Infosys has fixed most of the Income Tax portal glitches

Reetu | Sep 15, 2021 |

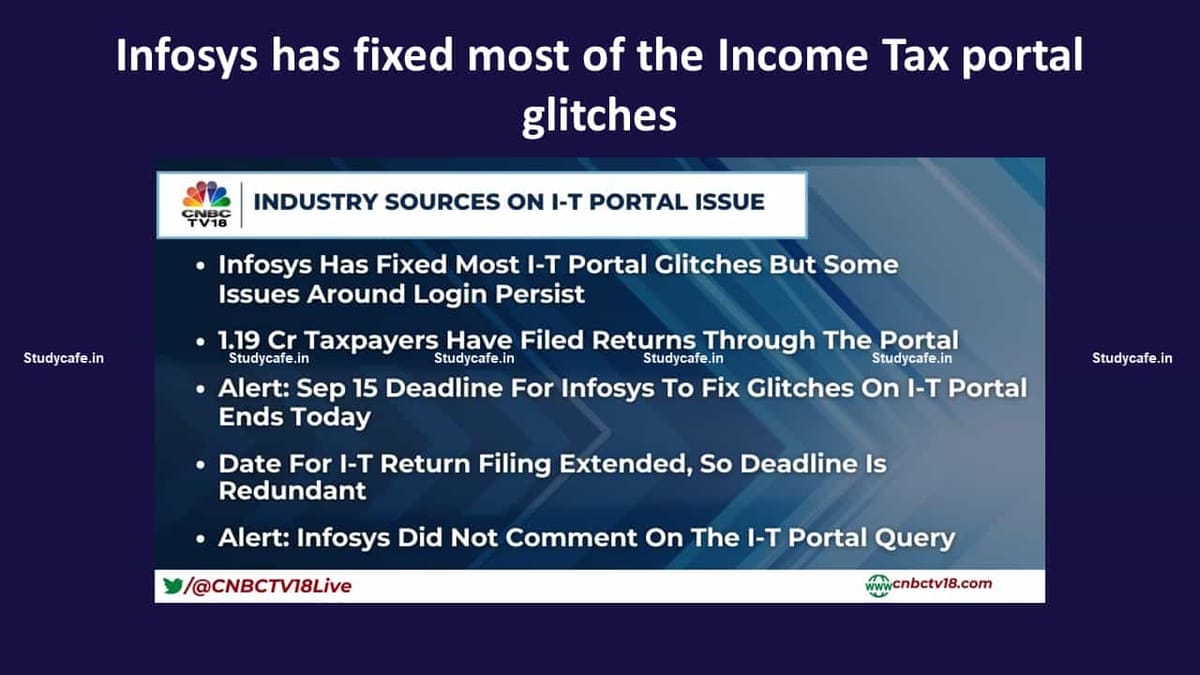

Infosys has fixed most of the Income Tax portal glitches

Sep 15 deadline for Infosys to fix glitches on the Income Tax portal has ended today.

As per the News Report:

| Income Tax Return and Audit Due Date for A.Y.2021-22 (F.Y.2020-21) | ||||

| Taxpayers | Particular | Original | 1st Extension | 2nd Extension |

| A. Company | TAX Audit Due Date | 30-09-2021 | 31-10-2021 | 15-01-2022 |

| B. Other than Company to whom audit applicable | ITR Due Date | 31-10-2021 | 30-11-2021 | 15-02-2022 |

| C. Partner of Firm to whom audit applicable | ||||

| D. Tranfer Pricing S. 92E | Audit Due Date | 31-10-2021 | 30-11-2021 | 31-01-2022 |

| ITR Due Date | 30-11-2021 | 31-12-2021 | 28-02-2022 | |

| Other than A/B/C/D (Individual+Non Tax Audit Assessee) | ITR Due Date | 31-07-2021 | 30-09-2021 | 31-12-2021 |

| Belated/Revised | ITR Due Date | 31-12-2021 | 31-01-2022 | 31-03-2022 |

| 1st Extension Given on 20/05/2021 (Circular No.9/2021) | 2nd Extension Given on 09/09/2021 (Circular No.17/2021) | |||

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"