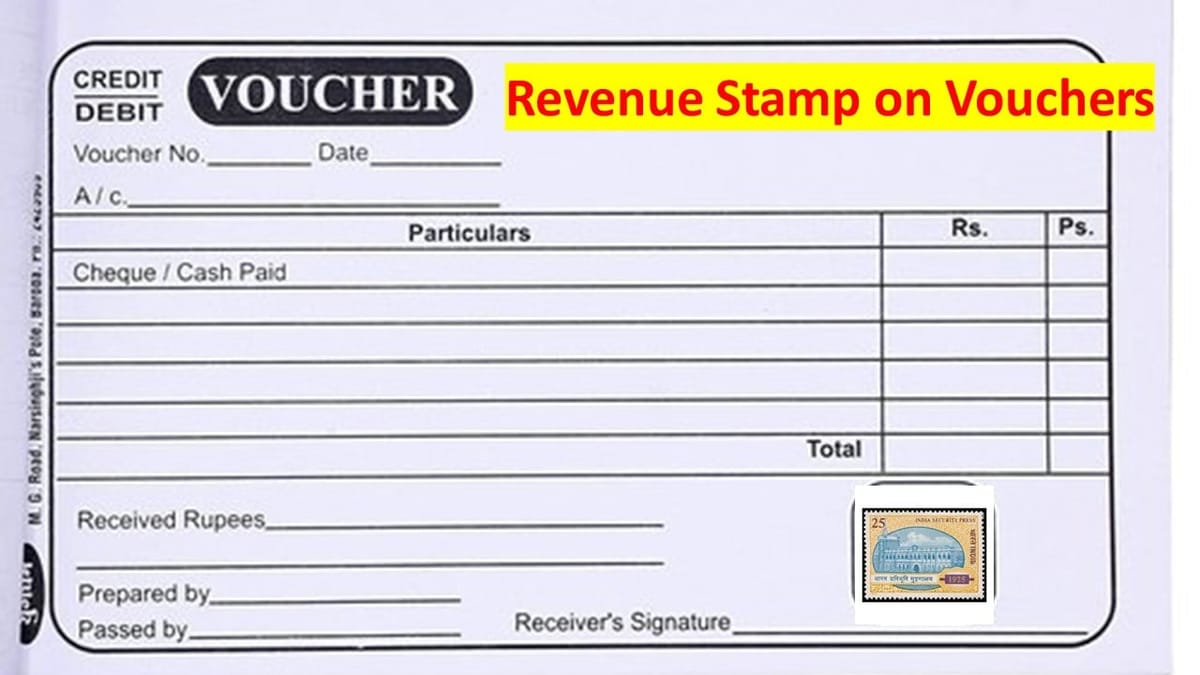

Non-fixation of Revenue Stamp on Vouchers Do Not Make them Illegal to be taxed under IT Act: ITAT

Meetu Kumari | Jun 16, 2022 |

Non-fixation of Revenue Stamp on Vouchers Do Not Make them Illegal to be taxed under IT Act: ITAT

In the present case, the appellant had claimed various business expenses and, in evidence thereof, supporting bills and vouchers have also been produced during assessment proceedings. AO questioned the genuineness of the expenses because of non-fixation of revenue stamps on the vouchers submitted. Out of the same, AO made disallowance of Hammali expenses (Rs. 3,64,737) and also made additions of Rs. 2,03,212 made to two parties, as each payment exceeded Rs. 75,0001 and for the reason of non-deduction of TDS.

Appeal before CIT(A): The ld.CIT(A) had decided the matter in favour of assessee as far as genuineness of the expenses and fixation of revenue stamps on vouchers was concerned. However, the ld.CIT(A) sustained the disallowances on account of non–deduction of TDS on payment of Rs. 2,03,212 made to two parties, each payment exceeding Rs. 75,000.

Appeal before ITAT: Aggrieved assessee approached the tribunal in appeal. The tribunal found that it is a consistent position of the assessee before the AO as well as before the ld CIT(A) that no payment has been made to a single hamali exceeding Rs 20,000 in cash per day. On deeper scrutiny of the assessee’s submissions, it was noted that individual name of the each of the recipient have also been stated in the vouchers which had apparently skipped the attention of the lower authorities. Therefore, disallowance so sustained by the ld. CIT(A) of Rs 2,03,212 was directed to be deleted and this ground was allowed.

Regarding other expenses namely, jalau lakdi and bardana expenses, as no documents were produced by the assessee, it was held that if the assessee is regularly undertaking such transactions with the Adivasis, it won’t be difficult for the assessee to gather relevant facts and figures and the periodicity of such purchases and submit the same before the taxing authorities to demonstrate the business necessity of such purchases being made in cash, as the onus is clearly on him to provide a suitable explanation in this regard. Therefore, the matter was set aside to the file of the AO to examine the same afresh as per law after providing suitable opportunity to the assessee.

Regarding the disallowance of excess interest paid to related parties, to determine the terms and features of such loan transactions and to what extent, they are comparable with the transactions in the instant case in the interest of justice, the matter was set-aside to the file of the AO to examine afresh the application of internal comparable vis-à-vis external comparable, as per law after providing a reasonable opportunity to the assessee.

Hence, the appeal of the assessee was partly allowed.

To Read Judgment Download Given PDF Below.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"