Corporate Compliance Calendar for the Month of February 2022

CS Lalit Rajput | Feb 12, 2022 |

Corporate Compliance Calendar for the Month of February 2022

ABOUT ARTICLE:

This article contains various Compliance requirements for the Month of February, 2022 under various Statutory Laws. Compliance means “adhering to rules and regulations.” Compliance is a continuous process of following laws, policies, and regulations, rules to meet all the necessary governance requirements without any failure.

If you think compliance is expensive, try non‐ compliance”

Compliance Requirement Under

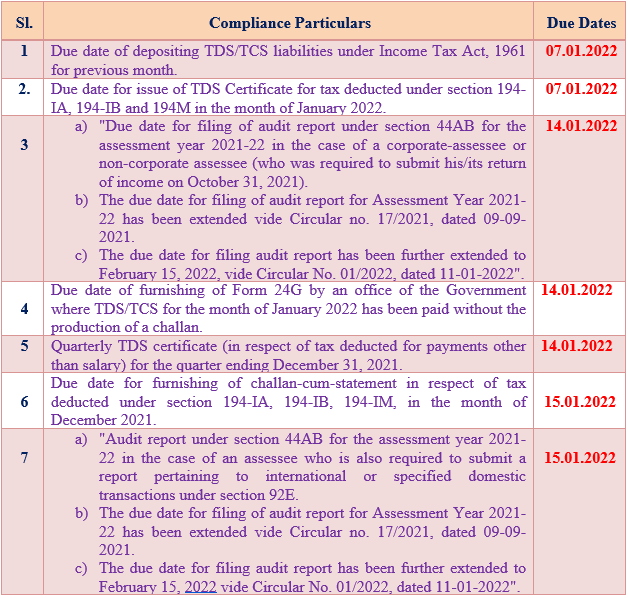

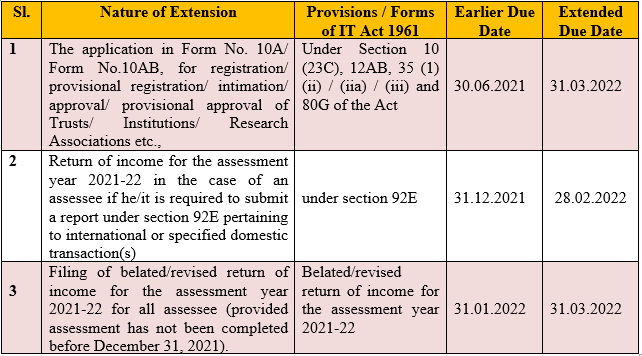

1. Income Tax Act, 1961

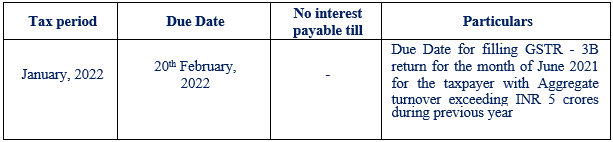

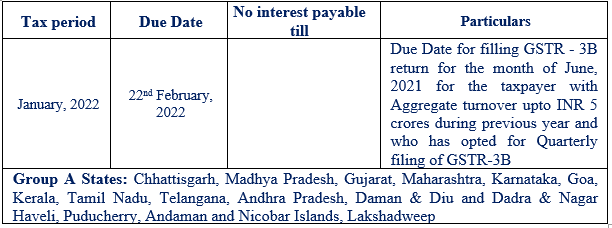

2. Goods & Services Tax Act, 2017 (GST) and Important Updates / Circulars

3. Companies Act, 2013 & LLP Compliance (MCA/ROC Compliance) and Notifications

4. Foreign Exchange Management Act, 1999 (FEMA) and Important Notifications

5. Other Statutory Laws and Updates

6. SEBI (Listing Obligations & Disclosure Requirements) (LODR) Regulations, 2015

7. SEBI Takeover Regulations 2011

8. SEBI (Prohibition of Insider Trading) Regulations, 2015

9. SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018

10. SEBI (Buyback of Securities) Regulations, 2018

11. SEBI (Depositories and Participants) Regulations 2018) and Circulars

12. Insolvency and Bankruptcy Board of India (IBBI) Updates

13. Competition Commission of India

| Sl. | Particulars of the Notification(s) | File No. / Circular No. | Link(s) |

| 1 | Income Tax department detects anomalies in 2 Chinese mobile firms | Tax News | Click Here |

| 2 | One-time relaxation for verification of all income tax-returns e-filed for the Assessment Year 2020-21 which are pending for verification and processing of such returns – reg. | Circular No. 21 / 2021 | Click Here |

| 3 | The Income-tax (34th Amendment) Rules, 2021 | Notification No. 138/2021 | Click Here |

| 4 | The Faceless Appeal Scheme, 2021. | Notification No. 139/2021 | Click Here |

| 5 | The Income-tax (35th Amendment) Rules, 2021 | Notification No. 140/2021 | Click Here |

| 6 | Income Tax notification to give effect to the Faceless Appeal Scheme, 2021 | Notification No. 141/2021 | Click Here |

| 7 | ‘Regional Air Connectivity Fund Trust (PAN AADTR1130P), | Notification No. 1/2022 | Click Here |

| 8 | Searches conducted by Income Tax Department largely in Uttar Pradesh and Maharashtra | Press Release ID: 1787764 | Click Here |

| 9 | Evasion of Customs duty of Rs. 653 crore by M/s Xiaomi Technology India Private Limited | Press Release ID: 1787686 | Click Here |

| 10 | Extension of timelines for filing of ITRs and various reports of audit for the Assessment Year 2021-22– reg | Circular No. 01/2022 | Click Here |

| 11 | Central Government hereby notifies for the purposes of the said clause, ‘International Financial Services Centres Authority’ | Circular No. 03/2022 | Click Here |

| 12 | Income tax (1st Amendment) , Rules, 2022. | Circular No. 06/2022 | Click Here |

| 13 | Income Tax Department conducts searches in Kerala | Press Release ID 1788947 | Click Here |

| 14 | Guidelines under clause (10D) section 10 of the Income-tax Act, 1961 – reg. | Circular No. 02/2022 | Click Here |

| 15 | CBDT notifies National Skill Development Corporation for exemption U/s. 10(46) | Notification No. 10/2022 | Click Here |

| 16 | The Securities Transaction Tax (1st Amendment), Rules, 2022 | Notification No. 09/2022 | Click Here |

| 17 | The Income tax (2nd Amendment) Rules, 2022. | Notification No. 08/2022 | Click Here |

| 18 | The “e-advance rulings Scheme, 2022”. | Notification No. 07/2022 | Click Here |

a) Taxpayers having aggregate turnover > Rs. 5 Cr. in preceding FY

b). Taxpayers having aggregate turnover upto Rs. 5 crores in preceding FY (Group A)

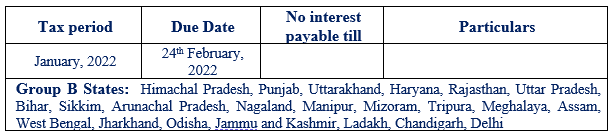

c). Taxpayers having aggregate turnover upto Rs. 5 crores in preceding FY (Group B)

To Read More Download PDF Given Below :

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"