Shri Pankaj Chaudhary in a response to question raised in Lok Sabha said, "GST Revenue of more than Rs. 18000 Crores from Healthcare and Life Insurance".

Reetu | Nov 27, 2024 |

GST Revenue of more than Rs. 18000 Crores from Healthcare and Life Insurance

The Minister of State for Finance, Shri Pankaj Chaudhary in a response to question raised in Lok Sabha said, “GST Revenue of more than Rs. 18000 Crores from Healthcare and Life Insurance”.

The Member of Parliament (Lok Sabha) Shri Raja Ram Singh raised the following question:

Will the Minister of FINANCE be pleased to state:

(a) the details of revenue earned by the Government from GST on cancer and other lifesaving drugs during the last five years;

(b) the revenue generated from GST on insurance and related items during the last five years;

(c) whether the Government has taken any steps towards rate reduction of GST on health and life insurance after numerous complaints of high GST rates from the beneficiaries; and

(d) the rationale behind having a high GST rate on health insurance, life insurance and lifesaving drugs in comparison to luxury items like diamonds?

Response:

The Minister of State for Finance, Shri Pankaj Chaudhary replied:

(a) The data regarding revenue earned on cancer drugs and life-saving drugs is not maintained. However, specified cancer, lifesaving and other critical medicines attract concessional GST rate of 5%.

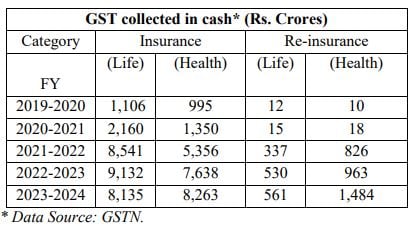

(b) The revenue generated from GST on Healthcare and Life insurance services is given in a table below:

(c) GST rates and exemptions for all services (including health and life insurance) are determined by the GST Council, a constitutional body made up of members from both the Union and State/UT governments.

The GST Council discussed the issue of GST on life and health insurance in its 54th meeting, which was held on September 9, 2024 in New Delhi. Following extensive consideration, the GST Council suggested forming a Group of Ministers (GoM) to investigate issues concerning GST on life insurance and health insurance. As a result, a Group of Ministers (GoM) on Life and Health Insurance was formed, chaired by Sh. Samrat Chaudhary, Hon’ble Deputy Chief Minister of Bihar. The first meeting of the GoM was held on October 19, 2024 in New Delhi, when the issues of GST rates on health and life insurance policies were discussed.

(d) GST rates and exemptions on all services and goods are prescribed on the recommendations of the GST Council which is a constitutional body comprising of members from both the Union and State/UT Governments.

Currently, GST on health insurance services is levied at the standard rate of 18%. Specific health insurance schemes catering to the requirements of differently abled and economically disadvantaged parts of society, such as Rashtriya Swasthya Bima Yojana (RSBY), Universal Health Insurance Scheme, Jan Arogya Bima Policy, and Niramaya Health Insurance Scheme, are GST exempt.

Pure term life insurance services, i.e. insurance policies not involving saving/investment element, are also at standard rate i.e. 18 per cent.

Life insurance services are given through specific schemes such as Varishtha Pension Bima Yojana, Pradhan Mantri Jeevan Jyoti Bima Yojana, Pradhan Mantri Jan Dhan Yojana, Pradhan Mantri Vaya Vandan Yojana, and others are exempt from GST.

Furthermore, all wholly government-sponsored insurance schemes, including Ayushman Bharat PM-JAY, are exempt from GST.

Prior to the GST (service tax), health and life insurance services were taxed at the standard rate, with equivalent exemptions granted for specific health and term life insurance schemes catering to the requirements of economically disadvantaged parts of society.

As mentioned above, medicines are levied to concessional rates of GST at 5% or 12%. Specified medicines, which generally include lifesaving and other critical medicines attract lower GST of 5%.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"