Tax Deducted at Source (TDS) means Tax deducted from Salay, interest, rent, dividends, etc.

CA Pratibha Goyal | Mar 25, 2023 |

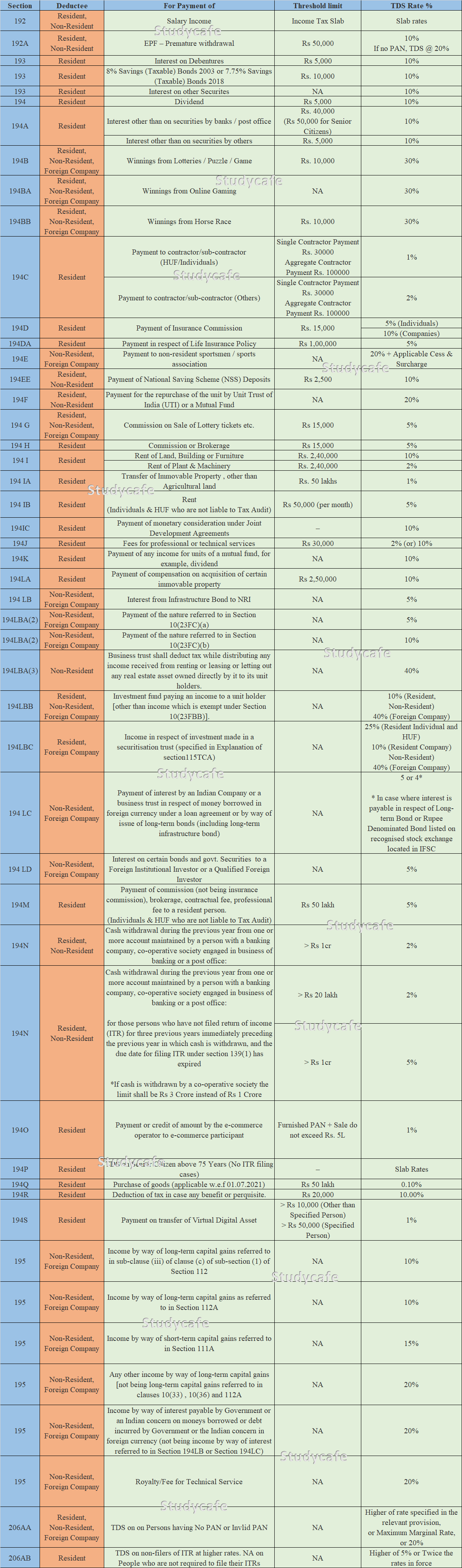

TDS Rate Chart FY 2023-24, AY 2024-25

Tax Deducted at Source (TDS) means Tax deducted from Salay, interest, rent, dividends, etc. The following changes were made by Budget 2023:

Budget 2023 introduced a new section 194BA for the deduction of tax at source (TDS) on the winnings from online games. This Section will be applicable with effect from 1st July 2023.

Section 196A has been amended for Non-residents earning income from mutual funds in India. Now they can provide a Tax Residency Certificate (TRC) and avail the benefit of TDS as per the rate given in the tax treaty, instead of 20%.

Section 196A has been amended to reduce TDS rate to 20% from the maximum marginal rate (MMR) on PF withdrawal for employees who do not have PAN

Earlier there was an exemption from TDS on interest from listed debentures u/s 193. This Exemption has now with taken away.

TDS threshold u/s 194N has been increased on cash withdrawal by by co-operative societies. Starting April 1st, 2023, tax will be deducted on cash withdrawals by co-operative societies if the amount exceeds Rs 3 crore, instead of the previous limit of Rs 1 crore.

