GSTN has recently implemented a useful function that allows users to access IRN even if it was not initially recorded for an invoice, credit note, or debit note.

Reetu | May 19, 2023 |

GST Portal Update: GSTN enabled functionality to find IRN using Document Number

The Goods and Services Tax Network (GSTN) has recently implemented a useful function that allows users to access the Invoice Reference Number (IRN) even if it was not initially recorded for an invoice, credit note, or debit note. If you find yourself in a position where you have forgotten to preserve the IRN, don’t panic; GSTN has made it simple to locate it.

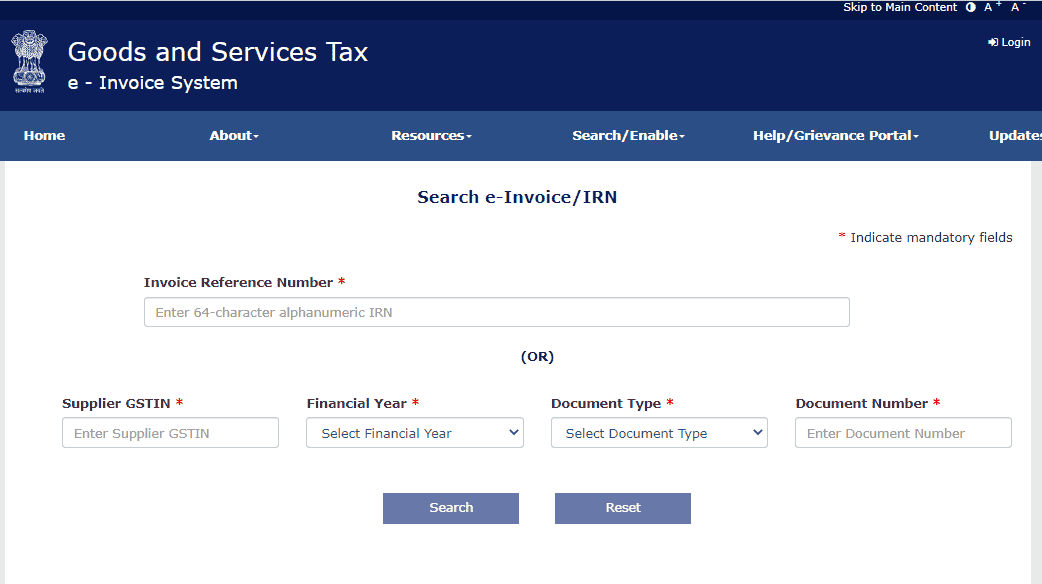

To access this new functionality, simply follow these steps:

1. Start by visiting the GSTN Dashboard.

2. Once you’ve arrived to the Dashboard, look for the option to search for or enable features. To continue, click on it.

3. This action will direct you to the Search IRNs page and you can search IRN via document number.

GSTN hopes to deliver a smooth experience for those who may have mistakenly neglected preserving the critical IRN by deploying this user-friendly tool. You may access the IRN for any document with a few clicks, ensuring that you keep correct records and follow GST laws.

The hash generated by IRP will become the e-invoice’s IRN (Invoice Reference Number). This must be unique to each invoice and so serve as the taxpayer’s unique identification for the whole fiscal year in the GST System.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"