Sushmita Goswami | Nov 17, 2021 |

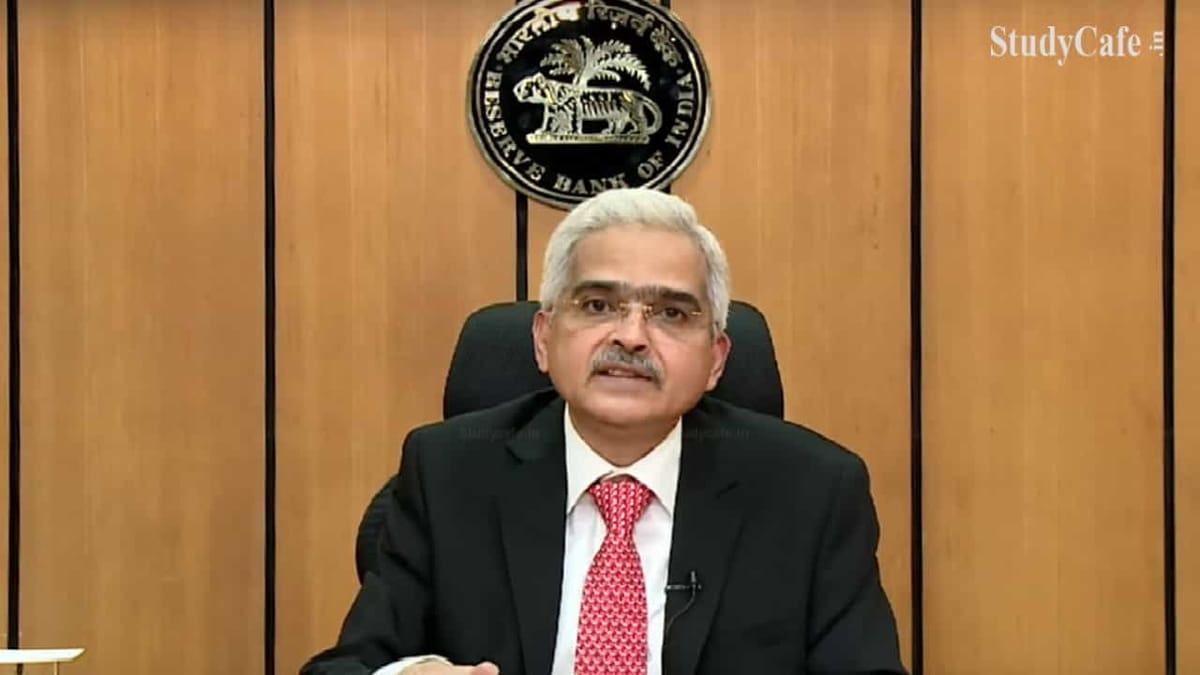

Far more serious difficulties with Cryptocurrencies, stated by RBI Governor Shaktikanta Das

RBI Governor Shaktikanta Das raised his concerns about cryptocurrencies for the second time in a week on Tuesday, stating that virtual currencies had “much deeper vulnerabilities” that might threat the country’s economic and financial stability.

The announcement comes only days after the Prime Minister held a meeting on cryptocurrencies in response to concerns over false claims of high profits on cryptocurrency investments.

The Parliamentary Standing Committee on Financing reviewed the advantages and disadvantages of crypto finance with various stakeholders on Monday, according to PTI, and several members were in favour of regulating crypto currency exchanges rather than outright banning them.

According to the PTI article, the government is expected to introduce a measure on cryptocurrencies at the winter session of Parliament, which begins on November 29.

When speaking at the 8th SBI Banking and Economic Conclave, Das pointed out that when the RBI expresses severe worries about crypto currencies, there are far more complex issues at play, requiring a more in-depth discussion.

“When the RBI says there are severe worries about macroeconomic and financial stability after appropriate internal deliberation, there are deeper issues that require much deeper conversations and much more well-informed discussions,” he said.

Das stated that he was not aware of what the Parliamentary Standing Committee on Finance discussed and debated on during its latest discussion on digital currency.

The governor questioned the current crypto currency trade numbers, claiming that credit is being used to entice investors to create accounts.

“We’ve received a lot of feedback that credit has been given to open accounts and various other sorts of incentives have been given to open accounts,” he added. “However, the overall account balance is simply approximately Rs 500, Rs 1,000, or Rs 2,000, which covers roughly 70 to 80 percent of the accounts.”

Das, on the other hand, claims that the value of virtual currency transactions and trade has increased, but that the number of accounts is inflated.

At a recent event, the RBI governor stated that new-age currencies represent major challenges to the country’s macroeconomic and financial stability, as well as doubting the number of investors trading on them and their claimed market value.

The Supreme Court overturned an RBI circular issued on April 6, 2018, barring banks and businesses regulated by it from offering services related to virtual currencies from March 4, 2021.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"