In a significant development, the Punjab State Government has increased Registration fees for Partnership Firm Registration from Rs.3 to Rs.5000.

Reetu | Sep 10, 2024 |

State Government increased Registration Fees for Registration of Partnership Firm from Rs.3 to Rs. 5000

In a significant development, the Punjab State Government has increased Registration fees for Partnership Firm Registration from Rs.3 to Rs.5000. This has been done on the basis of the latest amendment in the Punjab Partnership Act.

Punjab Government adopted the Karnataka model of imposition of duty to feed freebies.

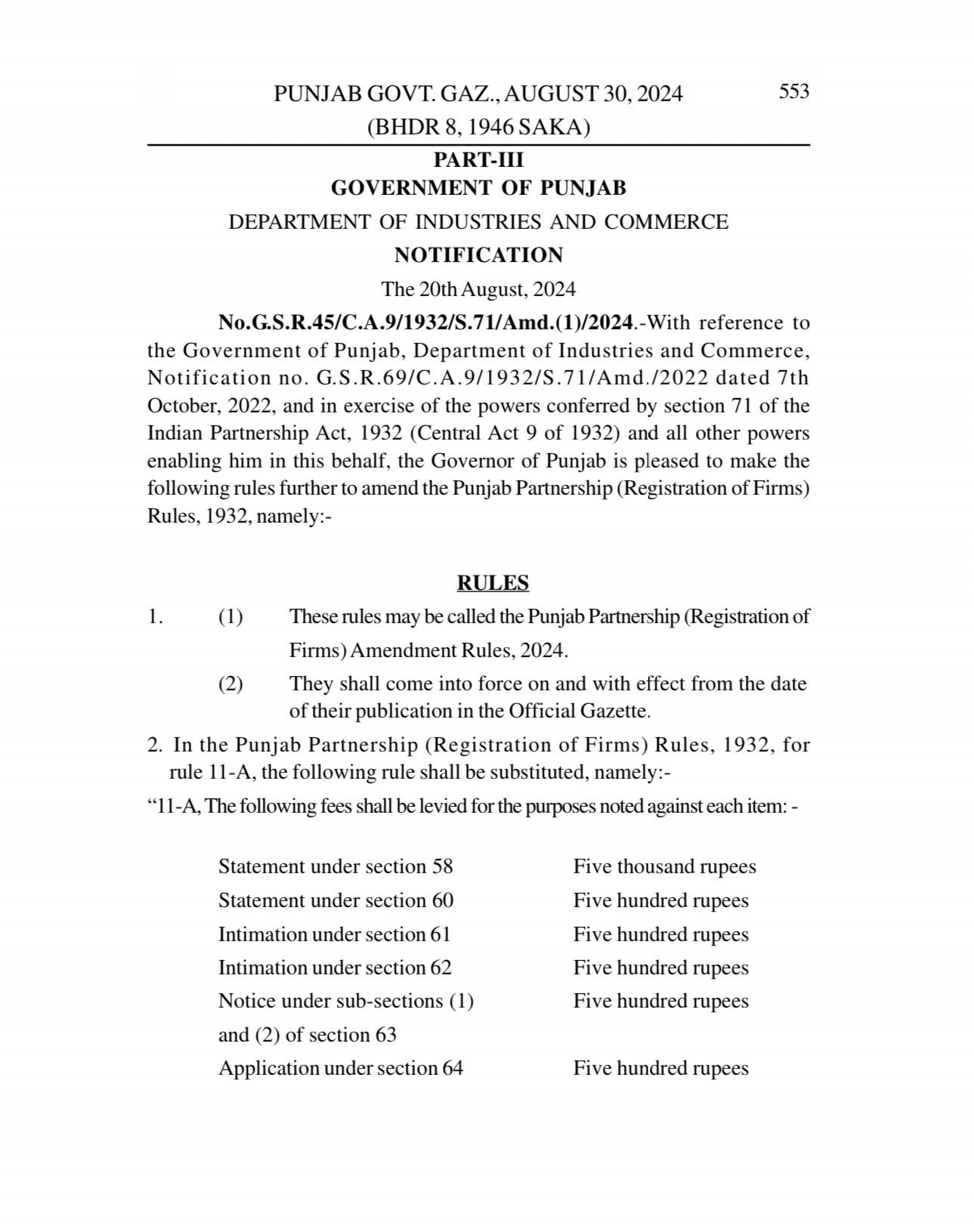

The government notified this via issuing an e-gazette notification dated 20th August 2024. The Text of the notification is given as follows:

With reference to the Government of Punjab, Department of Industries and Commerce, Notification no. G.S.R .6 9/C.A.9/ 1932/S.71/ Amd./2022 dated 7th October 2022, and in the exercise of the powers conferred by section 71 of the Indian Partnership Act, 1932 (Central Act 9 of 1932) and all other powers enabling him on this behalf, the Governor of Punjab is pleased to make the following rules further to amend the Punjab Partnership (Registration of Firms) Rules, 1932.

These rules may be called the Punjab Partnership (Registration of Firms) Amendment Rules, 2024. They shall come into force on and with effect from the date of their publication in the Official Gazette.

In the Punjab Partnership (Registration of Firms) Rules, 1932, for rule 11-A, the following rule shall be substituted, namely: –

“11-A, The following fees shall be levied for the purposes noted against each item: -“

| Statement under section 58 | Five thousand rupees |

| Statement under section 60 | Five hundred rupees |

| Intimation under section 61 | Five hundred rupees |

| Intimation under section 62 | Five hundred rupees |

| Notice under sub-sections (1) and (2) of section 63 | Five hundred rupees |

| Application under section 64 | Five hundred rupees |

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"