Course Key Features

- How to draft reply to notice u/s 143(2) / 142(1) / 148?

- How to file rectification u/s 154?

- How to reply penelty notices?

- How to reply questionnaire?

- How to reply Show cause notice against draft Assessment order?

- How to file Faceless Appeal ?

- Drafting of statement of Facts and Grounds of Appeal ?

- How to file return in response to notice U/s 148 ?

- How to document ur e-file of faceless Assessment and Faceless Appeal

Course Description

Team Studycafe is organizing a Certification Course on How To Draft Reply to Varios Notices Under Income Tax Act. This course is going to start on June 28 2021 and this course is for 3 Days. The timing of the course will be of 07:00 PM to 09:00 PM. Recording of all the days will be available for 30 Days.

Course Content

Day-1: How To Draft Reply to Notice Under Income Tax Act?

2 Hrs✔️ How to draft reply to notice u/s 143(2) ?

✔️ How to draft reply to notice u/s 142(1) ?

✔️ How to draft reply to notice u/s 148?

Day-2: How To Draft Reply to Notice Under Income Tax Act?

2 Hrs✔️ How to file rectification u/s 154?

✔️ How to reply penelty notices?

✔️ How to reply questionnaire ?

✔️ How to reply Show cause notice against draft Assessment order?

Day-3: How To Draft Reply to Notice Under Income Tax Act?

2 Hrs✔️ How to file Faceless Appeal ?

✔️ Drafting of statement of Facts and Grounds of Appeal ?

✔️ How to file return in response to notice U/s 148 ?

✔️ How to document ur e-file of faceless Assessment and Faceless Appeal?

Day-4: How To Draft Reply to Notice Under Income Tax Act?

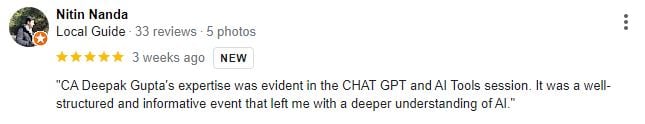

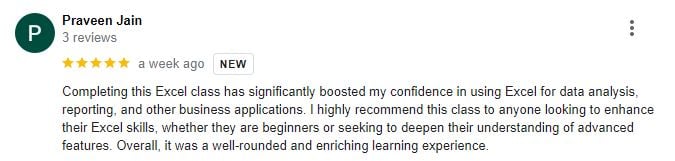

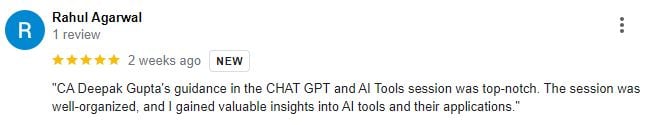

2 HrsReviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who Can Join this Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students

⭐ Tax professionals whether in JOB or Practice

⭐ Qualified CA/CS/CMA/LLB

⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐ Any other person not covered above can join course if interested.

What is the Duration of the Course?

Course will be of more than 7 Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 30 Days.

How Can we Join ths Course?

Please register yourself and make the fees.

Featured In

Terms and Conditions

- Recording will be Valid for 60 Days Only.

- At one Time Lecture can be seen Either on Mobile or Desktop.

Requirements

- Need to Have Active Internet Connection

- Lecture will be played either on Mobile, Laptop or Desktop.

This course includes:

- Hindi, English

- 6+ Hours of Video Content

- Recording is Available for 60 Days

- Studycafe Certificate of Completion

- Access on mobile or Computer/Laptop

Certificate to be provided to all the participants.