CA Amrish Aggarwal | Jun 14, 2020 |

Statutory Compliance calender June 2020

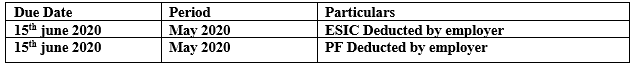

This Article compiles due dates of compliance related to GST Act 2017, Income Tax Act 1962, ESI, PF Acts which includes compliance related to GSTR-1, GSTR-3B, GSTR-5 & 5A, GSTR-6, GSTR-7, GSTR-8, Due dates for payment of TDS / TCS, Dues date for Payment of Advance Tax, Due date for Issue of TDS/ TCS Certificates, Due date for linking of Aadhaar number with PAN, Due date for payment of PF / ESIC .

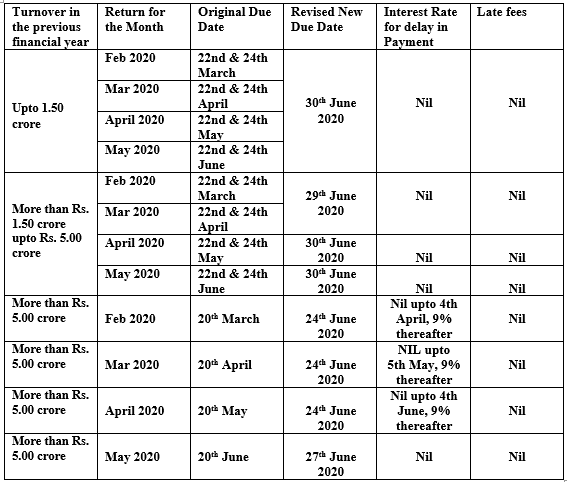

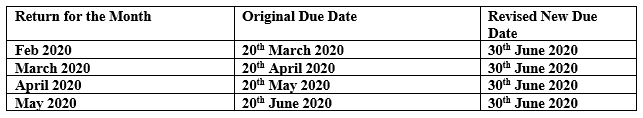

i) Due Dates for GSTR-3B

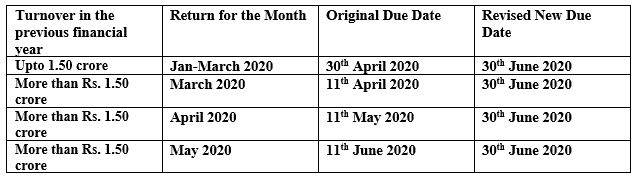

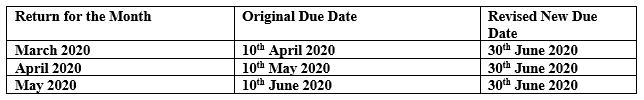

ii) Due Dates for GSTR-1

Statutory Compliance calender June 2020

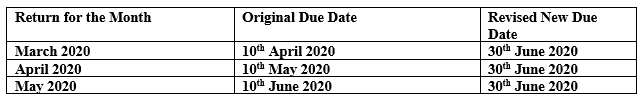

iii) Due Dates for GSTR-5 &5A (to be filed by the Non-Resident taxable person & OIDAR)

iv) Due Dates for GSTR-6 (to be filed by Input Service Distributor)

v) Due date for filing GSTR-7 (to be filed by the by the person who is required to deduct TDS under GST)

vi) Due date for filing GSTR-8 (to be filed by the by the by the E-commerce operators required to deduct TDS under GST)

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"