CA Pratibha Goyal | Dec 28, 2020 |

GST Rule 86B misconceptions, How Taxpayers are interpreting it wrongly

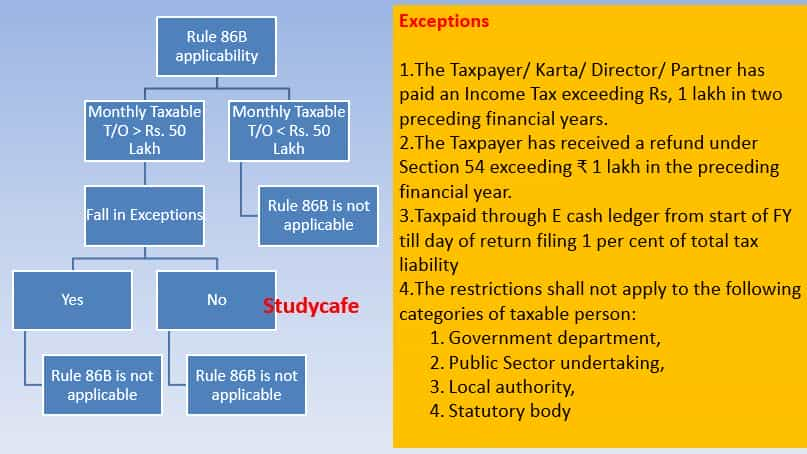

As per GST Notification number, 94/2020-Central Tax dated 22nd Dec 2020, GST rule 86B has been introduced which has imposed 99% restricted on ITC (Input Tax Credit) available in electronic credit ledger of Registered Person. This means 1% of Output liability to be paid in cash. This restriction is applicable in the case of Registered taxpayers having a monthly turnover of more than Rs. 50 Lakh.

This move is getting a large amount of criticism from the Taxpayers. There is a common myth, that everyone whose monthly turnover is more than Rs. 50 Lakh will fall under this rule. Through this article, let us try to understand the provisions more deeply and understand why these provisions were introduced.

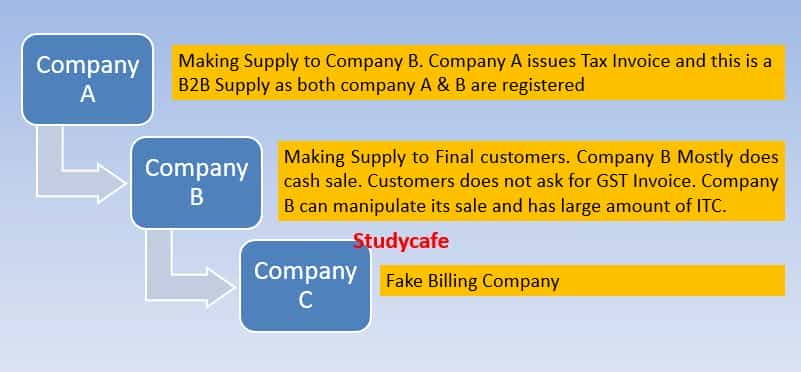

Firstly we need to understand that this rule has been introduced to curb the menace of Fake GST Invoicing. The practice of fake GST invoicing has made the entire GST ecosystem hollow.

Let us understand that who actually will come in clutches of rule 86B and why I am saying that genuine taxpayers will never fall in newly inserted Rule 86B.

For that, we need to understand the exceptions who will never fall in Rule 86B. [Proviso a to d of rule 86B of CGST Rules 2017]

Rule 86b exceptions

If you carefully see the exceptions given above, you will realize that a genuine taxpayer will never fall in this rule.

Let us discuss more of this with the help of an example.

One of the registered taxpayers is having an annual taxable turnover of Rs. 10 Cr. In all 12 months, he is having a monthly taxable turnover of more than Rs. 50 Lakhs. Neither he is engaged in exports or he is having an Inverted supply. Also, neither the Taxpayer/ Karta/ Director/ Partner has paid an Income Tax exceeding Rs, 1 lakh in two preceding financial years. He is claiming that he was never required to pay even 1% of the cumulative total output liability through the cash ledger as GST.

GST Rule 86B misconceptions, How Taxpayers are interpreting it wrongly

In my opinion, the claim of the taxpayer rather seems suspicious.

I am not saying that everyone is wrong. There can be some genuine Taxpayers who are falling in the above-given situation:

However, I still believe that an instance of a genuine taxpayer paying tax under section 86B is very low. Even if he has to pay tax, the tax liability will be very low. Just 1% of the Tax Liability.

Now let us understand through a situation how fake billing takes place, to better understand the reason why this rule has introduced

क्या हम GST Rule 86B को सही Interpret कर रहे हैं?

Tags: GST

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"