Transactions monitored by Income tax department

SWETA MAKWANA | Aug 13, 2021 |

Transactions monitored by Income tax Department

There are few transactions that are tracked by the Income-tax departments. I have just made a short snippet of it for the views to understand it without any technicality:

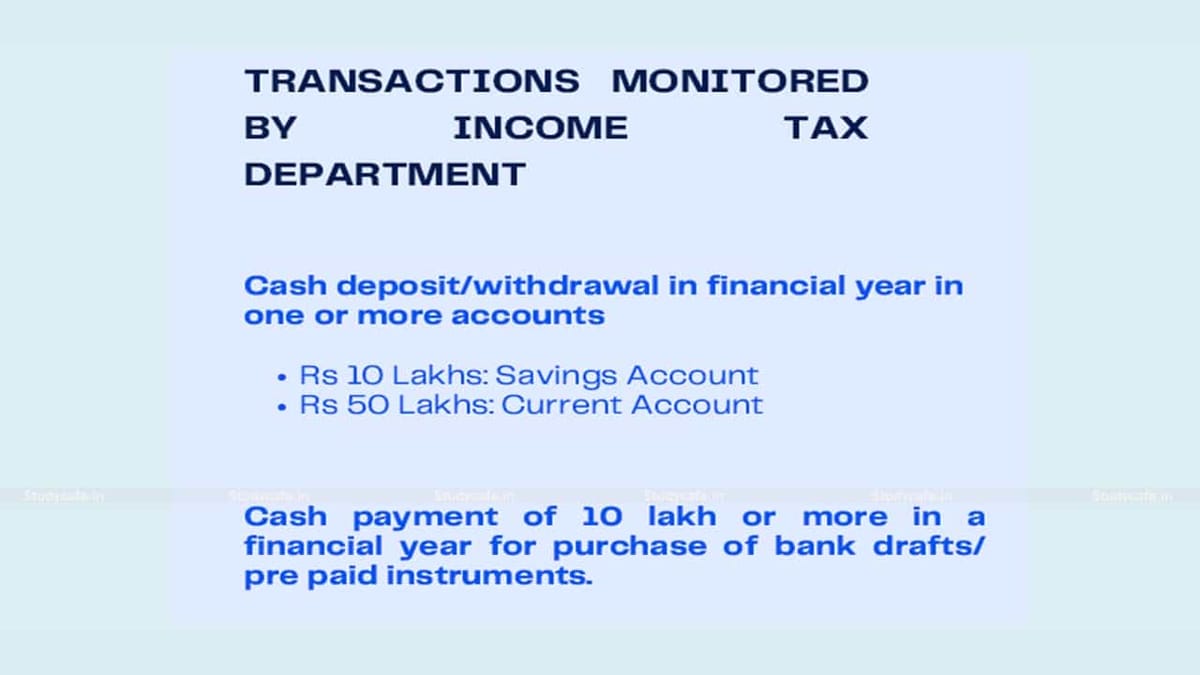

Cash deposit/withdrawal in financial year in one or more accounts

Cash payment of 10 lakh or more in a financial year for purchase of bank drafts/pre paid instruments.

Other transactions

>1 Lakh cash payment done for credit card

>2 Lakh cash payment done on purchase of car

> 2 Lakh receipt of cash payment for sale of any goods & services

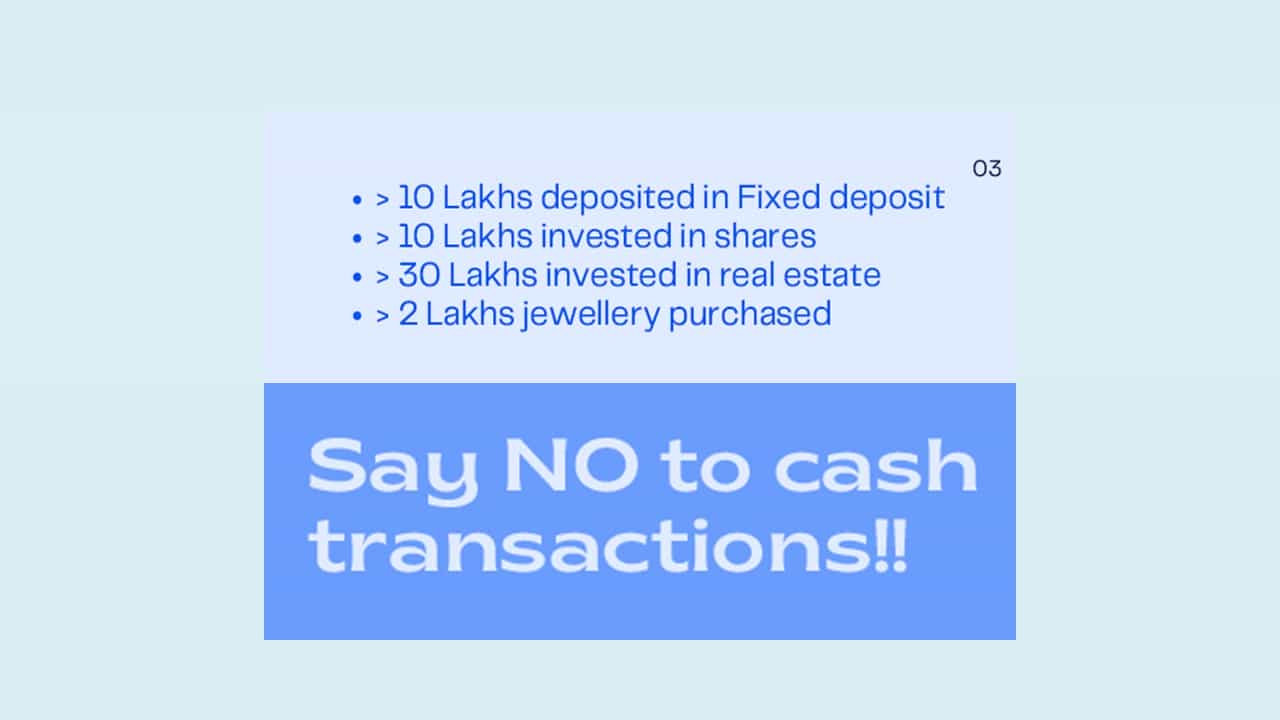

> 10 Lakhs deposited in Fixed deposit

> 10 Lakhs invested in shares

> 30 Lakhs invested in real estate

> 2 Lakhs jewelry purchased

Transactions monitored by Income tax department

Please refer to all the relevant sections, rules, amendments and consider all the necessary requirements as applicable. The author is not responsible for any losses caused or incurred.

The content is merely for sharing knowledge. The author can be reached at [email protected] or 9819244185.

A Practicing Chartered Accountant with over 4 years of rich experience in Company Law, Audits, Accounts & taxation. She is a writer at her own blog https://insights.buddingbusiness.com/. She is keen on streamlining business accounts of the Company and provide Startup consultancy.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"