The Institute of Company Secretary of India(ICSI) has notified Introduction of Escalation Mechanism for Resolution of Grievances of Members and Students.

Reetu | Apr 18, 2023 |

ICSI introduced Escalation Mechanism for Resolution of Grievances of Members and Students

The Institute of Company Secretary of India(ICSI) has notified Introduction of Escalation Mechanism for Resolution of Grievances of Members and Students.

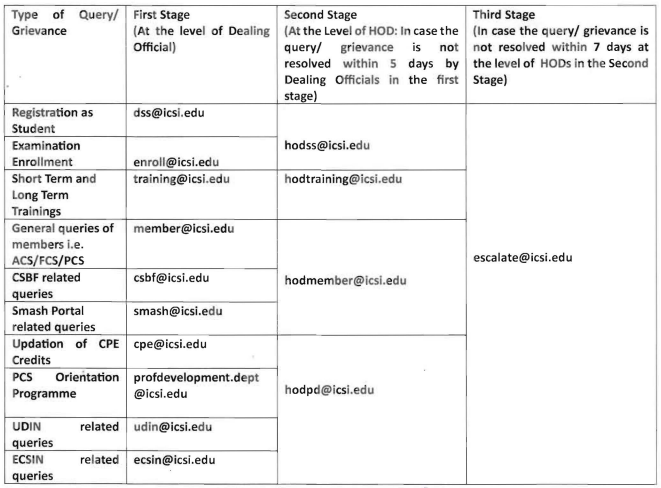

Institute has always been on the forefront of providing the best services to its stakeholders and continuously striving to resolve the queries / grievances of stakeholders in a time bond manner. With a view to strengthen the existing system and also to monitor / ensure time-bound resolution of grievances of Members and Students of ICSI, an escalation mechanism has been developed to resolve the queries of students on registration, examination enrolment, training, etc. and the queries of Members on updation of CPE Credits, PCS orientation programme, UDIN & ECSIN.

The details of the same are as under:

1. Members and students are asked to submit their queries/grievances to the Dealing Officials only at the First Stage, and any direct issue will not be considered at the Second/ Third Stage.

2. Unresolved queries/grievances shall be escalated sequentially from the First Stage (at the level of the Dealing Official) to the Second Stage (HOD Level), and then to the Third Stage.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"