Ankita Khetan | Dec 22, 2017 |

13th Amendment to CGST Rules vide Notification no. 70/2017

Seeks to further amend CGST Rules, 2017 (Thirteenth Amendment).

[To be published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i)]

Government of India

Ministry of Finance

(Department of Revenue)

Central Board of Excise and Customs

Notification No. 70/2017 Central Tax

New Delhi, the 21st December, 2017

G.S.R(E):- In exercise of the powers conferred by section 164 of the Central Goods and Services Tax Act, 2017 (12 of 2017), the CentralGovernment hereby makes the following rules further to amend the Central Goods and Services Tax Rules, 2017, namely:-

(1) These rules may be called the Central Goods and Services Tax (Thirteenth Amendment) Rules, 2017.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Central Goods and Services Tax Rules, 2017, –

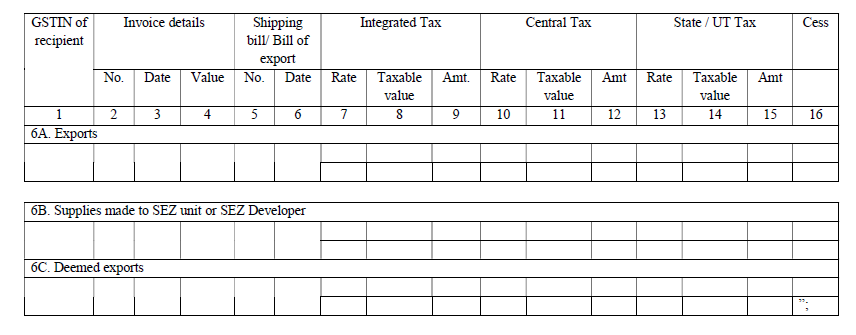

(i) in FORM GSTR-1, for Table 6, the following shall be substituted, namely:-

6. Zero rated supplies and Deemed Exports

(ii) in FORM GST RFD-01,-

(a) in Table 7, in clause (h), for the words Recipient of deemed export, the words Recipient of deemed export supplies/Supplier of deemed export supplies shall be substituted;

(b) after Statement 1, the following Statement shall be inserted, namely:-

Statement 1A [rule 89(2)(h)]

Refund Type: ITC accumulated due to inverted tax structure [clause (ii) of first proviso to section 54(3)]

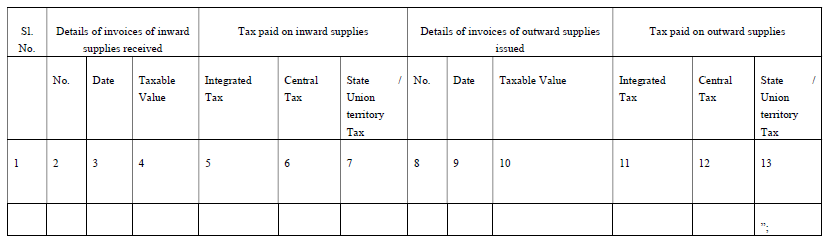

(c) after Statement 5A, the following Statement shall be inserted, namely:-

Statement 5B [rule 89(2)(g)]

Refund Type: On account of deemed exports

(Amount in Rs)

Sr. No. | Details of invoices of outward supplies in caserefund is claimed by supplier/Details ofinvoices of inward supplies in case refund isclaimed by recipient | Tax paid | |||||

No. | Date | Taxable Value | Integrated Tax | Central Tax | State /Union Territory Tax | Cess | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

(d) for the DECLARATION [rule 89(2)(g)], the following shall be substituted, namely:-

DECLARATION [rule 89(2)(g)] (For recipient/supplier of deemed export) In case refund claimed by recipient Designation / Status |

UNDERTAKING I hereby undertake to pay back to the Government the amount of refund sanctioned along with interest in case it is found subsequently that therequirements of clause (c) of sub-section (2) of section 16 read with sub-section (2) of section 42 of the CGST/SGST Act have not beencomplied with in respect of the amount refunded. Designation / Status; |

(iii) in FORM GST RFD-01A,-

(a) in Table 7, in clause (g), for the words Recipient of deemed export, the words Recipient of deemed export supplies/Supplier of deemed export supplies shall be substituted;

(b) after the DECLARATION [rule 89(2)(f)], the following shall be inserted, namely:-

DECLARATION [rule 89(2)(g)] (For recipient/supplier of deemed export) In case refund claimed by recipient Designation / Status |

UNDERTAKING I hereby undertake to pay back to the Government the amount of refund sanctioned along with interest in case it is found subsequently that the requirements of clause (c) of sub-section (2) of section 16 read with sub-section (2) of section 42 of the CGST/SGST Act have not been complied with in respect of the amount refunded. Designation / Status; |

(c) after Statement 1, the following Statement shall be inserted, namely:-

Statement 1A [rule 89(2)(h)]

Refund Type: ITC accumulated due to inverted tax structure [clause (ii) of first proviso to section 54(3)]

(d) after Statement 5A, the following Statement shall be inserted, namely:-

Statement 5B [rule 89(2)(g)]

Refund Type: On account of deemed exports

(Amount in Rs)

Sr. No. | Details of invoices of outward supplies in case refund is claimed by supplier/ Details of invoices of inward supplies in case refund is claimed by recipient | Tax paid | |||||

No. | Date | Taxable Value | Integrated Tax | Central Tax | State /Union Territory Tax | Cess | |

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

[F. No. 349/58/2017-GST(Pt.)]

(Gunjan Kumar Verma)

Under Secretary to the Government of India

Note:- The principal rules were published in the Gazette of India, Extraordinary, Part II, Section 3, sub-section (i) vide notification No.3/2017-Central Tax, dated the 19th June,2017, published vide number G.S.R 610 (E), dated the 19th June, 2017 and last amended videnotification No. 55/2017-Central Tax, dated the 15th November, 2017, published vide number G.S.R 1411 (E), dated the 15th November,2017.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"