Course Key Features

- Learn About How to Use Chat GPT to Reply Department Notices

- Learn About How to Use Send Payment Reminders to Clients in Single Click

- Learn About How to Use Chat GPT with Excel

- Learn About How to Use Chat GPT with Excel

- Learn About How to Solve Excel Problems With Chat GPT

- How to Write Macros using Chat GPT

- Learn to Use AI Tools in Powerpoint

- Learn About How toUse Mail Merge With Chat GPT

- Learn About How to send Bulk Emails from Chat GPT

- Learn About How to Draft Email Reply from Chat GPT

- Introduction to GST Returns

- Changes in GST Filing

- Complete Filing Process for Return - 1, 3b, 9 and 9C

- GST payments and refunds

- E-Way Bill

- Export Transactions

- Using Online and Offline Utility to file GST Return

- Understanding GST Invoice Management System

Course Description

Register Fast to unlock bonuses worth Rs. 12,000.

Certification Course on Chat GPT and AI Tools for Professionals and GST Practical Return Filing Process

In our continuous endeavor to empower more and more finance professionals and investors, this Course has been designed for you. Join this Certification Course on Chat GPT and AI Tools for Professionals and GST Practical Return Filing Process. Studycafe has organized this 8 Days Certification Course on Chat GPT and AI Tools for Professionals and GST Practical Return Filing Process. Recording of the Video is Valid for 1 Year. This Course contains Videos along with study material and Excel Files. Live training on Chat GPT and GST Practical Return Filing will be given.

How I will get the course:

This is an online Certification Course so there will not be any physical delivery of the lectures. After the purchase of the Certification Course you can see this Chat GPT and AI Tools for Professionals and GST Practical Return Filing Process Certification Course under my account option under purchased courses. All the videos, study materials, PDF files, PPT’s and Excel files will be uploaded there for quick access of participants. This Certification Course's Recording is valid for 1 Year.

Who is Eligible to Join this Course:

There is no bound on the eligibility from our side to join this Certification Course. Any person who want to learn about CHAT GPT, AI Tools and practical GST Return Filing can join this Course.

Course Duration:

The course duration is around 16+hours.

Certificate:

A Certificate of Participation from the Studycafe will be provided on completion of the Certification Course.

Views Limitation:

This is a Completely online course, no bar on the number of views. During 1 Year you can access this Certification Course from anywhere at any time with unlimited views.

Course Start Date:

This Course is starting on Dec 16, 2024 and will be completed on Dec 26, 2024.

Course Timing:

Timing: 6:00 pm to 8:00 pm

Course Content

Day-1: Introduction to GST Returns

120 Mins• Introduction to GST Returns along with recent changes

Day-2: Discussion on GSTR-1 Filing

120 Mins• Step by Step Discussion along with understanding the Form

• Lots of practical Examples

• Using Online and Offline Utility

Day-3: Discussion on GSTR-3B Filing

120 Mins• Step by Step Discussion along with understanding the Form

• Lots of practical Examples

• Using Online and Offline Utility

Day-4: Discussion on GST Annual Return (GSTR 9) and GST Self-Certified Statement (GSTR 9C) Discussion on E-Way Bill

120 Mins• Step by Step Discussion along with understanding the Form

• Lots of practical Examples

• Using Online and Offline Utility

Day-5: Discussion on E-Way Bill, E Invoicing, Export and GST Refund

120 Mins• Refund Rules

• Refund - Sections

• Export under GST

• Export-related provisions

• E-way Bill Rules

• Important circulars related to E-way bills

• E-way Bill Generation

Day-6: Discussion on GST Invoice Management System (IMS)

120 Mins• Concept of IMS and Its Requirement.

• Applicability and Restriction on Invoices and Records for IMS.

• Impact on GSTR 2B.

• GST Return Filing after IMS.

Day-7: Learn About How to Use Chat GPT for Professionals

120 MinsLearn About How to Use Chat GPT for Professionals

Day-8: Learn About How to Use Chat GPT for Professionals

120 MinsLearn and Master MS Office with CHATGPT & AI Tools to Leverage your Work

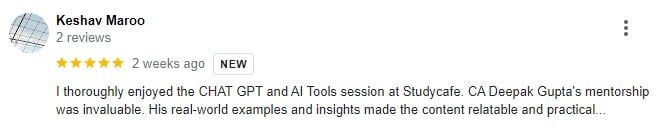

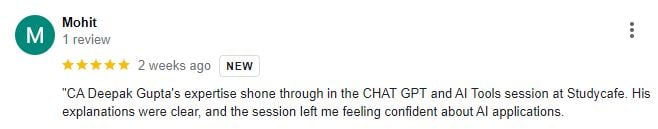

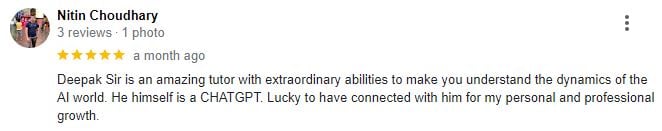

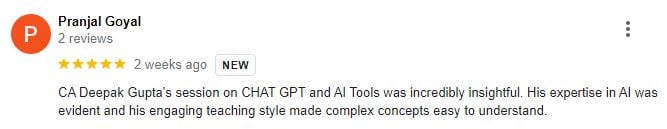

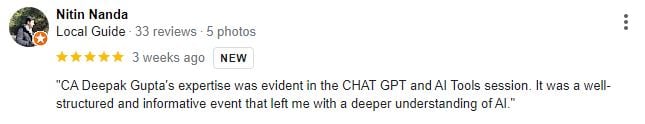

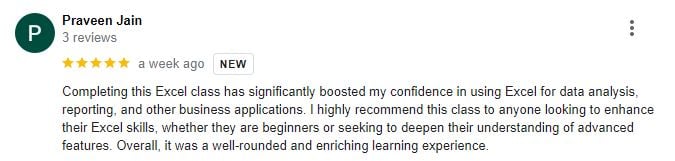

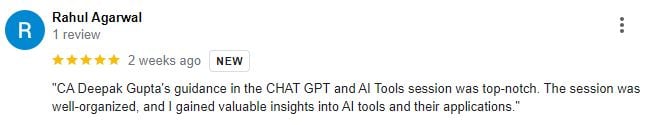

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who can join this Certification Course?

Anyone who want to Learn and Earn Can Join this course

What will be Language of this Certification Course?

It will be in English Language.

What is the Duration of this Certification Course?

Certification Course Duration will be of 4+ Hrs.

Whether Study Material will be Provided?

Yes, Study Material will be Provided.

Whether this Certification Course Recording will be Provided?

Yes Recording will be Provided for 1 Year.

How Can we Join this Certification Course?

Please register yourself and pay the fees. After paying fees you can see the Lectures in Course section.

Featured In

Terms and Conditions

- Course Recording will be Provided for 1 Year!

- No Limitation on Number of views, you can Watch it Unlimited Times

This course includes:

- English

- 16+ Hours of Video Content

- Recording is Available for 1 Year

- Studycafe Certificate of Completion

- Access on mobile or Computer/ Laptop

Certificate to be provided to all the participants.