Reetu | Apr 2, 2025 |

List of E-commerce Services Notified Under Section 9(5) of GST Act

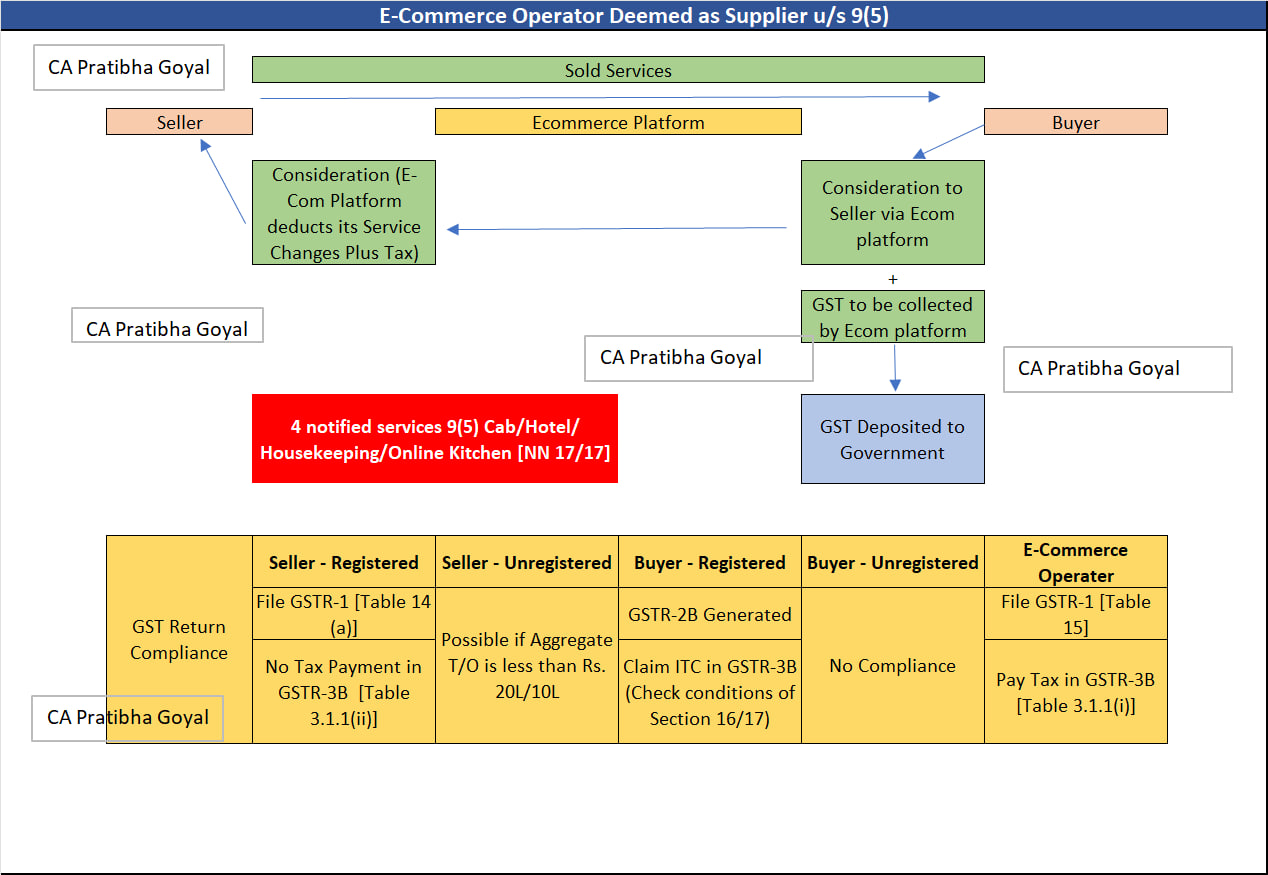

Usually, the taxes on the supply of goods or services are paid by the supplier. The reverse charge mechanism compels the recipient of goods or services to pay the tax, essentially reversing the chargeability.

