour & Employment, Government of India has issued Instructions for transfer online EPF. In case of change of Job, it is important to switch EPF account from previous employer to the new employer. This whole transfer process has to be done to reduce overall tax liability from the balance accumulated in two separate accounts (Account with Previous and New Organization).

FULL PROCESS

UPDATES TRACKER UNDER LABOUR LAWS:

| Sl. No. | Notification(s) | Link(s) |

| 1 | Relaxation of time limit for filling and depositing ESI contribution for the month of February, 2020 and March-2020 | Link |

| 2 | FAQ’s on ECR FILING AND PAYMENT OF CONTRIBUTIONS | Link |

| 3 | FAQ’s on Transfer Claims for Employees | Link |

| 4 | Gazette Notification regarding the reduction in the rate of EPF Contribution | Link |

SEBI MEASURES IN REPOSNSE TO COVID 19

COMPLIANCE REQUIREMENT UNDER SEBI (LISTING OBLIGATIONS AND DISCLOSURE REQUIREMENTS) (LODR) REGULATIONS, 2015

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"