Sushmita Goswami | Nov 30, 2021 |

Gross GST collection in FY 2021-22 is on the rise

Following the COVID-19 pandemic outbreak, gross GST collections are expected to rise in FY 2021-22. Shri Pankaj Chaudhary, Union Minister of State for Finance, mentioned this in a written response to a question in the Lok Sabha today.

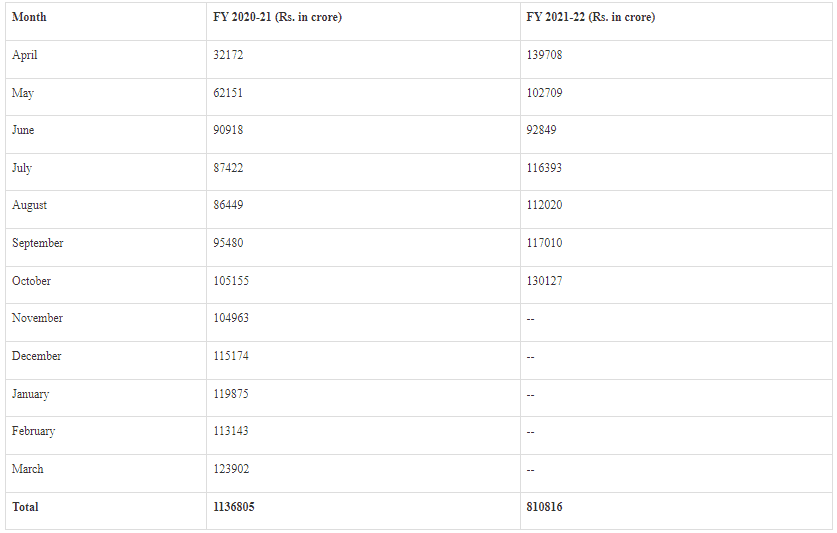

The Minister went on to say that the gross GST collection for FY 2020-21 and 2021-22 (till October 2021) will be as follows: –

The Minister revealed the Gross Direct Tax collection figures for FY 2021-22, stating that as of 23.11.2021, Gross Direct Tax collection figures for FY 2021-22 are at Rs. 815262.7 crore, representing a growth of 48.11 percent and 18.15 percent over the corresponding periods in FY 2021-22 and FY 2019-20, respectively. The Minister noted that the Net Direct Tax Collection figures for FY 2021-22 as on 23.11.2021 were Rs. 692833.6 crores, representing an increase of 67.93 percent and 27.29 percent, respectively, over the Net Collection figures for the comparable periods FY 2020-21 and FY 2019-20, as per Annexure-I.

The GST compensation cess levied under Section 8 of the GST Act (Compensation to States) , 2017 is transferred into a non-lapsable Fund known as the GST Compensation Fund, which forms part of the Public Account of India as provided in Section 10(1) of the Act, according to the Minister. According to Section 10(2) of the aforementioned Act, the States will be compensated for any revenue loss resulting from the adoption of GST for a period of five years from the Compensation Fund. The states have already received GST compensation for the fiscal years 2017-18, 2018-19, and 2019-20, according to the Minister.

According to the Minister, the pandemic’s economic impact has resulted in a larger compensation requirement due to reduced GST collection and, at the same time, lower GST compensation cess collection. Because the amount in the GST Compensation Fund was insufficient to fulfil the full compensation requirement, a GST compensation of Rs. 1,30,464 crore has been issued to all States/UTs to partially cover the compensation payable for the period April 20 to March 21. The issue of a shortfall in GST compensation release was discussed at the 41st and 42nd GST Council meetings, and as a result, the Centre borrowed Rs. 1.1 lakh crore from the open market and passed it on to States/UTs as a back-to-back loan to cover their resource gap caused by the short release of GST compensation for FY 2020-21.Similarly, the 43rd GST Council meeting decided that the Centre would borrow Rs. 1.59 lakh crore and transfer it on to the States/UTs, as it did last year. The Minister stated that the pending GST compensation to States/UTs is as per Annexure II, taking into account the GST compensation released to States as well as the back-to-back loan.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"