However, Tax paid u/s 9(5) by the E-Commerce operator, is neither paid by the Buyer or seller. In this mechanism, the E-Commerce Operator is deemed as Seller for purpose of GST Compliance.

1. Transportation of passengers by a radio taxi, motor cab, maxi cab and motorcycle

The RCM is levied on the Transportation of passengers by a radio taxi, motor cab, maxi cab, and motorcycle when the supplier is a “Taxi Driver or rent a cab operator” and the receiver is “Any Person.” This is notified by Master Notification 13/2017-Central Tax (Rate).

2. Providing accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes

The RCM is levied on the above-mentioned services when the supplier is an “Unregistered Hotel, Inn, club, etc.” and the receiver is “Any Person.” This is notified by Master Notification 13/2017-Central Tax (Rate).

3. Restaurant service other than the services supplied by restaurants, eating joints, etc. located at specified premises

In the case of Services mentioned above, the RCM is levied when the supplier is an “All types of restaurants (Excl. hotels having rooms above 7500)” and the receiver is “Any Person.” This is inserted by Notification No. 17/2021- Central Tax (Rate), dated 18-11-2021, w.e.f. 1-1-2022.

4. Services by way of house-keeping, such as plumbing, carpentering etc.

The supply of services mentioned above attracts RCM when the supplier is “House keeping, Cleaning, Plumbing Etc” and the receiver is “Any Person.” This is inserted by Notification No. 23/2017-Central Tax (Rate), dated 22-8-2017.

5. Transport of passengers by any type of motor vehicle*

In the case of the above-mentioned Services, the RCM is levied when the supplier is “Transport of passenger by motor vehicles” and the receiver is “Any person.” This is inserted by Notification No. 17/2021- Central Tax (Rate), dated 18-11-2021, w.e.f. 1-1-2022.

| Sr. | Type of Service | Status of Service Provider | Status of Recipient | Description of service | Tax Payable by (Provider) | Tax Payable by (Recipient to E – Commerce operators) | Notification and Effective From |

| 1 | Transportation of passengers by a radio-taxi, motorcab, maxicab and motor cycle | Taxi Driver or rent a cab operator | Any Person | Service provided by an agent of business correspondent to business correspondent | Nil | 18% by E – Commerce operators | Notification No. 17/2017 – Central Tax (Rate) w.e.f. 01.07.2017 |

| 2 | Providing accommodation in hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes | Unregistered Hotel, Inn, Clubs etc | Any Person | Service by way of providing accommodation in hotel, inns, guest house, clubs, campsite or other commercial places meant for residential or lodging purposes | Nil | 18% by E-Commerce operators | Notification No. 17/2017 – Central Tax (Rate) w.e.f. 01.07.2017 |

| 3 | House-keeping, such as plumbing, carpentering etc | Unregistered | Any Person | House-keeping, such as plumbing, carpentering etc | Nil | 18% by E-Commerce operators | Inserted by Notification No. 23/2017-Central Tax (Rate), dated 22-8-2017 |

| 4 | Restaurant service | Restaurant other than restaurant, eating joints etc. located at specified premises | Any Person | Restaurant service | Nil | 5% by E-Commerce operators | Inserted by Notification No. 17/2021- Central Tax (Rate), dated 18-11-2021, w.e.f. 1-1-2022 |

| 5 | Transport of passengers, by any type of motor vehicles | Transporter | Any Person | Transport of passengers, by any type of motor vehicles | Nil | 18% by E-Commerce operators | Inserted by Notification No. 17/2021- Central Tax (Rate), dated 18-11-2021, w.e.f. 1-1-2022 |

Notification 17/2017 – Central Tax (Rate) and Notification 14/2017 – Integrated Tax (Rate) is the master notification for GST on E-commerce Services under section 9(5) of CGST and 5(5) of IGST Act.

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"