If you opt for New Tax Regime, and you have only a Rental Income of upto Rs. 10 Lakh, the same will be Tax-Free.

CA Pratibha Goyal | May 22, 2023 |

How Rental Income of upto Rs. 10 Lakh can be Tax-Free: Read to Know Further

If you opt for the New Tax Regime of Income Tax in FY 2023-24 (AY 2024-25) and you have only Rental Income, Your Rental Income of upto Rs. 10 Lakh can be Tax Free. Want to know how?

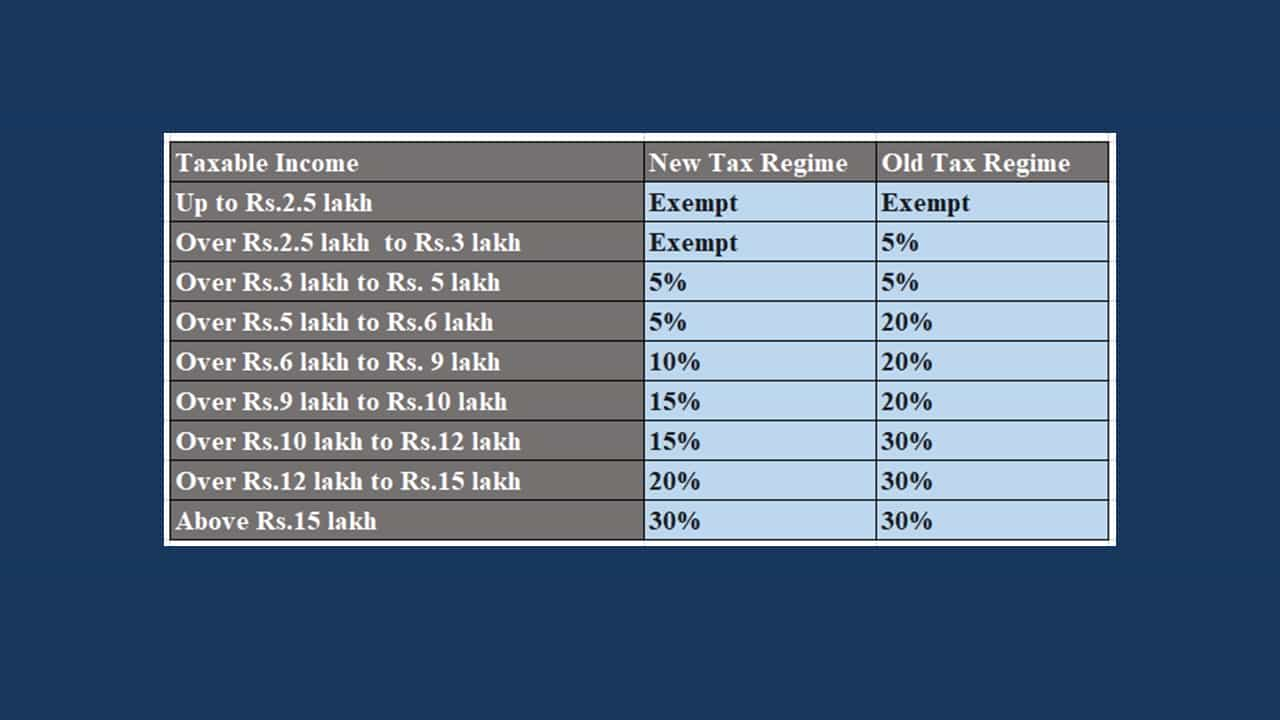

Slab Rates for the Old Tax Regime are:

For 0 – 2.5 Lakhs of Income, there is No Tax, For 2.5 – 5 Lakhs of Income Tax Rate is 5%, For 5 – 10 Lakhs of the Income tax rate is 20%, Tax Rate is 30% for income above 10 Lakhs.

Slab Rates for the New Tax Regime are:

The new Slab for New Tax Regime notified by Finance Act 2023 is for 0 – 3 Lakhs of Income, there is No Tax, For 3 – 6 Lakhs of Income Tax Rate is 5%, For 6 – 9 Lakhs of the Income tax rate is 10%, For 9 – 12 Lakhs of the Income tax rate is 15%, For 12 – 15 Lakhs of the Income tax rate is 20%, Tax Rate is 30% for income above 15 Lakhs.

Rebate is available in New Tax Regime for Income up to Rs. 7 Lakhs. This means there is no Tax if your Income is up to Rs. 7 Lakhs.

While calculating Rental Income, the government gives a Standard deduction of 30%. This means if your rental Income is Rs. 10,00,000, you get a Standard deduction of Rs. 3,00,000 (30% of Rs. 10,00,000).

Besides that, you also get the deduction of Municipal Taxes Paid During the Year and Interest on Housing Loan.

Thus if you opt for New Tax Regime, and you have only a Rental Income of upto Rs. 10 Lakh, the same will be Tax-Free.

Does this mean I do not need to file ITR?

No, this doesn’t mean that you don’t need to file ITR. You Income might be tax-free, but still, ITR filing provisions might be applicable to you as Tax Return filing is mandatory when Income (without considering any Deductions) Exceeds the Slab Limit.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"