Reetu | Oct 13, 2022 |

FAQs on GST E-invoice or IRN System

As per the notification No. 17/2022 Dated :01-08-2022. The e-Invoice System is for GST registered person for uploading all the B2B invoices to the Invoice Registration Portal (IRP). The IRP generates and returns a unique Invoice Reference Number (IRN), digitally signed e-invoice and QR code to the user.

As per Rule 48(4) of CGST Rules, notified class of registered persons shall prepare an invoice by incorporating the Invoice Reference Number (IRN) and the QR-Code generated by uploading specified particulars in FORM: GST INV-01 on Invoice Registration Portal (IRP).

Such invoice containing, inter alia, the QR Code embedded with IRN (mentioning IRN separately, is optional), issued by the notified supplier to buyer is commonly referred to as ‘e-invoice’ in GST.

Please note that ‘e-invoice’ doesn’t mean generation of invoice on a Government portal or issue of invoice in pdf form.

There is no much difference between the e-invoice and a normal invoice. In the e-invoice system, the notified registered persons will continue to create their GST invoices on their own Accounting/Billing/ERP Systems, but it shall bear the QR Code embedded with IRN (mentioning IRN separately, is optional), pre-generated on IRP. In other words, the specified contents of the invoices will have to be first posted in FORM: GST INV-01 on IRP, to generate the said unique IRN with a QR Code. e-Invoice is nothing but an invoice issued to the receiver of goods/services by the supplier along with the QR Code .

A GST invoice issued by the notified supplier will be valid only with a valid IRN/QR-code.

