Course Key Features

- What are Mutual Funds ?

- What is Concept of NAV ?

- What are Open Ended and Close Ended Funds ?

- Regular Plan v/s Direct Plan

- Industry and Regulatory Body for Mutual Fund

- Taxation of Mutual Funds - Classification into Short Term and Long Term Capital Gains

- How to Calculate Capital Gain on Sale of Mutual Funds ?

- Taxation on Dividends from Mutual Funds

- Taxation on Capital Gain from Sale of Mutual Funds etc.

Course Description

2 Day Certification Course on Mutual Fund and Taxation of Mutual Funds

In our continuous endeavor to empower more and more finance professionals, this Mutual Fund certification course has been designed for you. A detailed 2 Days course has been designed where daily more than 2 hrs sessions have been organized. This Course contains Videos along with study material.

How I will get this 2 Day Certification Course on Mutual Fund and Taxation of Mutual Funds:

This is an online 2 Day Certification Course on Mutual Fund and Taxation of Mutual Funds so there will not be any physical delivery of the lectures. After the purchase of the Mutual Fund Certification course you can see the 2 Day Certification Course on Mutual Fund and Taxation of Mutual Funds under my account option under purchased courses. All the videos, study materials, PDF files, PPT’s, excel files will be uploaded there for quick access of participants. This Mutual Fund Certification course is valid for 60 Days.

Who is Eligible to Join 2 Day Certification Course on Mutual Fund and Taxation of Mutual Funds:

There is no bound on the eligibility from our side for 2 Day Certification Course on Mutual Fund and Taxation of Mutual Funds. Any person who want to learn and master in Mutual Fund can join this course. However, it will be more beneficial for the below-mentioned persons:

⭐ Commerce Graduates/CA/CS/CMA/Law students

⭐ Tax professionals whether in JOB or Practice

⭐ Qualified CA/CS/CMA/LLB

⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐ Any other person not covered above can join course if interested.

2 Day Certification Course on Mutual Funds and Taxation of Mutual Funds Duration:

The course duration is around 4 hours.

Certificate:

A Certificate of Participation from the Studycafe will be provided on completion of the Mutual Fund Certification course.

Views Limitation:

This is a Completely online course, no bar on the number of views. During 60 days you can access this Mutual Fund Certification course from anywhere at any time with unlimited views.

About the Faculties:

Enroll Now in this Course and Kick Start your Investment Journey.

"Unlock the Power of the Mutual Fund Investing: Learn, Invest, And Prosper!" Meet you in Class!!

First Session on Basics of Mutual Funds will be taken by Mr.Mukul Lamba who is a Young and Talented Business Mentor and Stock Market Enthusiast. He is Founder of Government of India Recognized Startup Bizz Gyaan Private Limited and He is a CA and CS Final Student.

Second Session on Taxation of Mutual Funds will be taken by CA Manoj Lamba. CA MANOJ LAMBA is a practicing Chartered Accountant. He is CA by profession and Trainer by passion. He is Co-Founder of Bizz Gyaan Private Limited which is Govt. Of India recognized Startup. He is also registered as Mentor on Startup India Govt. Portal. He actively runs a YouTube Channel Tax ki Pathshala through which he aims to spread Tax Awareness among his Fellow Members and Society. He is also a final pass of Institute of Companies secretaries of India. Besides that, He is also a Law Graduate. He is also a member of All India Management Association (AIMA). He has vast experience of 25 years in Auditing, Income Tax & Company Law. He has been regularly associated with ICAI since 1999. He has mentored over 10000+ students and fellow members by taking over 500+ Seminars and Webinars throughout India. He has also Authored 3 Books titled A Simplified Guide to GST for B.com (KUK) university students, E-Book on Vivad se Vishwas and E-book on Rectification of Mistakes under Income Tax Act 1961.

Course Content

Day-1: Basics of Mutual Funds

2 Hrs1. What are Mutual Funds

2. What is Concept of NAV

3. What are Open Ended and Close Ended Funds

4. What are Different Types of MF Schemes

5. Regular Plan v/s Direct Plan

6. Advantages and Disadvantages of Mutual Funds

7. Industry and Regulatory Body for Mutual Funds

Day-2: Taxation of Mutual Funds

2 Hrs1. Taxation of Mutual Funds - Classification into Short Term and Long Term Capital Gains

2. How to Calculate Capital Gain on Sale of Mutual Funds?

3. Taxation on Dividends from Mutual Funds

4. Taxation on Capital Gain from Sale of Mutual Funds

5. Taxation on Equity Mutual Funds

6. Taxation on ELSS (Equity Linked Saving Scheme)

7. Taxation on Debt Mutual Funds

8. Taxation on Hybrid Mutual Funds

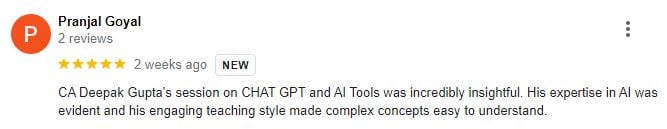

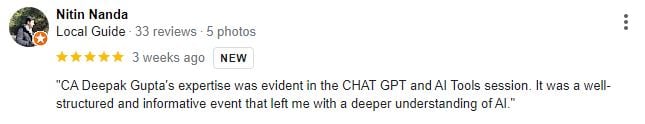

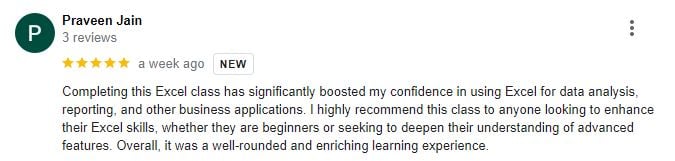

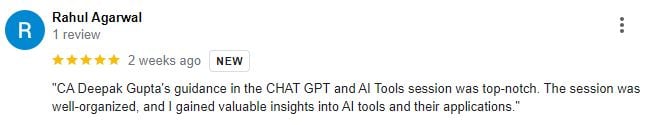

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join Workshop on Mutual Fund Certification Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students ⭐ Tax professionals whether in JOB or Practice ⭐ Qualified CA/CS/CMA/LLB ⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry ⭐ Any other person not covered above can join course if interested.

What will be Language of Mutual Fund Certification Course?

It will be in English Language.

What is the Duration of the Course?

Course Duration will be of 4+ Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 60 Days.

How Can we Join this Mutual Fund Certification Course?

Please register yourself and pay the fees. After paying fees you can see the Lectures in Course section.

Featured In

Terms and Conditions

- Course Recording will be Provided for 60 Days!

- No Limitation on Number of Views you can Watch it Unlimited Times

Requirements

- Required internet connection. Lectures can be viewed on Mobile or Laptop

- No Prior Knowledge or Experience Required to Join this Workshop!

This course includes:

- Hindi, English

- 4+ Hours of Video Content

- Recording is Available for 60 Days

- Studycafe Certificate of Completion

- Access on mobile or Laptop

Certificate to be provided to all the participants.