The UPI revolution in India is unstoppable, with a 138% increase in transaction value from 2017-18 to 2023-24, redefining the nation's journey toward a digital-first economy.

Reetu | Nov 4, 2024 |

New India’s UPI Revolution: UPI unstoppable with 138% growth in Transaction Value from 2017-18 to 2023-24

The UPI revolution in India is unstoppable, with a 138% increase in transaction value from 2017-18 to 2023-24, redefining cashless convenience and pushing the nation’s journey toward a digital-first economy.

The Department of Financial Services (DFS), Ministry of Finance, is a key player in promoting digital payments in the country.

Efforts to expedite the adoption of quick payment systems, such as the Unified Payments Interface (UPI), have transformed the way financial transactions are carried out, allowing millions of people to make payments in real-time, securely and seamlessly.

This effort is consistent with the government’s objective of a cashless and inclusive economy that empowers all citizens in making financial decisions.

In comparison to previous financial years, the digital payment landscape has grown significantly in the Financial Year (FY) 2023-24. Key highlights included are discussed below.

Digital payments in India have grown significantly, with the total volume of digital payment transactions increasing from 2,071 crore in FY 2017-18 to 18,737 crore in FY 2023-24, at a compound annual growth rate (CAGR) of 44%. Furthermore, during these last five months (April-August) of the current financial year 2024-25, the transaction volume hit 8,659 crore.

The value of transactions increased from Rs.1,962 lakh crore to Rs.3,659 lakh crore at an 11% CAGR. Furthermore, in these five months (April-August) of the current financial year 2024-25, the overall transaction value increased to an amazing Rs.1,669 lakh crore.

UPI remains the foundation of India’s digital payment ecosystem. UPI has transformed digital payments in the country; UPI transactions increased from 92 crore in FY 2017-18 to 13,116 crore in FY 2023-24 at a CAGR of 129%. Furthermore, during these five months (April-August) of the current financial year 2024-25, the transaction volume hit 7,062 crore.

The ease of usage, aided by an expanding network of collaborating banks and fintech platforms, has made UPI the most popular way of real-time payment for millions of users around the country.

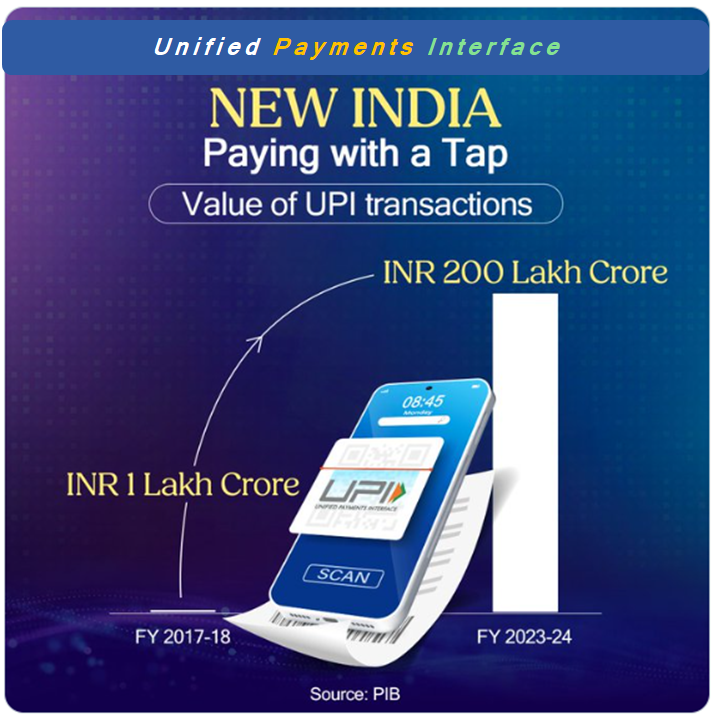

The value of UPI transactions increased from Rs.1 lakh crore to Rs.200 lakh crore at a CAGR of 138%. Furthermore, over these five months (April-August FY2024-25), the overall transaction value has increased to an astonishing Rs.101 lakh crore.

India’s digital payment revolution is spreading beyond its boundaries. Both UPI and RuPay are rapidly expanding globally, allowing Indians to conduct smooth cross-border transactions while living and travelling abroad. UPI is currently available in seven countries, including significant markets such as the UAE, Singapore, Bhutan, Nepal, Sri Lanka, France, and Mauritius, allowing Indian consumers and businesses to send and receive payments abroad. This growth will boost remittance flows, increase financial inclusion, and strengthen India’s position in the global financial environment. According to the ACI Worldwide Report 2024, India will account for approximately 49% of total worldwide real-time payment transactions in 2023.

India is rapidly becoming a global leader in digital payments. With UPI’s global expansion and the ongoing rise of digital transactions, India is establishing new standards for financial inclusion and economic empowerment for the common citizens of the country.

The Department of Financial Services continues committed to developing safe, scalable, and inclusive digital payment systems, as well as exploring new opportunities to boost India’s position in the global financial ecosystem.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"