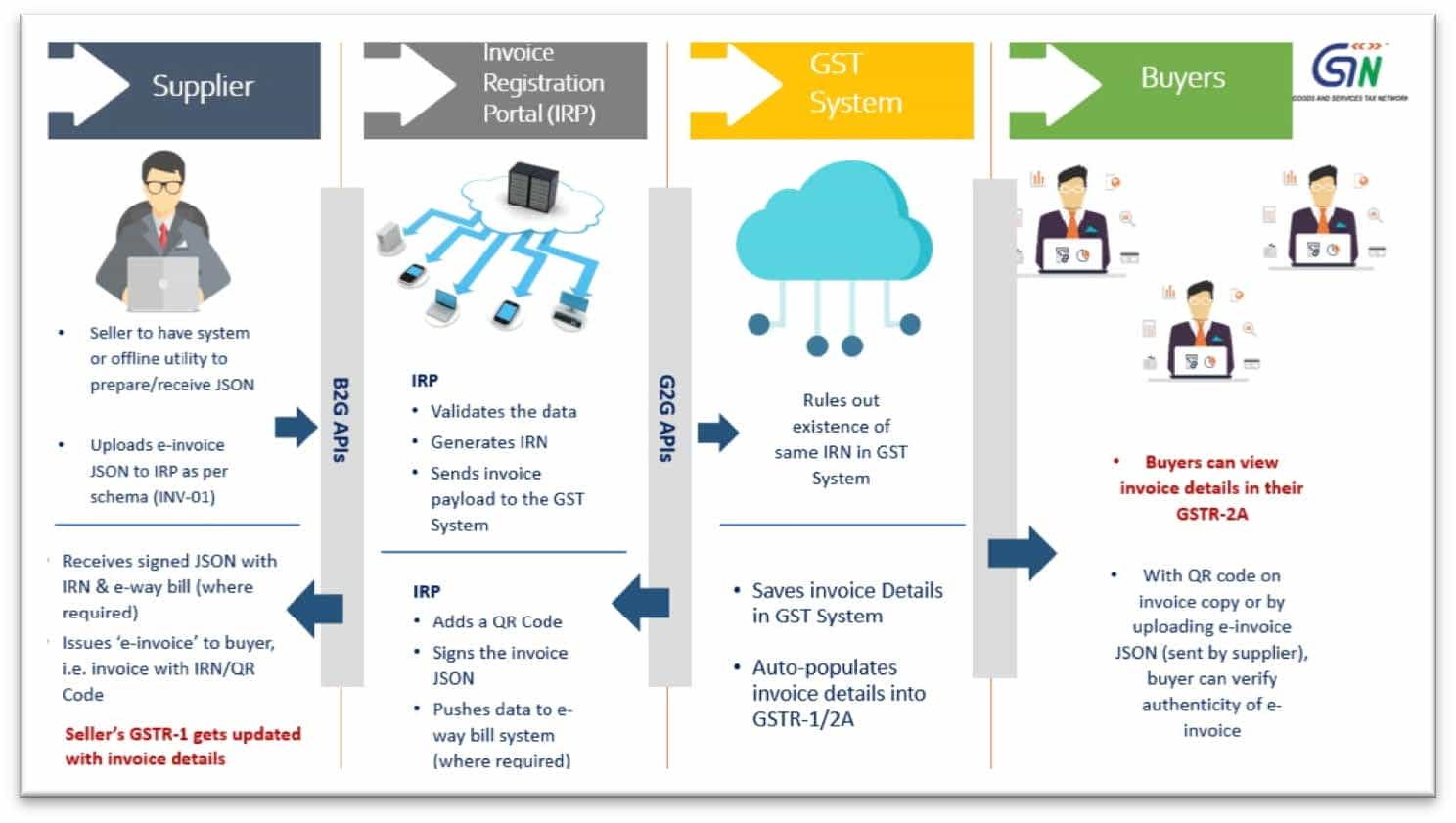

The following flow chart indicates the process of generation of e-Invoice: –

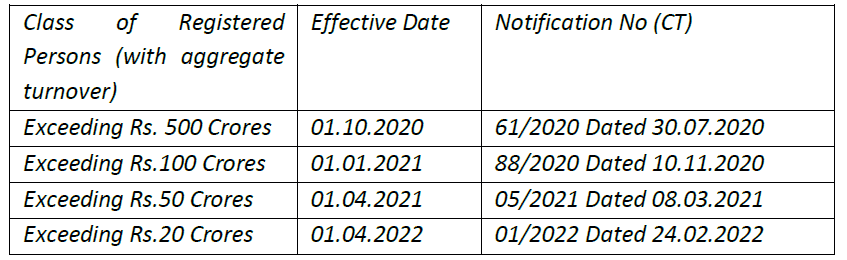

E-invoicing is mandatory for the class of Registered Persons whose aggregate turnover (based on PAN) is more than the prescribed limit (as per relevant notification) in any preceding financial year from 2017-18 onwards. The effective date from which the e-Invoice was notified as mandatory for different class of Registered Persons is indicated hereunder:

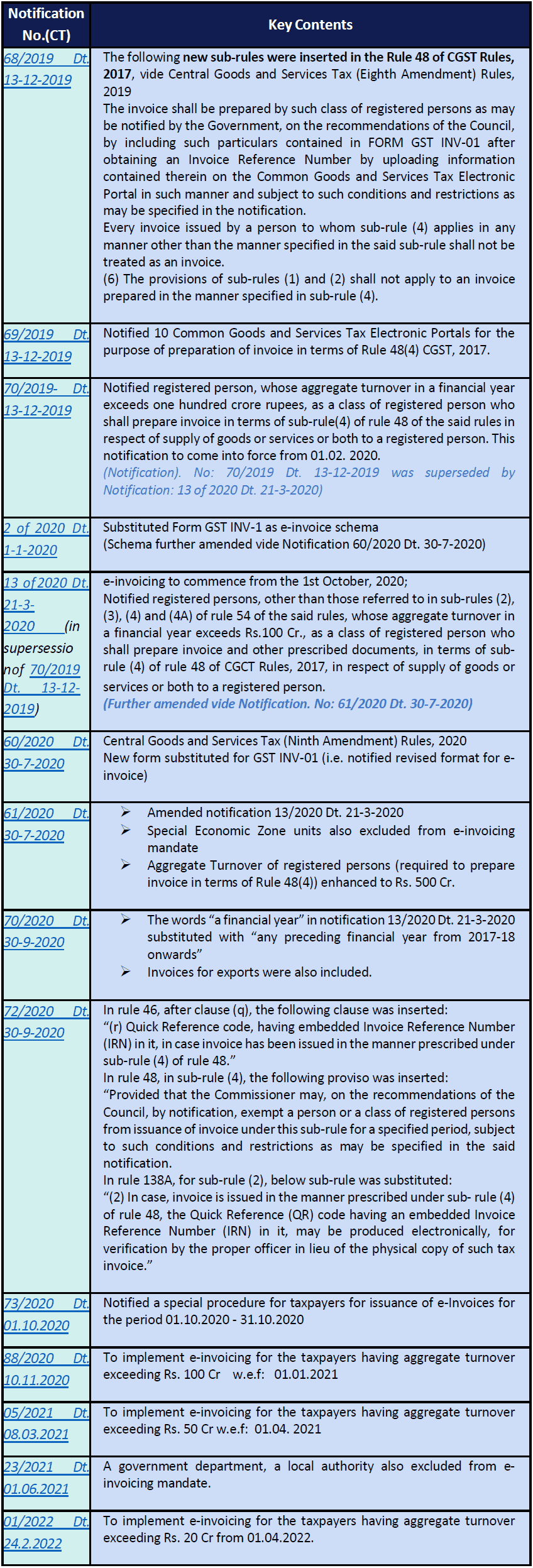

The following Notifications provide the legal basis for e-invoice:

