YES Bank has updated certain aspects of all of its credit cards, with the exception of the 'private' credit card type. The changes only affect the fuel fee category on some of the bank's credit card types.

Reetu | Mar 30, 2024 |

Utility Bill Payments from YES Bank Credit Card chargeable @1% from 1st April; Know Details

YES Bank has updated certain aspects of all of its credit cards, with the exception of the ‘private’ credit card type. The changes only affect the fuel fee category on some of the bank’s credit card types.

These changes, with the exception of ‘private’, are linked to the calculation of the spend threshold for waiver of the annual and joining fees. There is also a change in terms of the additional fee for utility transactions. All of these amended changes take effect on May 1, 2024.

As of March 29, 2024, the YES Bank website states that “a 1% charge will be applicable on all utility transactions in a statement cycle.”

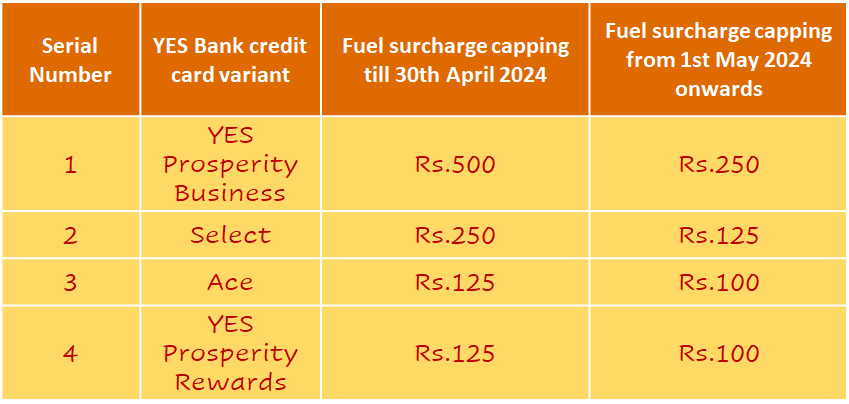

YES Bank has revised the fuel surcharge capping limits for the following credit card variations, as per their website:

The fuel surcharge is an additional cost levied by the bank that issued the credit/debit card on transactions made at petrol stations using a credit card, as well as some debit cards. For example, if you buy fuel worth Rs.39,000 per month and the fuel fee is 1%, the surcharge cost is Rs.390.

If your card includes a fuel fee waiver feature, it would have waived the top two types mentioned in the table. However, with the capping reduced to Rs.250, you will wind up paying Rs.140 extra even for the top variant of the card. The impact would be greater for lower variants.

According to experts, banks often incur expenses for processing offline and online payments, which are passed on to businesses as a merchant discount rate (MDR). However, because fuel stations run on extremely low margins, if banks charge MDR to them, they will be unable to accept card payments. As a result, the RBI has enabled banks to charge a 1% extra on fuel purchases from consumers. This arrangement allowed banks to charge 0% merchant discount rates (MDR) at petrol stations.

YES Bank website as of March 29, 2024 states that the “Spends threshold for Annual and Joining Fee reversal will exclude Rent and Wallet Transactions.” However, the changes do not apply to YES Bank’s lifetime free credit cards.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"