Reetu | Mar 14, 2024 |

Know ICAI Peer Review extended Due Dates

The Institute of Chartered Accountants of India (ICAI) has extended the Due Dates of Peer Review.

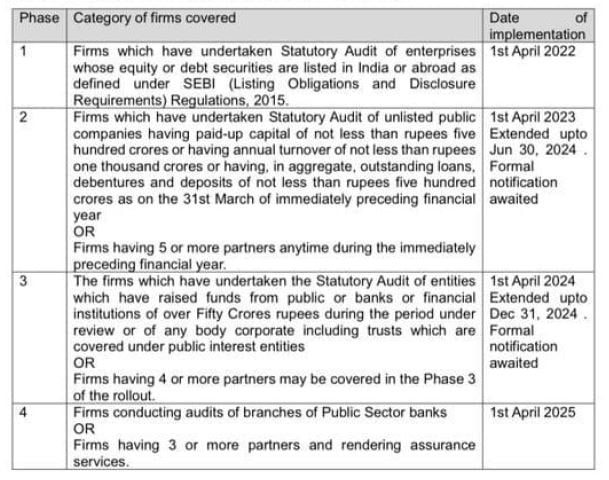

The Council at its 407th Meeting of the Council held from 7th-9th January 2022 decided to mandate the Peer Review process for coverage or more firms under the Peer Review process. The glide path was to be in four following stages. The present status of the same is as under. An extension has been granted in the Council meeting held on March 7, 2024, but the formal announcement is yet to be made by ICAI as of March 11, 2024.

As per the Revised Peer Review Mandate, Practice Units rendering attestation services and having 5 or more partners has to obtain Peer Review Certificate before accepting any Statutory audit. The same is applicable from 1st April 2024. The same is covered in Phase 2 of the Peer Review Mandate. A grace period of 3 months i.e. till 30 June 2024 has been approved by the council to complete the Peer Review.

Also Read: Peer Review mandatory for firms giving attestation services with 5 or more partners

Practice Units which propose to undertake Statutory Audit of unlisted public companies having paid-up capital of not less than rupees five hundred crores or having annual turnover of not less than rupees one thousand crores or having, in aggregate, outstanding loans, debentures and deposits of not less than rupees five hundred crores as on the 31st March of immediately preceding financial year are also covered in this Mandate in Phase 2.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"