E-invoice has many advantages for businesses such as:

1. Smooth ITC reconciliation by Auto-reporting of invoices into GST return;

2. Simultaneous generation of EWB

3. Utmost reliability (no need to doubt the genuineness- eliminates fake invoices);

4. Reconciliation problems are eliminated;

5. Standardisation & eliminates data entry errors;

6. Documents become tax compliant on real time basis;

7. Reduction of processing costs;

8. improve payment cycles;

9. thereby greatly improving overall business efficiency and ensure Ease of doing business.

Businesses will continue to issue invoices as they are doing now. Necessary changes on account of e-invoicing requirement (i.e., to enable reporting of invoices to IRP and obtain IRN), will be made by ERP/Accounting and Billing Software providers in their respective software. They need to get the updated version having this facility.

As you are aware National Informatics Centre (NIC) has released beta of version of ‘NIC-GST e-invoice Preparing and Printing’ (NIC-GePP) excel based Tool to assist the tax payers, who are not having the ERP solution, to enter invoice in web based form and print the e-invoice with QR code, after downloading the IRN from e-invoice portal. In this, main user can create sub user accounts with respective user’s mobile number mapped to it and use with GePP-Online, GePP-Offline and Bulk generation tool.

It is mandatory on the part of all notified registered persons to generate the IRN & QR code as detailed above, by posting the specified information in GST INV-01, on IRP; and they will continue to generate e-invoices on their internal systems, whether through ERP or their accounting / billing systems or any other application.

A. Invoices

B. Credit Notes (CDN)

C. Debit Notes (DBN)

when issued by notified class of registered persons, to another registered recipient of goods/services (B2B) or for the purpose of Exports, are currently covered under e-invoicing system. “Bill of supply” is not covered under the e-Invoice system.

Although Credit & Debit notes are also covered, for ease of reference and understanding, the system is referred as ‘e-invoicing’.

As per Rule 48(4) of CGST Rules, 2017 and the notification issued thereunder, a notified person shall prepare invoice by uploading specified particulars in FORM GST INV-01 on Invoice Registration Portal and after obtaining Invoice Reference Number (IRN) and QR-code.

As per Rule 48(5) CGST Rules, 2017, any invoice issued by a notified person in any manner other than the manner specified in Rule 48(4), the same shall not be treated as an invoice.

Therefore, an invoice/CDN/DBN issued by notified person becomes legally valid only with an IRN (QR-code having an embedded IRN).

Supplies to registered persons (B2B), Supplies to SEZs (with/without payment), Exports (with/without payment), Deemed Exports, by notified class of taxpayers are currently covered under e-invoicing.

No. Reporting B2C invoices by notified persons is not applicable/allowed currently.

No. For supplies attracting NIL-rate or those wholly-exempt, a “bill of supply” is prescribed; but not a tax invoice. Hence, e-Invoice is not mandatory even if such supplies are by the notified registered person. However, for an invoice-cum-Bill of supply issued under Rule 46A of CGST Rules, 2017 for supply of taxable as well as exempted goods or services or both to a registered person, e-Invoice is mandatory.

No. It is only the credit and debit notes issued under Section 34 of CGST Act, 2017, shall be reported on IRP and are issued with IRN/QR-code.

E-invoicing by notified persons is mandated for supplies of goods or services or both to a registered person.

Thus, where the Government Department/entity doesn’t have any registration under GST (i.e. not a ‘registered person’), e-invoicing is not required.

However, where the Government department/entity is having a GSTIN (as entity supplying goods/services/ deducting TDS), the same has to be mentioned as recipient GSTIN in the e-invoice.

To Read More Download PDF Given Below:

In case of any Doubt regarding Membership you can mail us at contact@studycafe.in

Join Studycafe's WhatsApp Group or Telegram Channel for Latest Updates on Government Job, Sarkari Naukri, Private Jobs, Income Tax, GST, Companies Act, Judgements and CA, CS, ICWA, and MUCH MORE!"