Reetu | Jun 15, 2024 |

Sales Tax hike on Fuel might make Petrol and Diesel costlier in Karnataka

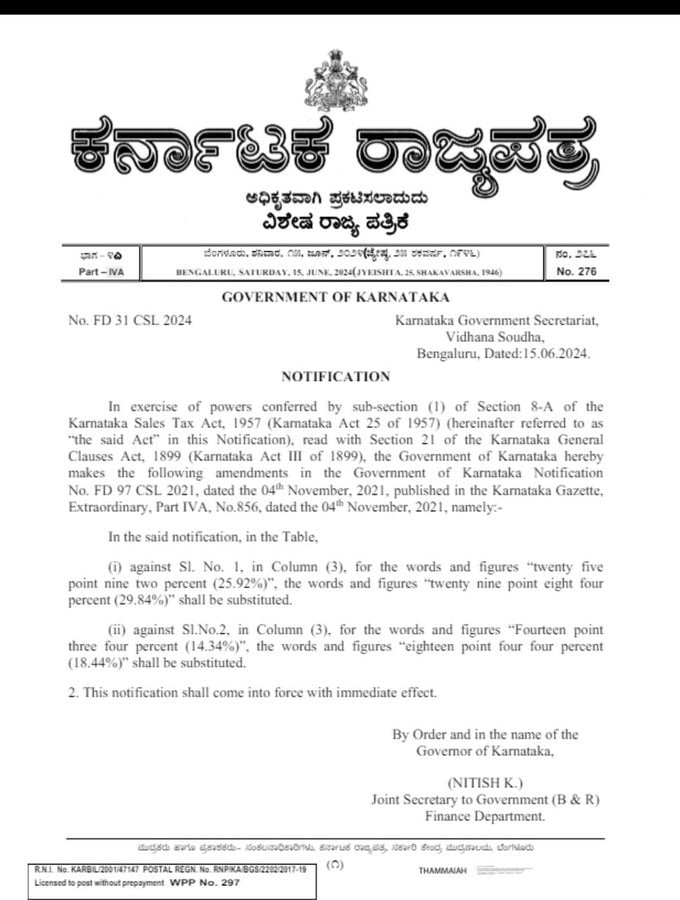

The Government of Karnataka has hiked the sales tax on fuel which impacted the cost of Petrol and Diesel in the state. Now, Petrol and Diesel have become costlier in the region of Karnataka.

In a notification issued by the Karnataka government, the rates of petrol and diesel increased by 3.92% and 4.1% respectively.

According to official sources, the cost of a litre of petrol will rise by Rs.3 and diesel by Rs.3.5. The government anticipates this will generate Rs.2,500-2,800 crore during the financial year.

This was done just days after Siddaramaiah reviewed the state’s revenue generation and financial position, who was once the finance minister of Karnataka, and currently serving as a Chief Minister of Karnataka. Hikes in prices are done as Chief Minister Siddaramaiah seeks to mobilize resources.

The Notification released is given below:

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"