Reetu | Jun 25, 2022 |

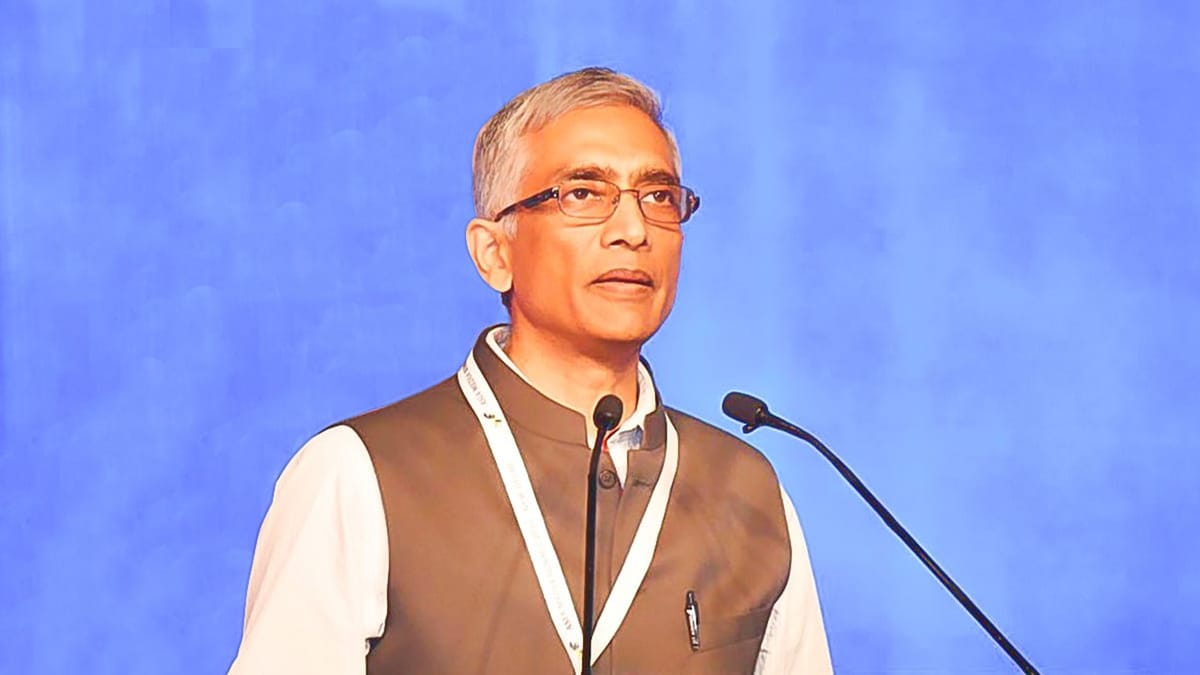

Parameswaran Iyer appointed as CEO of NITI Aayog

The Department of Personnel and Training announced that Former Drinking Water and Sanitation Secretary Parameswaran Iyer has been appointed as the CEO of NITI Aayog. Shri Parameswaran Iyer has been appointed as Chief Executive Officer for a term of two years.

After the current CEO Amitabh Kant’s term ends on June 30, 2022, Iyer will take over as CEO.

On February 17, 2016, Kant was chosen to lead the National Institution for Transforming India (Niti Aayog) for a predetermined two-year period. Later, Kant received an extension to June 30, 2019. He received another two-year extension till the end of this month in June 2019. Kant received a further one-year extension in June 2021.

The 63-year-old IAS official hails from the 1981 batch of the Uttar Pradesh cadre and was born in Srinagar. He graduated from Delhi’s St. Stephen’s College and Dehradun’s The Doon School.

The Notification is Given Below:

The Appointments Committee of the Cabinet has approved the appointment of Shri Parameswaran Iyer, lAS (UP:81), Retd. as Chief Executive Officer, NITI Aayog vice Shri Amitabh Kant upon completion of his tenure on 30.06.2022, for a period of two years or until further orders, whichever is earlier, on the same terms and conditions as were applicable in respect of Shri Amitabh Kant.

For Official Notification Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"