Reetu | Jan 21, 2022 |

ICAI Launches Online Refresher Course on Revenue Standard – Ind AS 115

The Ind AS Implementation Committee of ICAI is pleased to announce the launch of online refresher course – ‘Deep Dive into Revenue Standard – Ind AS 115’.

For registration, kindly visit the link(s) below: –

https://learning.icai.org/committee/asb/deep-dive-lease-standard-ind-as-115/

Total sessions – 5 || Session Duration – 3 hours per session (includes session break as decided by the faculty).

This course is for: –

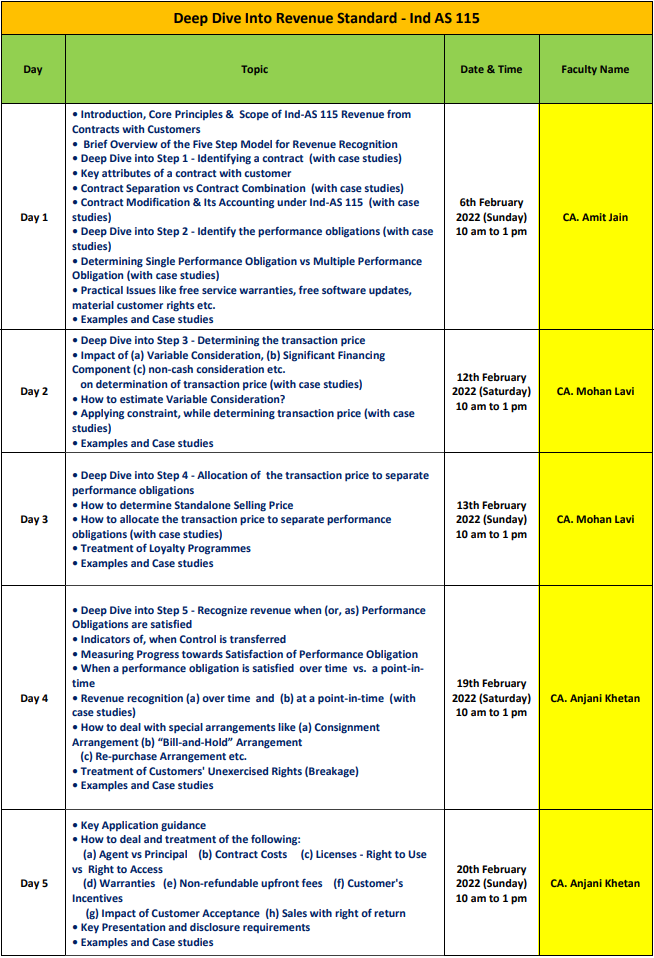

Session schedule, faculty details & timings:

CPE – 15 Structured || Cost – Rs. 1200 + 18% GST (i.e., Rs. 1416/-).

It may be noted that physical copies of the books WILL NOT be provided with the course. PPTs and recorded sessions (post completion of LIVE sessions) shall be made available via the Digital Learning Hub (learning.icai.org) of ICAI.

Registration will be on “first-come, first-serve basis”. In case refund/admission cancellation request has been received from the member for any reason, 10% of gross fee paid (inclusive of GST) will be deducted as per norms of ICAI. No refund request will be entertained after 2nd February 2022. In case, batch has been cancelled by the Committee due to unavoidable circumstances, full fees will be refunded to the member by the Committee. In case of any query, kindly email [email protected]

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"