Course Key Features

- Form 15G and Form 15H relevance and Applicability

- Overview of TDS and TCS Provisions

- Overview of TDS Provisions Under Section 192 to Section 196

- Overview of TDS Provisions Under Section 195

- Practical Demo and insights of TRACES

- Filing of TDS returns and TCS returns for tax deduction and collection under various sections of this chapter.

- What is Lower Tax Deduction Certificate and How to apply for lower deduction of TDS TCS as per Section 197

Course Description

Certification Course on TDS and TCS Provisions under Income Tax Act 1961

Course Content

Day-1: Overview of TDS Provisions Under Section 192 to Section 196

2 Hrs👉 Overview of TDS Provisions Under Section 192 to Section 196

👉 Form 15G and Form 15H relevance and its Applicability.

👉 What is Lower Tax Deduction Certificate and How to apply for lower deduction of TDS TCS as per Section 197.

Day-2: Overview of TDS Provisions Under Section 192 to Section 196

2 Hrs👉 Detailed discussion on Section 192, 194C, 194I, 194J.

👉 Detailed discussion on TDS on cash withdrawal from Bank section 194N

👉 Applicability of TDS on E-Commerce operator section 194O

Day-3: Overview of TDS Provisions Under Section 192 to Section 196

2 Hrs👉 Detailed discussion on Section 192EE, 194G, 194H, 194I, 194I-A, 194-IB, 194-IC, 194-LA,194M, 194N, 194O,

Day-4: Detailed discussion on Section 195

2 Hrs👉 Detailed discussion on Section 195,

Day-5: Overview of TCS Provisions under Section 206C

2 Hrs👉 Practical demo and insights of TRACES.

👉 Filing of TDS returns and TCS returns for tax deduction and collection under various sections of this chapter.

👉 What is Lower Tax Deduction Certificate and How to apply for lower deduction of TDS TCS as per Section 197.

👉 Overview of TCS Provisions under Section 206C

👉 Panel consequences in case of default of TDS and TCS provisions under Section 201(1A), 220(2), 234E, 271C, 271H, 40(a)(ia).

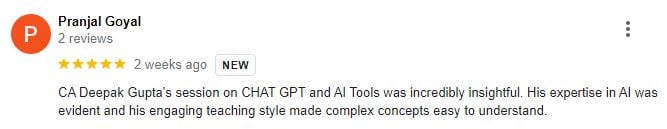

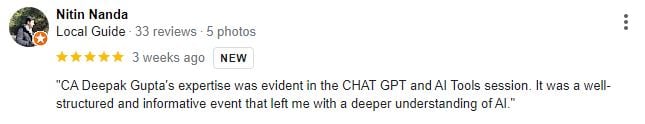

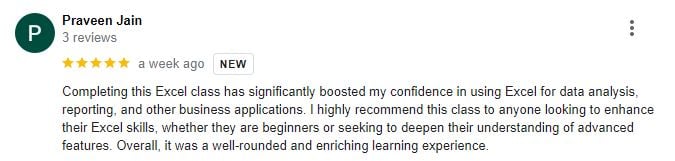

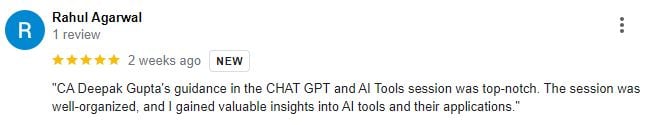

Reviews of Course Participants

Our Alumni at Leading Companies

FAQ

Who Can Join this Course?

⭐ Commerce Graduates/CA/CS/CMA/Law students

⭐ Tax professionals whether in JOB or Practice

⭐ Qualified CA/CS/CMA/LLB

⭐ Semi-qualified CA/CS/CMA working in CA Firms or in Industry

⭐ Any other person not covered above can join course if interested.

What is the Duration of the Course?

Course will be of more than 5 Hrs.

Whether Course Material will be Provided?

Yes, Course Material will be Provided.

Whether Course Recording will be Provided?

Yes Recording will be Provided for 30 Days.

How Can we Join ths Course?

Please register yourself and make the fees.

Featured In

Terms and Conditions

- Recording will be Valid for 30 Days Only.

- At one Time Lecture can be seen Either on Mobile or Desktop.

Requirements

- Need to Have Active Internet Connection

- Lecture will be played either on Mobile, Laptop or Desktop.

This course includes:

- Hindi

- 10+ Hours of Video Content

- Recording is Available for 30 Days

- Studycafe Certificate of Completion

- Access on mobile or Computer/Laptop

- Downloadable Course Material

Certificate to be provided to all the participants.