| Section | Deductee | For Payment of | Threshold limit | TDS Rate % |

| 192 | Resident, Non-Resident | Salary Income | Income Tax Slab | Slab rates |

| 192A | Resident, Non-Resident | EPF – Premature withdrawal | Rs 50,000 | 10% If no PAN, TDS @ 20% |

| 193 | Resident | Interest on Debentures | Rs 5,000 | 10% |

| 193 | Resident | 8% Savings (Taxable) Bonds 2003 or 7.75% Savings (Taxable) Bonds 2018 | Rs. 10,000 | 10% |

| 193 | Resident | Interest on other Securites | NA | 10% |

| 194 | Resident | Dividend (Dividend other than listed companies) | Rs 5,000 | 10% |

| 194A | Resident | Interest other than on securities by banks / post office | Rs. 40,000 (Rs 50,000 for Senior Citizens) | 10% |

| Interest other than on securities by others | Rs. 5,000 | 10% | ||

| 194B | Resident, Non-Resident, Foreign Company | Winnings from Lotteries / Puzzle / Game | Rs. 10,000 | 30% |

| 194BA | Resident, Non-Resident, Foreign Company | Winnings from Online Gaming | NA | 30% |

| 194BB | Resident, Non-Resident, Foreign Company | Winnings from Horse Race | Rs. 10,000 | 30% |

| 194C | Resident | Payment to contractor/sub-contractor (HUF/Individuals) | Single Contractor Payment Rs. 30000 Aggregate Contractor Payment Rs. 100000 | 1% |

| Payment to contractor/sub-contractor (Others) | Single Contractor Payment Rs. 30000 Aggregate Contractor Payment Rs. 100000 | 2% | ||

| 194D | Resident | Payment of Insurance Commission | Rs. 15,000 | 5% (Individuals) |

| 10% (Companies) | ||||

| 194DA | Resident | Payment in respect of Life Insurance Policy | Rs 1,00,000 | 5% |

| 194E | Non-Resident, Foreign Company | Payment to non-resident sportsmen / sports association | NA | 20% + Applicable Cess & Surcharge |

| 194EE | Resident, Non-Resident | Payment of National Saving Scheme (NSS) Deposits | Rs 2,500 | 10% |

| 194F | Resident, Non-Resident | Payment for the repurchase of the unit by Unit Trust of India (UTI) or a Mutual Fund | NA | 20% |

| 194 G | Resident, Non-Resident, Foreign Company | Commission on Sale of Lottery tickets etc. | Rs 15,000 | 5% |

| 194 H | Resident | Commission or Brokerage | Rs 15,000 | 5% |

| 194 I | Resident | Rent of Land, Building or Furniture | Rs. 2,40,000 | 10% |

| Rent of Plant & Machinery | Rs. 2,40,000 | 2% | ||

| 194 IA | Resident | Transfer of Immovable Property , other than Agricultural land | Rs. 50 lakhs | 1% |

| 194 IB | Resident | Rent (Individuals & HUF who are not liable to Tax Audit) | Rs 50,000 (per month) | 5% |

| 194IC | Resident | Payment of monetary consideration under Joint Development Agreements | – | 10% |

| 194J | Resident | Fees for professional or technical services | Rs 30,000 | 2% (or) 10% |

| 194K | Resident | Payment of any income for units of a mutual fund, for example, dividend | NA | 10% |

| 194LA | Resident | Payment of compensation on acquisition of certain immovable property | Rs 2,50,000 | 10% |

| 194 LB | Non-Resident, Foreign Company | Interest from Infrastructure Bond to NRI | NA | 5% |

| 194LBA(2) | Non-Resident, Foreign Company | Payment of the nature referred to in Section 10(23FC)(a) | NA | 5% |

| 194LBA(2) | Non-Resident, Foreign Company | Payment of the nature referred to in Section 10(23FC)(b) | NA | 10% |

| 194LBA(3) | Non-Resident | Business trust shall deduct tax while distributing any income received from renting or leasing or letting out any real estate asset owned directly by it to its unit holders. | NA | 40% |

| 194LBB | Resident, Non-Resident, Foreign Company | Investment fund paying an income to a unit holder [other than income which is exempt under Section 10(23FBB)]. | NA | 10% (Resident, Non-Resident) 40% (Foreign Company) |

| 194LBC | Resident, Foreign Company | Income in respect of investment made in a securitisation trust (specified in Explanation of section115TCA) | NA | 25% (Resident Individual and HUF) 10% (Resident Company) Non-Resident) 40% (Foreign Company) |

