CBDT has introduced, interest Waiver on Income Tax Dues, New Monetary Thresholds are given in this article.

Anisha Kumari | Nov 9, 2024 |

CBDT Introduces Interest Waiver on Income Tax Dues, Sets New Monetary Thresholds

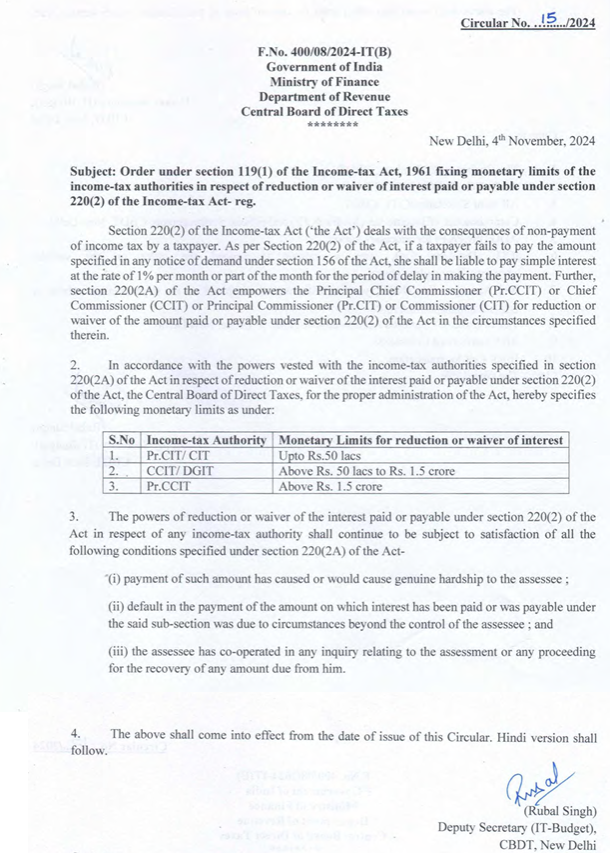

The Central Board of Direct Taxes (CBDT) has introduced a discretionary waiver of interest on outstanding income tax dues, which arise due to demand notices served upon taxpayers. However, this waiver is subject to certain monetary limits, which designate the approval authority based on the amount waived.

Under Section 220(1) of the Income Tax Act, any amount—other than advance tax specified as payable in a demand notice under Section 156 must be paid within 30 days from the date the notice is served. Failure to pay within this period results in an interest charge under Section 220(2) of the Act, accruing at 1% per month for each month of delay in payment.

The new CBDT circular also prescribes monetary limits for such waivers. For instance, all waivers up to Rs 50 lakh can now be approved by principal commissioners; those between Rs 50 lakh and Rs 1.5 crore by chief commissioners; and waivers above Rs 1.5 crore by principal chief commissioners.

This adjustment to Section 220(2) is seen as an integrated approach in tax administration. The imposition of monetary limits is expected to streamline waiver applications, making the system more responsive to taxpayers.

The circular aims to enhance the efficiency of waiver processing. By setting specific limits, the CBDT empowers officials at various levels to review and decide on requests based on their designated thresholds. This structure enables quicker decision-making, as cases within these thresholds can be resolved without undue administrative delays, thereby minimizing bottlenecks in the waiver process.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"