How to Claim Income Tax Deduction Benefit of More Than Rs. 2 Lakhs by Investing in NPS

Sushmita Goswami | Mar 9, 2022 |

How to Claim Income Tax Deduction Benefit of More Than Rs. 2 Lakhs by Investing in NPS

Several provisions in the Income Tax Act of 1961 allow for tax deductions on investments in specified avenues. Section 80CCD deductions are one such common yet popular option. You can deposit more than 2 lakh in the National Pension System (NPS) in a financial year, which can help you reduce your tax liabilities. The Income Tax Act contains three sections that allow individuals to claim deductions for money invested in NPS.

Section 80CCD: The National Pension System (NPS) was established by the central government to provide Indian citizens with the benefit of an organized pension scheme. The fundamental purpose of the NPS is to assist individuals in building a retirement fund and obtaining a fixed monthly distribution so that they can live well after they retire.

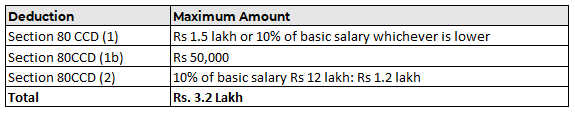

Section 80CCD (1): The rules governing the income tax deduction available to people for NPS donations are defined in this section. Whether the contribution was made by a government employee, a private employee, or a self-employed individual makes no difference. All Indian citizens between the ages of 18 and 70 who contribute to the NPS are subject to the provisions of this section. Non-resident Indians are also affected. Important provisions (1) Section 80CCD:

The maximum deduction allowed under this provision is 10% of the individual’s gross income or 10% of his or her wage (basic + DA).

In FY 2017-18, the ceiling for self-employed individuals was raised to 20% of gross total income, with a maximum restriction of Rs. 150,000 per financial year.

In the Union budget for 2015, a new adjustment to Section 80CCD was added as sub-section 80CCD (1B). Individuals can now claim an additional Rs. 50,000 deduction under the new regulations. Both paid and self-employed people can take advantage of this.

As a result, the maximum deduction under Section 80CCD has been raised to Rs. 2,00,000/-. In addition to the deductions provided under Section 80CCD, tax benefits under Section 80CCD(1B) can be claimed (1).

Section 80CCD (2): The provisions of Section 80 CCD (2) apply when an employer contributes to an employee’s NPS. Employers can contribute to the NPS in addition to the PPF and EPF. The contribution of the employer can be equal to or larger than that of the employee.

This clause solely pertains to salaried employees; it does not apply to self-employed people. This section’s deductions are in addition to the ones allowed under Section 80 CCD (1). Section 80CCD (2) allows salaried employees to claim deduction upto 10% of their salary(14% in case of CEntral Govt Employees), which includes the basic pay and dearness allowance or is equal to the employer’s NPS contributions. This deduction is allowed under the old as well as new tax regime.

How tax benefit under section 80CCD (2) can be claimed

As per Section 80CCD(2) of Income Tax Act The tax benefit can be availed only if the employer is willing to contribute to the NPS account of an employee. If the employer is willing, then using this route, investment in NPS account will exceed Rs 2 lakh in financial year.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"