| 194 LC | Non-Resident, Foreign Company | Payment of interest by an Indian Company or a business trust in respect of money borrowed in foreign currency under a loan agreement or by way of issue of long-term bonds (including long-term infrastructure bond) | NA | 5 or 4* * In case where interest is payable in respect of Long-term Bond or Rupee Denominated Bond listed on recognised stock exchange located in IFSC |

| 194 LD | Non-Resident, Foreign Company | Interest on certain bonds and govt. Securities to a Foreign Institutional Investor or a Qualified Foreign Investor | NA | 5% |

| 194M | Resident | Payment of commission (not being insurance commission), brokerage, contractual fee, professional fee to a resident person. (Individuals & HUF who are not liable to Tax Audit) | Rs 50 lakh | 5% |

| 194N | Resident, Non-Resident | Cash withdrawal during the previous year from one or more account maintained by a person with a banking company, co-operative society engaged in business of banking or a post office: | > Rs 1cr | 2% |

| 194N | Resident, Non-Resident | Cash withdrawal during the previous year from one or more account maintained by a person with a banking company, co-operative society engaged in business of banking or a post office: for those persons who have not filed return of income (ITR) for three previous years immediately preceding the previous year in which cash is withdrawn, and the due date for filing ITR under section 139(1) has expired *If cash is withdrawn by a co-operative society the limit shall be Rs 3 Crore instead of Rs 1 Crore | > Rs 20 lakh | 2% |

| > Rs 1cr | 5% | |||

| 194O | Resident | Payment or credit of amount by the e-commerce operator to e-commerce participant | Furnished PAN + Sale do not exceed Rs. 5L | 1% |

| 194P | Resident | TDS on Senior Citizen above 75 Years (No ITR filing cases) | – | Slab Rates |

| 194Q | Resident | Purchase of goods (applicable w.e.f 01.07.2021) | Rs 50 lakh | 0.10% |

| 194R | Resident | Deduction of tax in case any benefit or perquisite. | Rs 20,000 | 10.00% |

| 194S | Resident | Payment on transfer of Virtual Digital Asset | > Rs 10,000 (Other than Specified Person) > Rs 50,000 (Specified Person) | 1% |

| 195 | Non-Resident, Foreign Company | Income by way of long-term capital gains referred to in sub-clause (iii) of clause (c) of sub-section (1) of Section 112 | NA | 10% |

| 195 | Non-Resident, Foreign Company | Income by way of long-term capital gains as referred to in Section 112A | NA | 10% |

| 195 | Non-Resident, Foreign Company | Income by way of short-term capital gains referred to in Section 111A | NA | 15% |

| 195 | Non-Resident, Foreign Company | Any other income by way of long-term capital gains [not being long-term capital gains referred to in clauses 10(33) , 10(36) and 112A | NA | 20% |

| 195 | Non-Resident, Foreign Company | Income by way of interest payable by Government or an Indian concern on moneys borrowed or debt incurred by Government or the Indian concern in foreign currency (not being income by way of interest referred to in Section 194LB or Section 194LC) | NA | 20% |

| 195 | Non-Resident, Foreign Company | Royalty/Fee for Technical Service | NA | 20% |

| 206AA | Resident, Non-Resident, Foreign Company | TDS on on Persons having No PAN or Invlid PAN | NA | Higher of rate specified in the relevant provision, or Maximum Marginal Rate, or 20% |

| 206AB | Resident | TDS on non-filers of ITR at higher rates. NA on People who are not required to file their ITRs | NA | Higher of 5% or Twice the rates in force |

Disclaimer: This list is Exhaustive and not inclusive. I have made every effort to ensure that this chart is error-free, still, the Author is not responsible for any loss or damage of any kind arising out of any information in this article nor for any actions taken in reliance thereon. Further, no portion of our article or newsletter should be used for any purpose(s) unless authorized in writing and we reserve a legal right for any infringement on the usage of our article or newsletter without prior permission.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"