Reetu | Mar 23, 2022 |

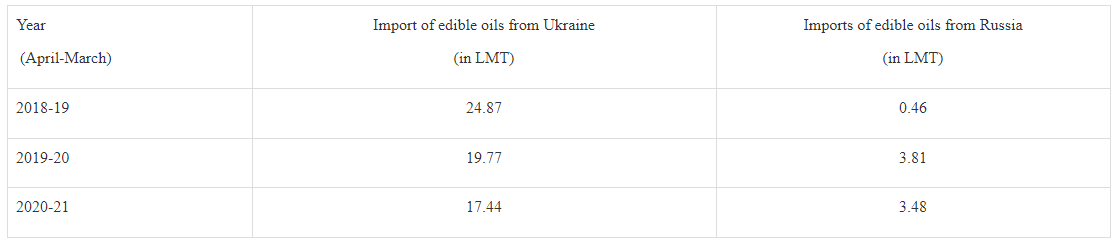

India imported 17.44 LMT and 3.48 LMT edible oils from Ukraine and Russia in 2020-21

Ms. Sadhvi Niranjan Jyoti, Union Minister of State for Consumer Affairs, Food and Public Distribution, gave the following data about edible oil imports from Russia and Ukraine during the last three years in a written reply to a question in the Lok Sabha today:

Imports of edible oils are subject to an Open General Licence (OGL). The requisite quantities are imported from overseas by the private sector. For the purpose of expediting imports, the government has arranged discussions with private industry and edible oil organisations.

The Government of India has been implementing a Centrally Sponsored Scheme, National Food Security Mission- Oilseeds & Oil palm (NFSM-OS&OP) from 2018-19 to augment the availability of vegetable oils and to reduce the import of edible oils by increasing the production and productivity of oilseeds and area expansion of Oil Palm & Tree Borne Oilseeds in the country.

The government has now launched the National Mission for Edible Oils (Oil Palm)- NMEO (OP) to promote oil palm production in order to make the country Atmanirbhar in edible oils, with a special focus on the North-Eastern States and the Andaman and Nicobar Islands.

In order to improve the domestic availability and to keep prices of edible oils under control, the Government has been rationalizing the duty structure on edible oils during 2021-22 to reduce the price burden of common man. The following measures have been taken:

In addition, the Department of Food and Public Distribution had imposed stock limits on Edible Oils and Oilseeds w.e.f. 8th October, 2021 for a period up to 31st March, 2022.

Further, an amended Order “The Removal of Licensing Requirements, Stock Limits and Movement Restrictions on Specified Foodstuffs (Amendment) Order, 2022” has been notified w.e.f 03rd February, 2022 specifying the quantities of stock limits of edible oil & oil-seeds, to be implemented by all States/UTs. This Order has been issued to ensure the smooth availability of edible oils and oil-seeds in the country.

In case of any Doubt regarding Membership you can mail us at [email protected]

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"